Solutions financières au service de l'innovation.

Construisez l'avenir de la finance. Instantanément.

Faites plus, demandez moins

L'instantanéité pour tous

Augmentez la limite

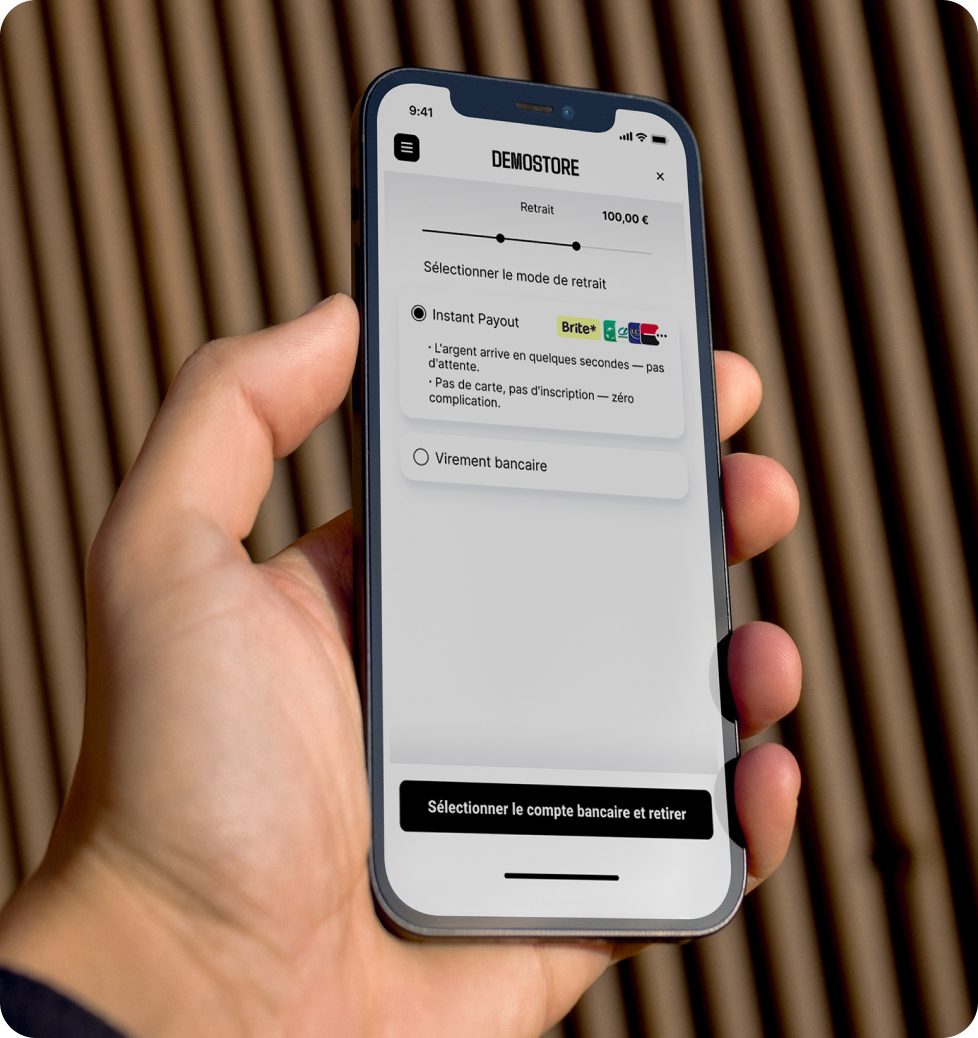

Nos paiements et payouts instantanés bénéficient de plafonds de transaction bancaire adaptés aux besoins de vos consommateurs à forte valeur.

Simplifiez votre trésorerie

Un seul partenaire, un seul solde, une seule vue pour toute l’Europe. Notre réseau accélère et facilite la réconciliation.

