Brite Play

Du paiement à l'inscription en quelques secondes

Qu'est-ce que Brite Play ?

Un seul flux. De nombreux bénéfices.

Accélérez la conversion

Augmentez la valeur de vos paiements

Intégration plus fluide

Accélérez l’acquisition de vos clients, obtenez les données nécessaires sur la provenance des fonds et la lutte contre le blanchiment d’argent, sans nuire à l’expérience utilisateur.

UX Optimale

Un parcours d’accueil, de KYC et de paiement conçu pour fidéliser vos clients dès la première étape.

Pourquoi Brite Play est essentiel pour les entreprises dont la création de compte génère des frictions de paiement.

« Nous écoutons les entreprises en ligne : la plus grande fuite d’acquisition se produit au niveau du formulaire d’inscription. Brite Play est la solution essentielle, car il fait de la vérification et du paiement une seule et même action.

Notre flux unique et facile à utiliser élimine entièrement l’obstacle du KYC, permettant aux clients de vérifier leur identité, de s’inscrire et d’approvisionner leur compte en quelques secondes. Finies les formalités administratives : nous vous livrons immédiatement un client vérifié, dont les fonds sont disponibles et surtout, qui est satisfait du service. »

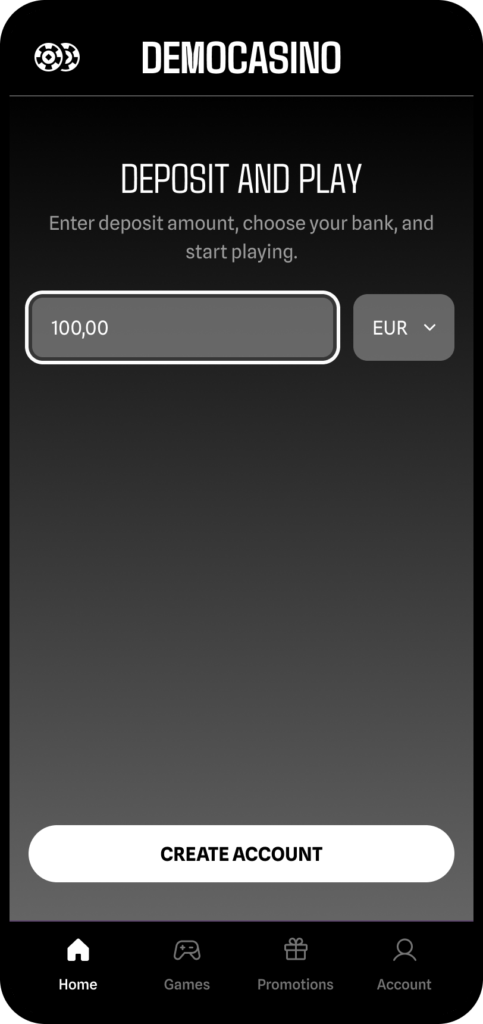

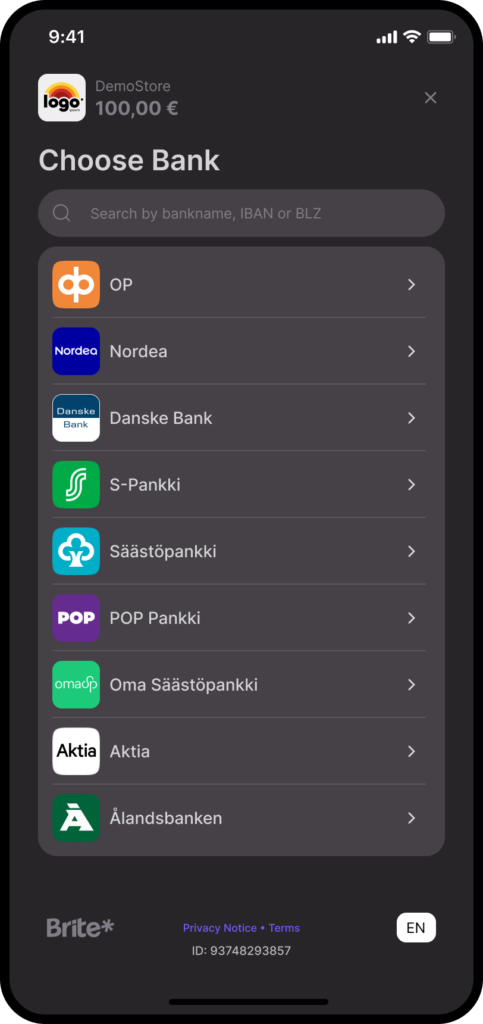

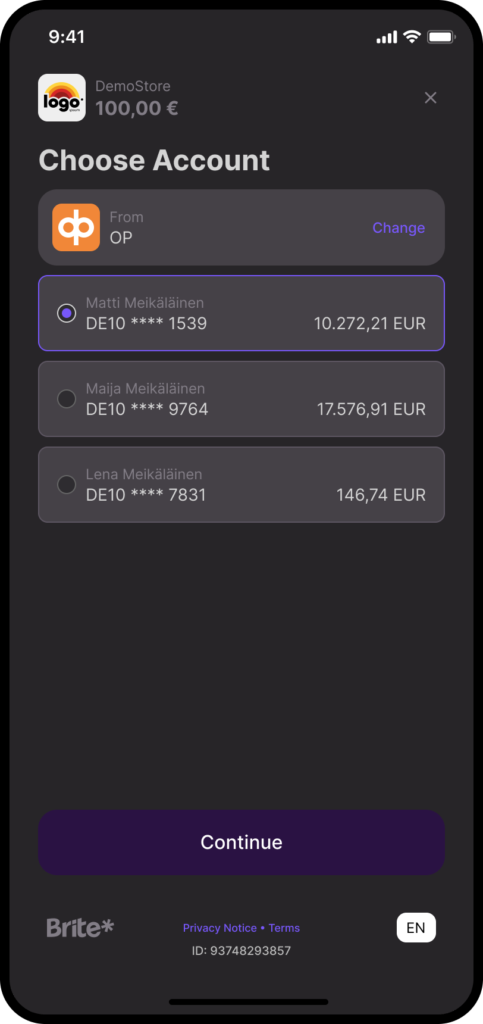

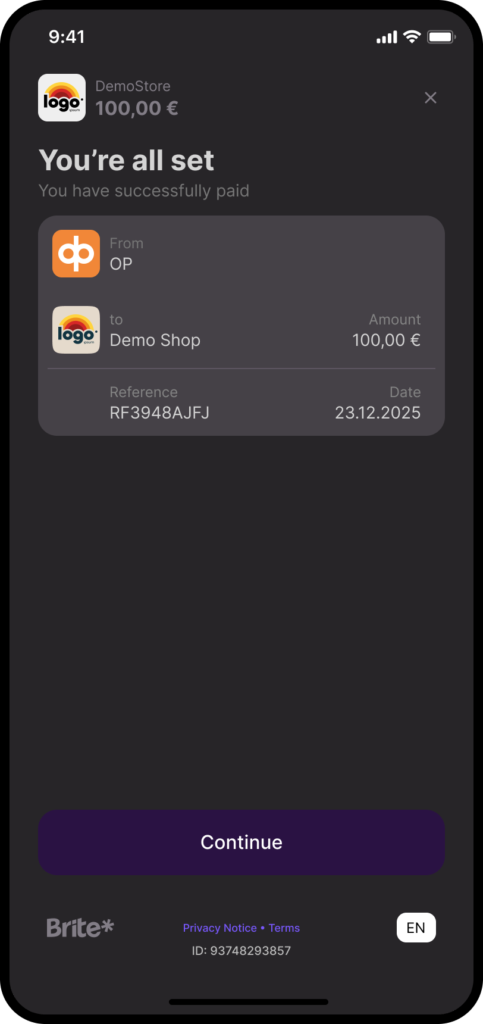

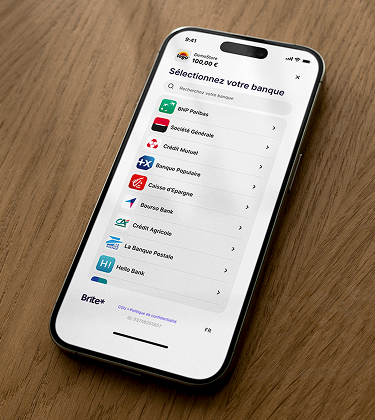

L'expérience Brite Play

Des fonctionnalités qui fidélisent vos clients.

01 -- 05

Brite Performance

La conformité totale n’exige pas de sacrifier la vitesse ou la conversion. Brite garantit un flux fluide : de la vérification initiale du client au premier dépôt, le tout en quelques secondes seulement.

<60s

+7.7%

<20s

Nos Clients

Gaming

Gaming

Rhino Entertainment

Moins d'appels. Plus de données.

Nous répondons à toutes vos questions sur Brite Play.

Any more questions?

What is Brite Play?

Brite Play is Brite’s all-in-one unified solution that merges the complex processes of KYC/account verification and the first payment/deposit into a single, high-conversion flow. It eliminates the need for manual form-filling and document uploads, delivering a fully verified, compliant, and funded consumer in seconds.

What impact can we expect on our Average Order Value (AOV) using Brite Play compared to standard payment flows?

