Instant Payouts

Le Payout en temps réel

Des payouts rapides et flexibles

Gagnez la confiance des consommateurs

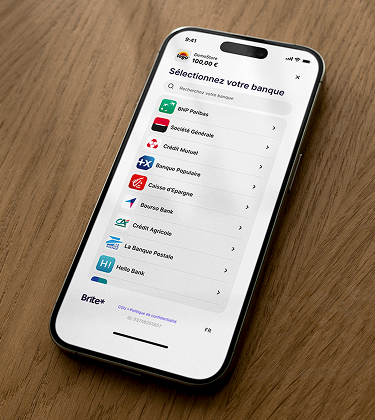

Couverture européenne

« Où sont mes fonds ? »

Plafonds élevés

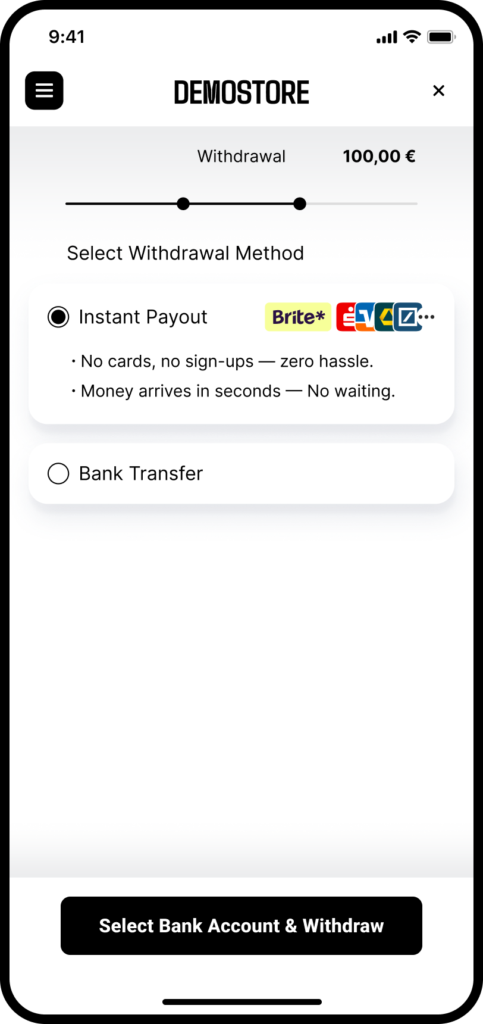

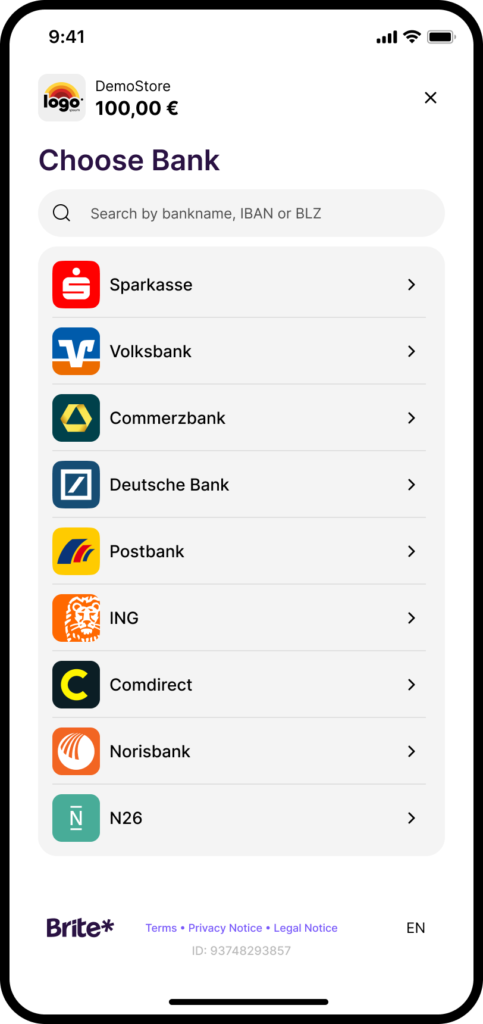

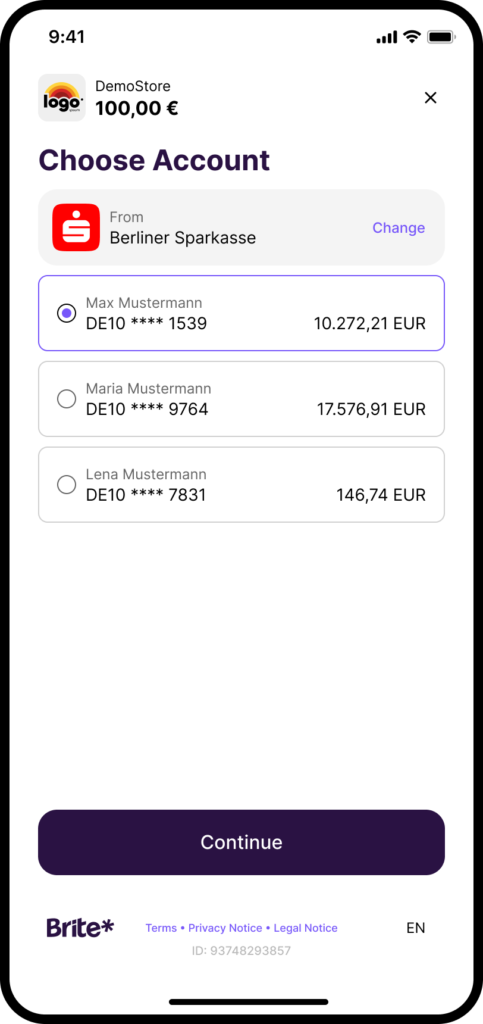

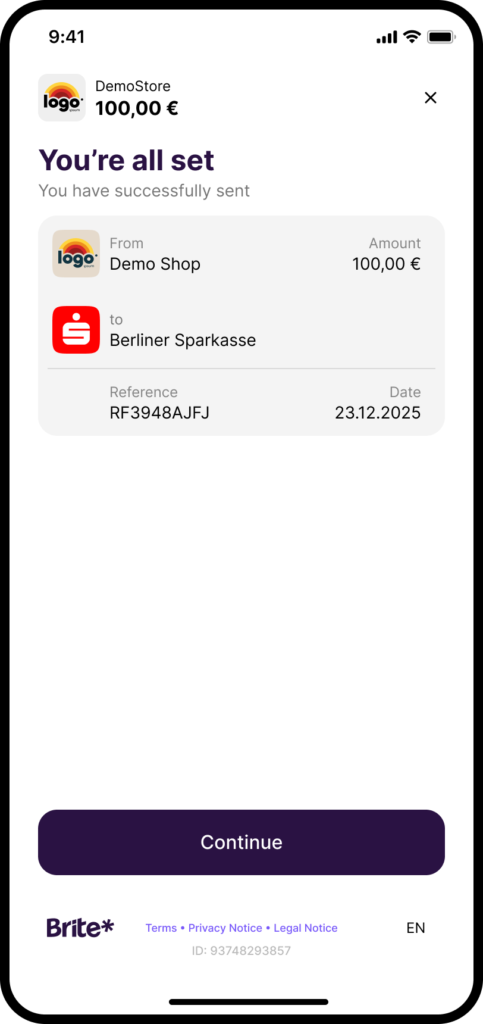

Des étapes simples pour un contrôle total.

Brite Performance

>99%

<40s

1 clic

Les utilisateurs récurrents qui consentent bénéficient d’une expérience de décaissement plus rapide et simplifiée.

Key feature

Le moteur des Payouts instantanés de Brite

Des décaissements qui vous donnent un avantage concurrentiel majeur

Time2Money

Merchant FX

Suivi des décaissements en temps réel

Nos Clients

Financial Services

Financial Services

Utilities

Cas d'usage par secteur d'activité

Conçu pour l'évolutivité. Prêt en quelques heures.

Dernières Ressources

Tout ce que vous devez savoir sur les décaissements instantanés

How fast is an Instant Payout? And when does the consumer actually get their money?

A Brite Instant Payout is typically delivered in seconds.

Our proprietary network operates 24/7, 365 days a year, meaning the consumer receives their money immediately, without being held up by bank holidays or weekend clearing cycles. The payment is processed and cleared at the same speed.

Internal Brite data shows that the median settlement time for a payout to arrive is around 4 seconds.

What happens if a Brite payout fails (e.g., wrong account details)?