Our Customers

Financial Services

Financial Services

Financial services

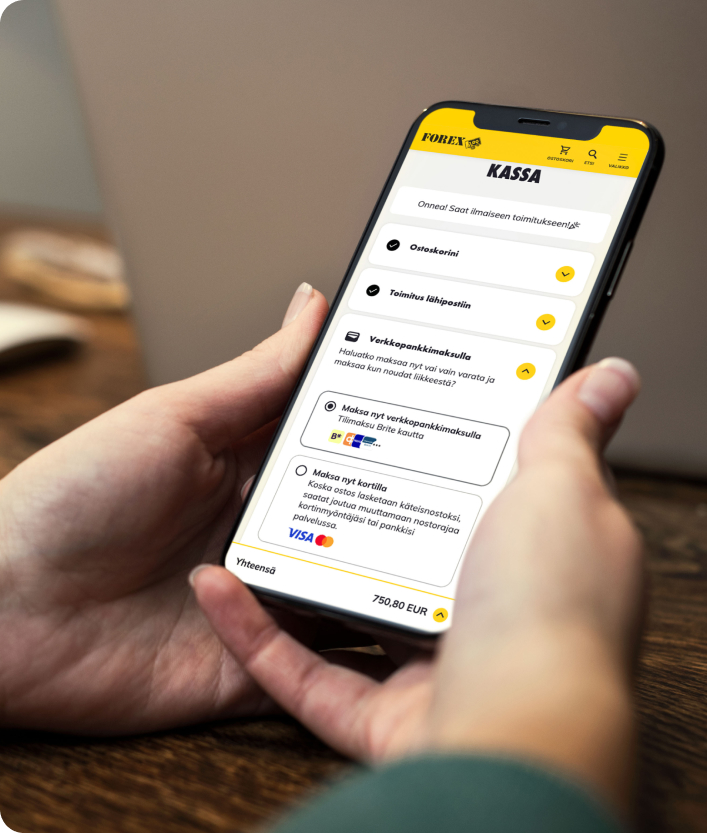

FOREX

Key feature

Virement instantané, conçu pour une fiabilité 24/7.

