Passez à la vitesse supérieure avec les paiements instantanés

Nos paiements en temps réel éliminent les délais de règlement afin d’optimiser la trésorerie de votre entreprise.

Nos Produits

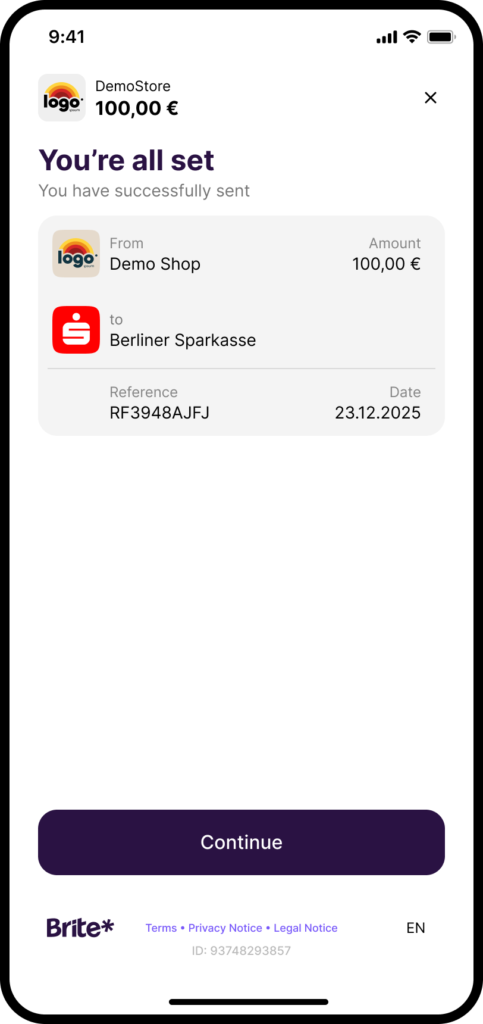

Instant Payments

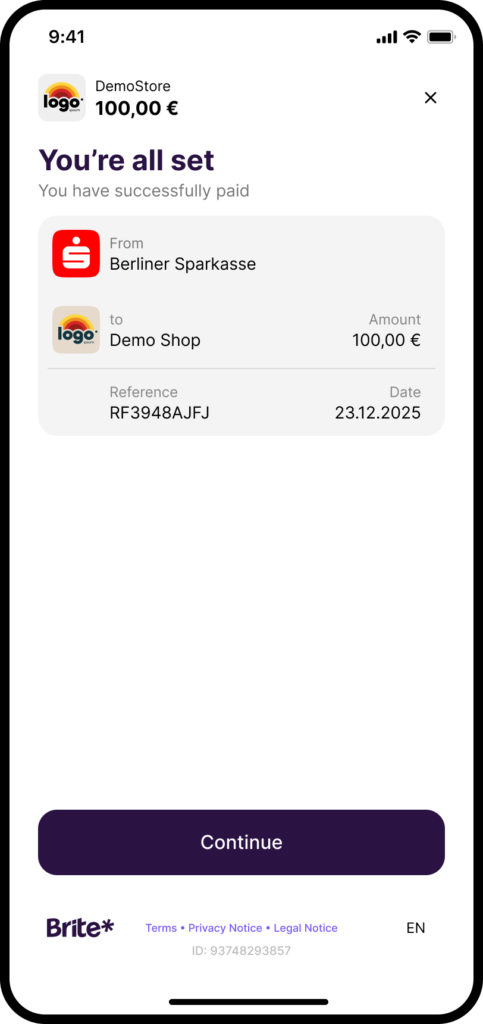

Des paiements réglés en quelques secondes