Internal Brite data across various merchants has shown that Brite Play can deliver a significant average order value (AOV) uplift. We’ve seen up to a 31% increase in AOV and an average of 7.7% increase across all merchants using Brite when comparing Brite Play deposit amounts to regular payments.

This is attributed to the optimised, low-friction experience and the strong consumer trust generated by paying directly through their bank environment. (Note: While we can’t provide a precise figure without a specific A/B test, industry data shows optimisation tools can increase AOV significantly.)

How much faster is the Brite Play onboarding process compared to traditional registration and payment flows?

Brite Play dramatically reduces friction, transforming the sign-up and payment process from a multi-step, minutes-long task into a fast, single-session flow that takes less than 60 seconds. This speed is achieved by leveraging bank-verified data and instant payment initiation simultaneously.

What is the technical impact (API calls/overhead) of combining KYC and deposit into one API flow?

The technical benefit is significant simplicity and reduced overhead. Instead of managing separate API integrations for identity verification, account creation, and payment processing, Brite Play consolidates these steps behind a single, clean API flow. This minimises the technical complexity and testing burden on your development team.

How does Brite’s closed-loop payout system work? Is it a mandatory requirement for all payout transactions?

The closed-loop payout system is a key AML/security control where withdrawals are restricted exclusively to the bank account that initiated the original deposit. This mechanism is important for Brite Play as it confirms the verified identity is tied to the movement of funds, preventing money laundering and account takeover fraud.

The industry in which your business operates will abide by regulations that dictate whether this process should be mandatory. If so, Brite Play is here to help you stay compliant.

Does Brite Play fully satisfy our initial KYC/AML requirements, or is further verification needed?

Brite Play provides bank-verified data and proof of identity at the point of funding. This reduces the need for manual document checks and gives you a greater ability to ensure your consumer is compliant from the first transaction. Further Enhanced Due Diligence (EDD) may still be required based on your specific risk model or a consumer’s subsequent behaviour.

Any more questions?