Brite’s system includes automated checks and retry mechanisms to resolve common errors instantly. If a payout genuinely fails (e.g. closed account or incorrect details), you receive an immediate status notification via API or dashboard. This allows your customer support team to contact the consumer promptly to correct the details and ensure a speedy resolution.

If you, as a merchant, send funds to the wrong person, you are covered under bank scheme rules to be able to push for the funds to be returned.

Can we send an Instant Payout to a customer who paid us using a different method (like a card)?

Yes. Through our Manual Payouts feature, you can issue refunds or send funds to any consumer’s bank account, even if the original deposit was made using an external method, such as a card.

This gives you maximum flexibility for customer service and operational reconciliation.

How does Brite’s Merchant FX feature work for cross-border payouts?

Merchant FX simplifies your cross-border treasury. It allows you to fund your Brite balance in one single currency, and then exchange that balance directly within our platform to pay consumers in multiple local European currencies at competitive rates.

This eliminates the need for multiple balances and reliance on external bank FX processing.

What is Brite’s Time2Money feature, and how does it help my customer support team?

Time2Money is a powerful feature that provides the estimated time of arrival (ETA) for a consumer’s payout. This helps you proactively communicate accurate timelines, drastically reducing « Where Is My Money? » (WIMMO) support tickets and building overall consumer trust.