En savoir plus →

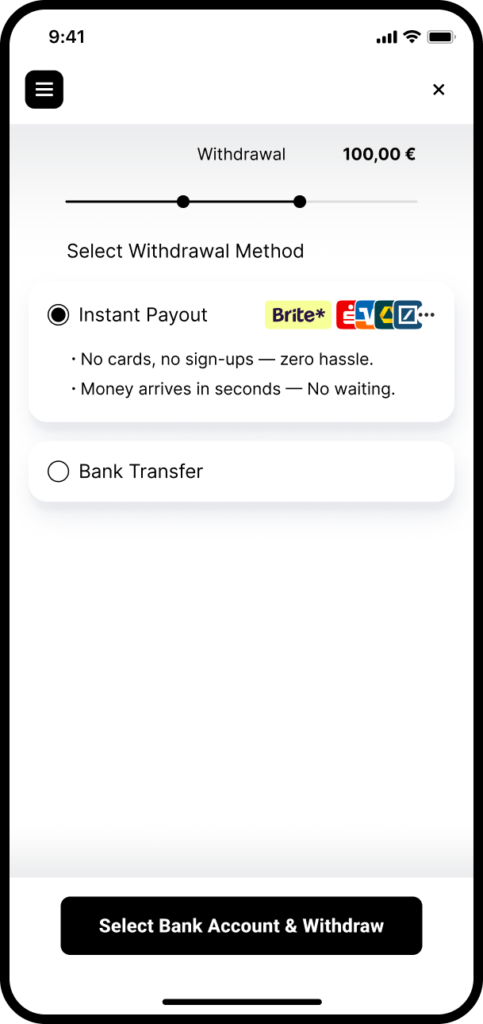

Instant Payouts

Payez sans délai, quel que soit le bénéficiaire

En savoir plus →

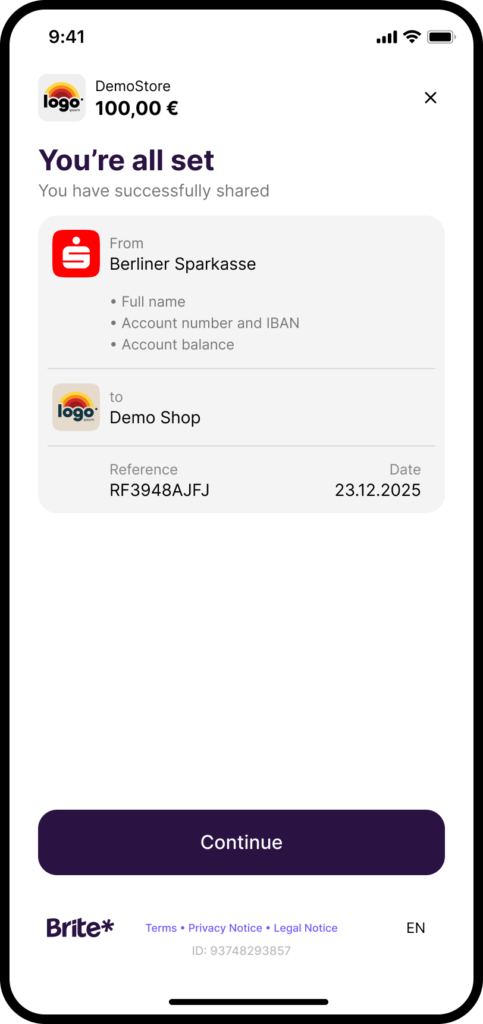

Data Solutions

Des données qui vous donnent une longueur d’avance

En savoir plus →

Vitesse. Fiabilité. Support.

Encaissement instantané. Décaissement immédiat.