L'innovation au service de la finance

01 -- 05

Solutions de paiement conçues pour la croissance des services financiers

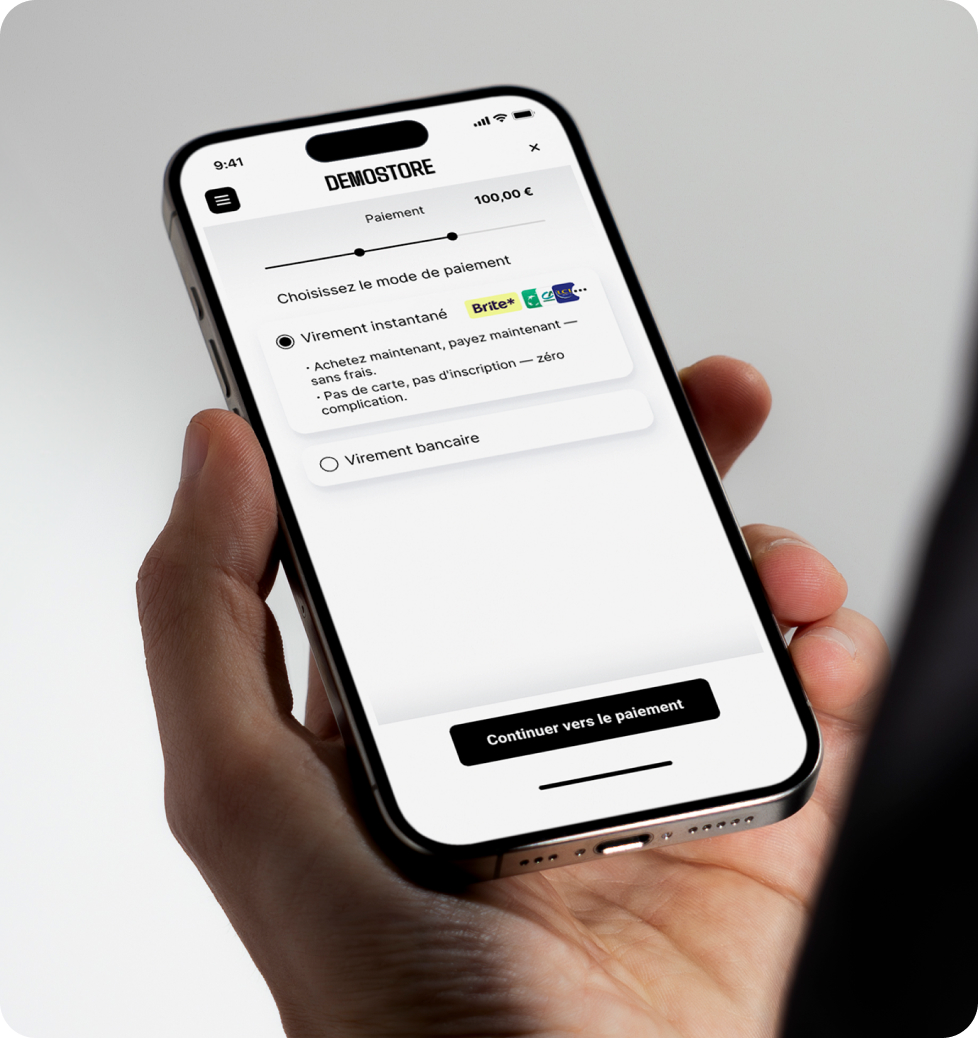

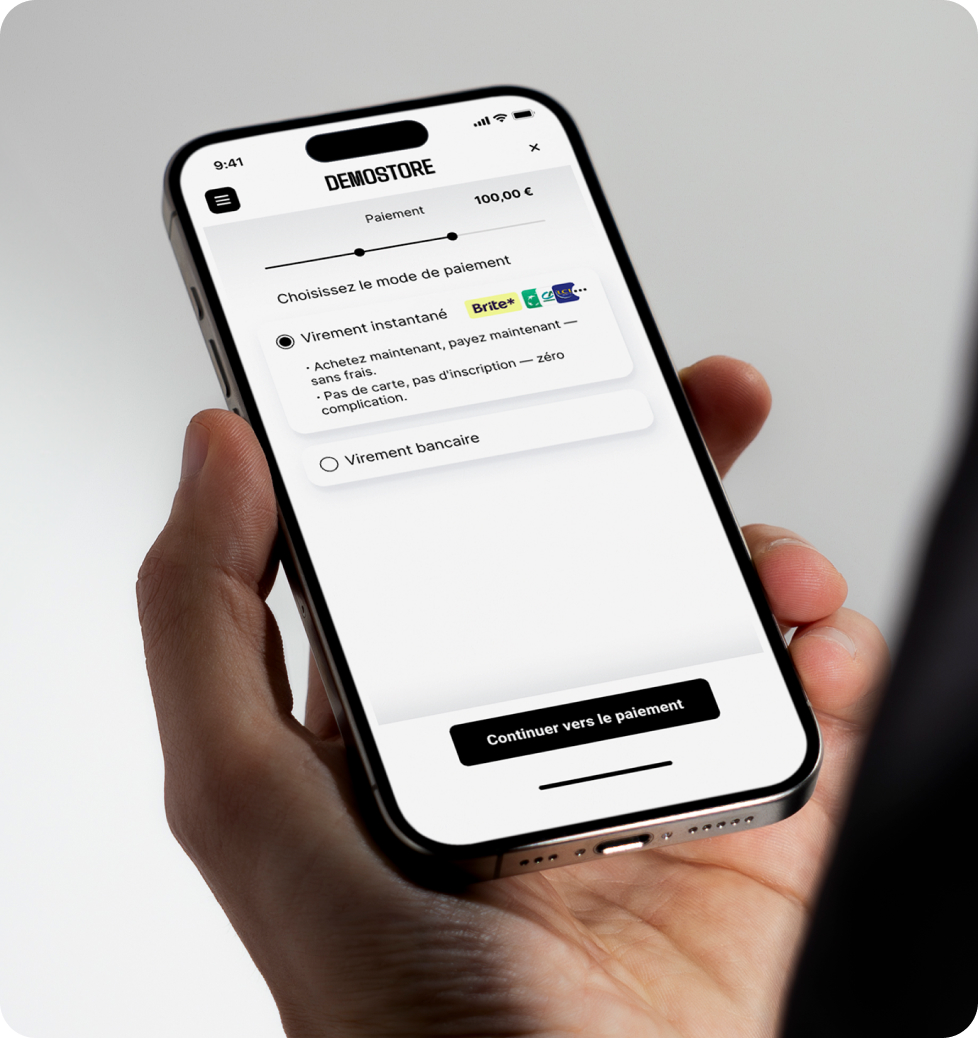

Simplifiez les paiements

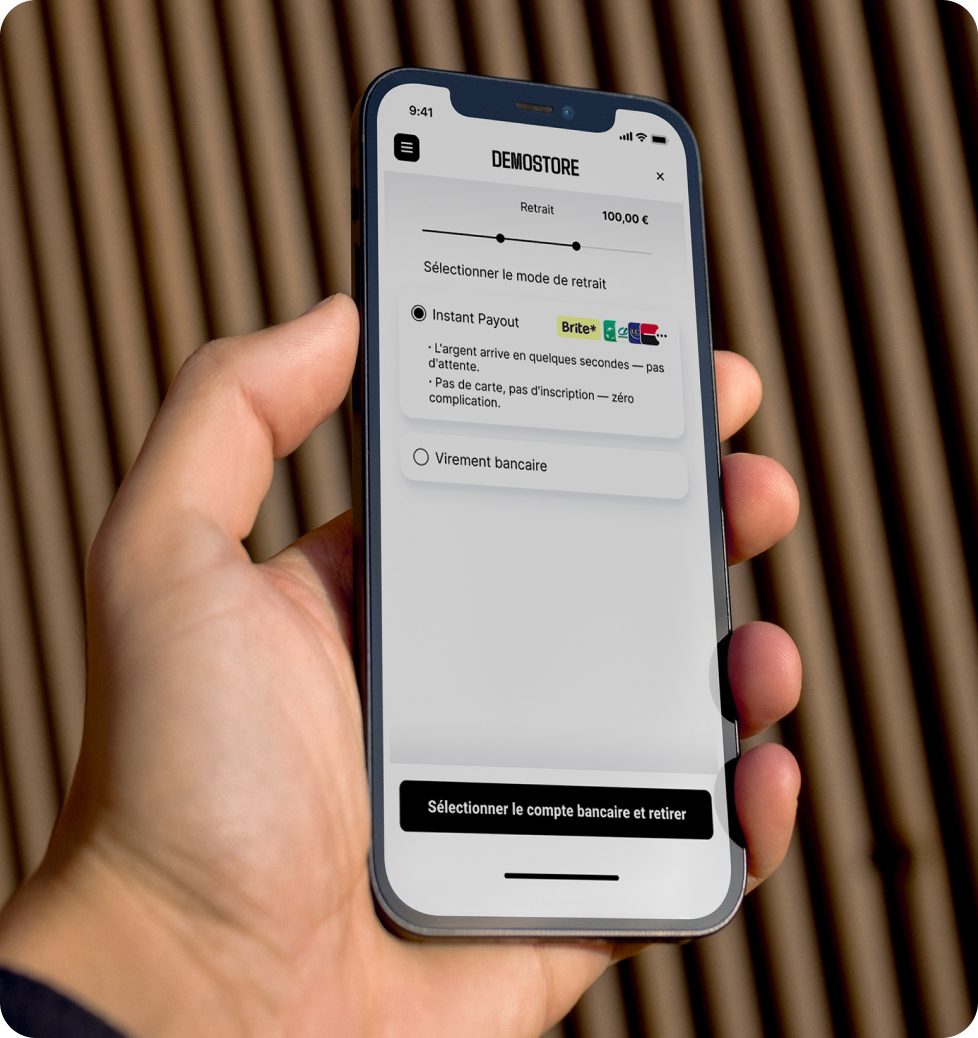

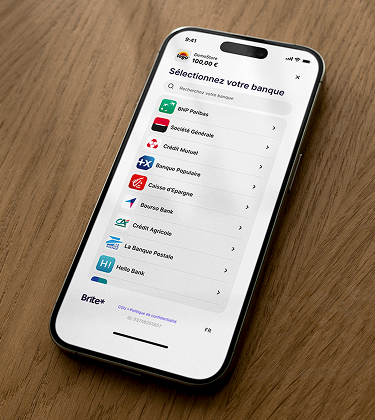

Retraits en temps réel 24/7

Créez des services exceptionnels grâce à des données vérifiées

Des fondations robustes : stabilité et conformité garanties.

Résilience opérationnelle

Notre architecture, conçue pour un fonctionnement continu, assure le traitement en temps réel 24/7/365, vous donnant un avantage concurrentiel sur les systèmes traditionnels qui limitent l’accès client.

Sécurité des Fonds et Contrôle LBC/FT

Tous les dépôts sont vérifiés par la banque via l’Authentification Forte du Client (SCA), éliminant ainsi les chargebacks et la fraude par carte. Grâce à nos solutions de données, le KYC et la vérification de compte sont automatisés, ce qui permet d’identifier le déposant en amont et d’optimiser les protocoles LBC/FT.

Conformité exemplaire

La confiance des régulateurs est notre norme. Notre solution est conçue pour une adhésion stricte aux règlements DSP2 et LBC/FT, ce qui allège votre charge réglementaire et réduit votre exposition aux risques.

Construisez l'avenir de la finance

Dernières Ressources

Nous répondons à toutes vos questions sur les services financiers

Why are Brite solutions well-suited to Financial Services?