UX optimisée

Support dédié

Fiabilité absolue

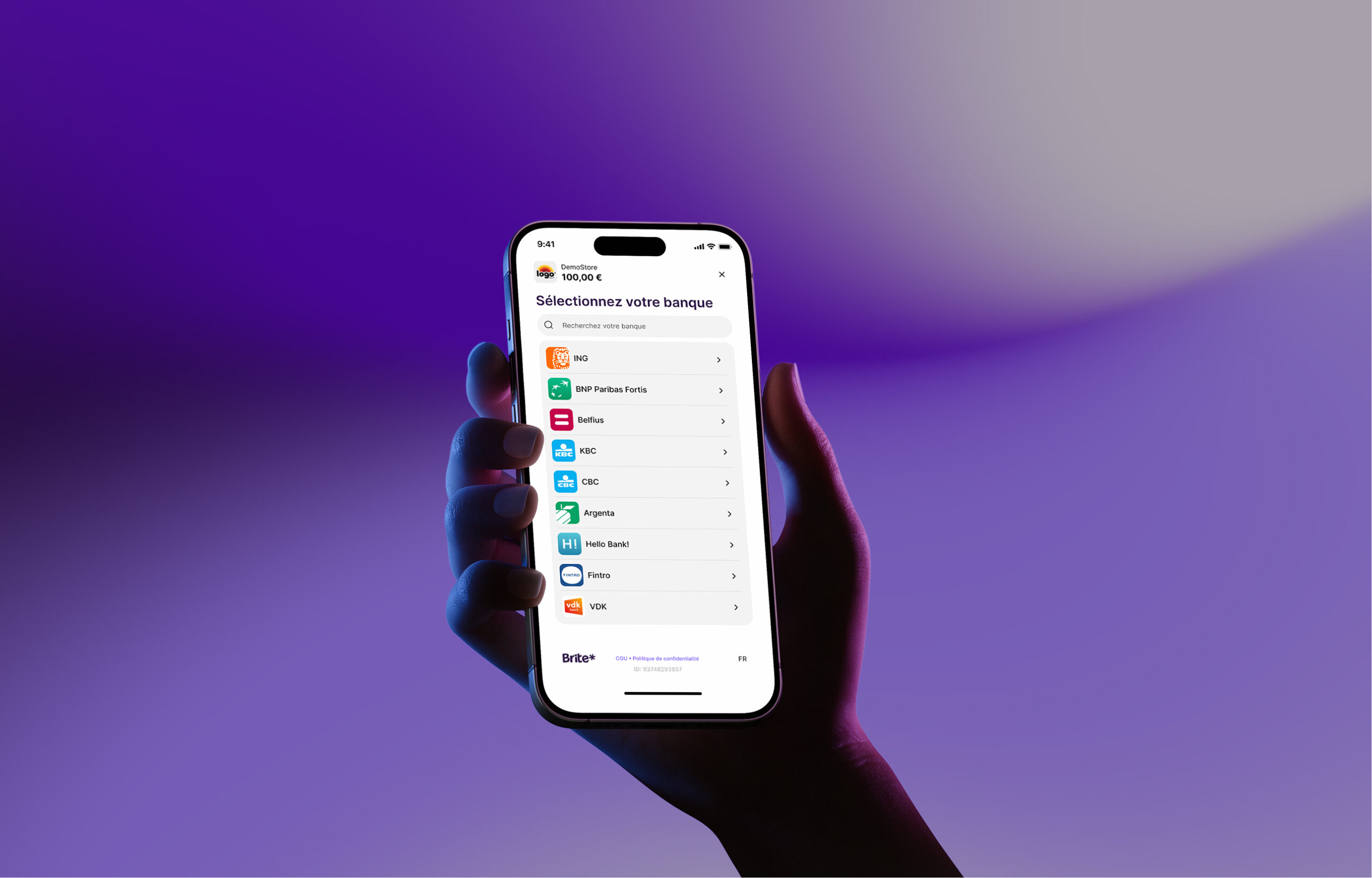

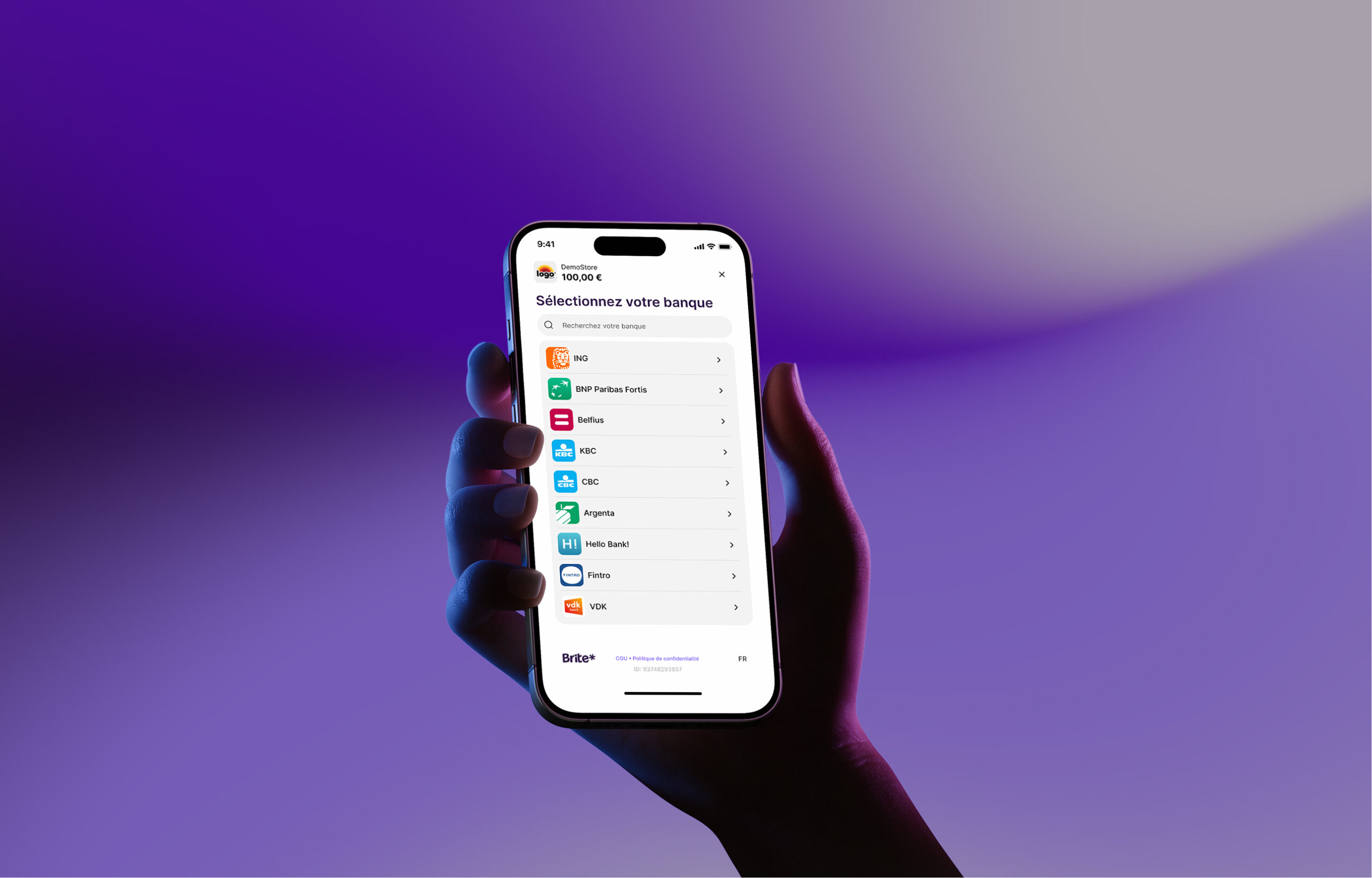

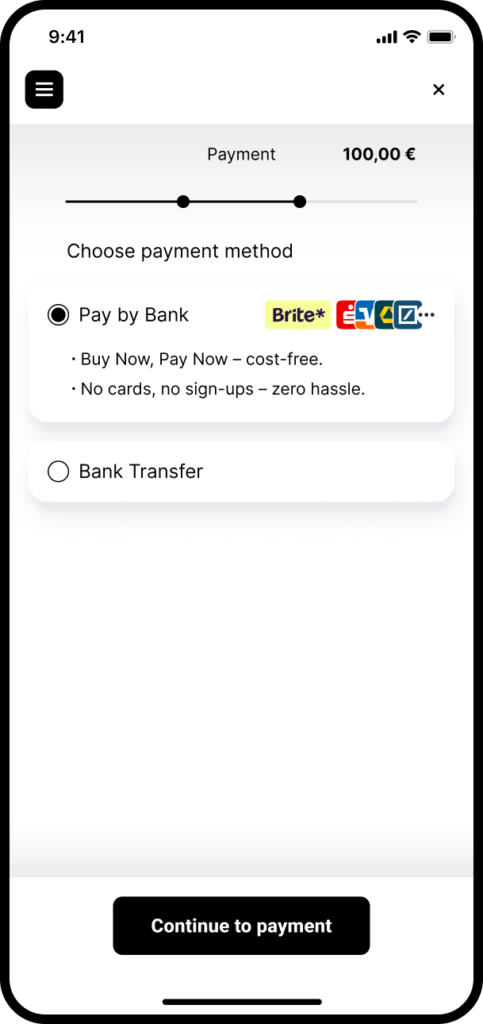

Le virement instantané pour maximiser vos conversions

Le virement instantané pour maximiser vos conversions

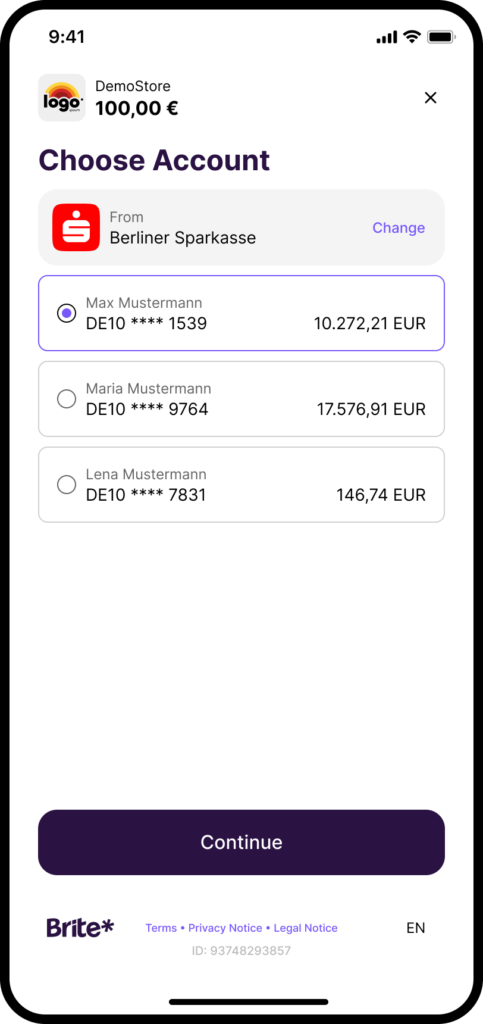

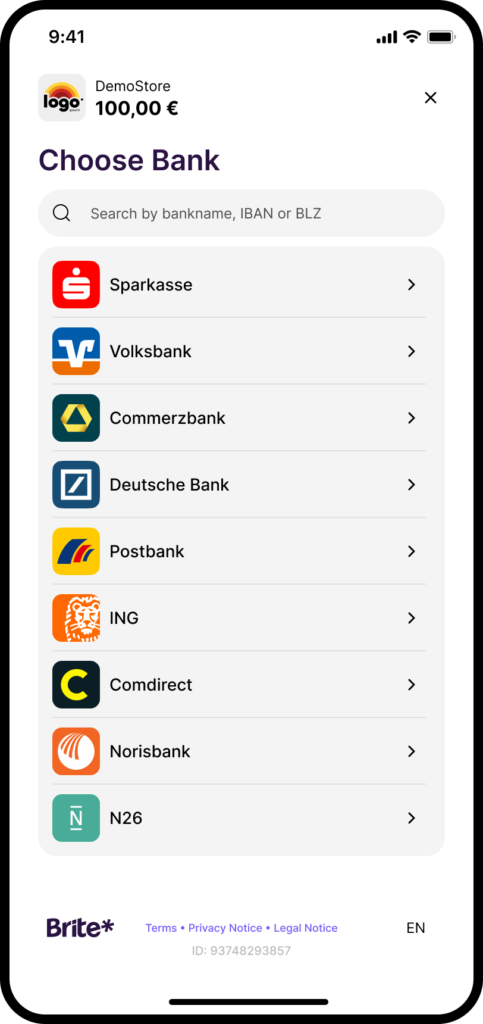

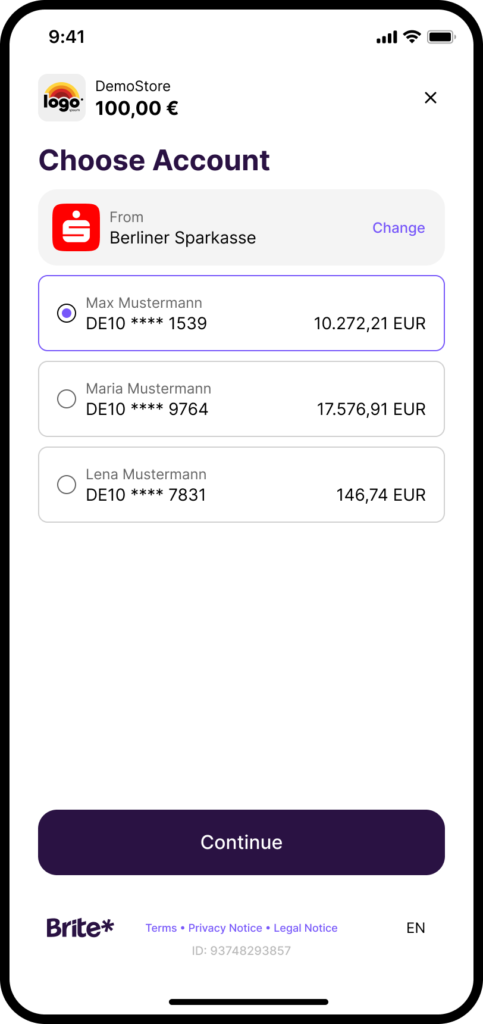

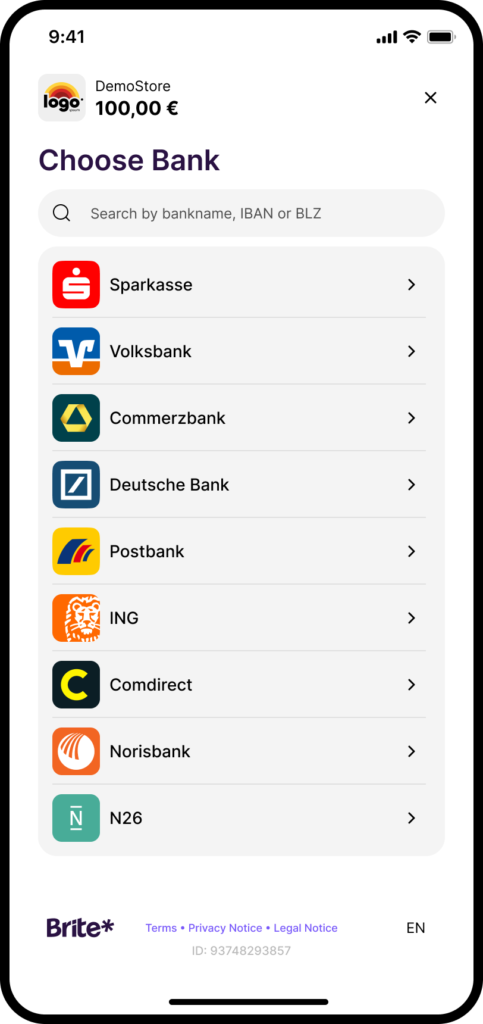

Des étapes simples pour un contrôle total

Un parcours unique pour toutes les situations

Nos Clientes

E-commerce

Financial Services

Financial Services

Cas d'usage par secteur d'activité

Intégration en quelques heures seulement.

Simple, performant, conçu pour les développeurs.

Notre API et notre documentation détaillée vous mènent de l’environnement de test au lancement rapidement. Ne perdez plus de temps avec l’intégration, concentrez-vous sur l’innovation.

La sécurité n'est pas une option. C'est le fondement de notre service.

Stabilité éprouvée

Notre taux de disponibilité atteint 99,99 %. Brite intègre nativement un chiffrement de niveau bancaire et respecte les principaux standards du secteur en matière de protection des données.

Risque de fraude minimal

Alors que l’authentification bancaire directe et l’authentification forte du client (SCA) sont au cœur du virement instantané, Brite va plus loin. Grâce à notre infrastructure, Brite IPN, nous réduisons les taux de fraude et de paiements non réglés à un niveau proche de zéro.

L’excellence réglementaire au cœur de nos processus

Nous déployons une approche par les risques, assurant une surveillance continue et une conformité stricte aux exigences KYC et LCB-FT. Nos dispositifs sont alignés sur les standards de nos marchés, notamment le RGPD et le règlement DORA.

Dernières Ressources

Clarté immédiate

D’autres questions?

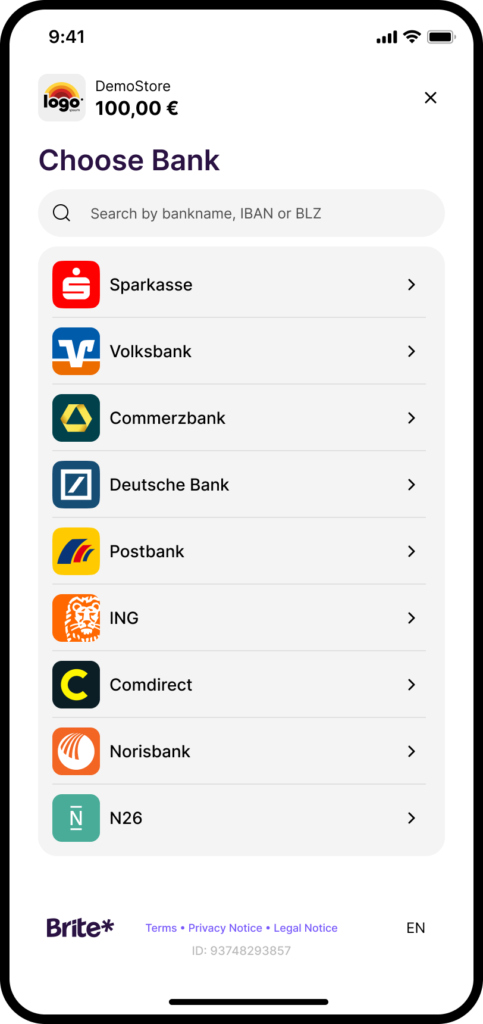

Qu’est-ce que Brite Payments?

Fintech suédoise de premier plan, Brite Payments est l’un des leaders européens du paiement de compte à compte (A2A) basé sur l’Open Banking. Grâce à notre solution « Pay by Bank », nous permettons aux utilisateurs de régler leurs achats en temps réel, directement depuis leur interface bancaire, sans carte de crédit ni inscription préalable.

Où est basée l'entreprise Brite Payments?

Le siège de Brite Payments est situé à Stockholm, en Suède. Brite est également présente à Londres (Royaume-Uni), Malaga (Espagne) ainsi qu’à La Valette (Malte).

Quel est le niveau de sécurité des transactions Brite pour mon entreprise et mes clients?

Les transactions via Brite bénéficient d’un niveau de sécurité maximal. Notre réseau repose sur la directive DSP2, qui impose une Authentification Forte (SCA). Chaque paiement est validé par une authentification à double facteur (ex: biométrie) gérée directement par la banque de l’utilisateur. Pour votre entreprise, ce modèle élimine le stockage de données bancaires sensibles, réduisant ainsi drastiquement les risques de fraude et simplifiant vos obligations de conformité PCI.

For your business, this means no sensitive card data is stored, drastically reducing your fraud risk and PCI compliance burden.

Combien de temps faut-il pour intégrer Brite à mon site ou à ma plateforme?

Brite met à disposition une documentation API claire, structurée et pensée avant tout pour les développeurs, afin de garantir une intégration rapide et une efficacité maximale.

Si le délai de mise en production dépend naturellement de vos ressources internes, notre plateforme, enrichie d’outils comme le Checkout UX Assistant (CHUX), est conçue pour permettre aux entreprises d’intégrer, tester et lancer leur première solution en l’espace de quelques jours à quelques semaines.

D’autres questions?