Brite solutions are built for the resilience, speed, and compliance demands of modern finance. This combination means we’re well-positioned as a trusted partner to the current and next wave of Financial Service innovators.

Our platform enables instant funding and real-time withdrawals, critical for asset managers and trading platforms. We also integrate Data Solutions to streamline KYC, Affordability, and AML checks, ensuring you can innovate without compromising regulatory integrity.

How does Brite’s platform help me meet my specific regulatory and compliance (KYC/AML) obligations?

Our integrated Data Solutions help merchants speed up compliance during onboarding. We provide bank-grade verification of consumer identity, check for account ownership, and offer crucial insights for Source of Funds (SoF) and Affordability. This process minimises manual review, ensures adherence to PSD2 and AML rules, and provides a clear audit trail.

How are Brite's Instant Payments different or better than using SEPA Instant?

While SEPA Instant is a vital clearing standard, Brite’s proprietary network (IPN) offers significant advantages:

24/7/365 Availability: Our IPN is built to eliminate reliance on traditional bank cut-off times and batch cycles, ensuring instant settlement even on weekends and holidays.

Unified API: We provide one simple integration for 27 European markets, addressing the « fragmented nature » of SEPA and simplifying multi-region operations and treasury management.

How much faster is Brite’s Onboard and Pay process compared to traditional registration and payment flows?

Brite helps reduce the multi-day delays caused by manual KYC and traditional funding methods (like SEPA or card processing). By combining user authentication and payment initiation into one frictionless flow, we reduce the onboarding time from days to seconds, allowing your customers to fund their accounts and act on market movements instantly.

Research suggests the time to onboard and pay within Financial Services can range from a few minutes to a number of days. With Brite, we typically see the same process taking less than 90 seconds to complete on average, which is a significant improvement.

What does Brite’s developer support and technical onboarding process look like for a FinServ partner?

Technical onboarding is prioritised for speed and stability. You receive access to a clean, well-documented API built on our full-stack infrastructure. Our onboarding process includes direct access to Brite merchant solutions experts who specialise in complex FinServ use cases, ensuring efficient integration and minimising reliance on third-party aggregators.

What is Brite’s Time2Money feature, and how does it help my customer support team?

Time2Money provides the consumer with the estimated time of arrival (ETA) for their payout. This feature builds trust and drastically reduces the volume of « Where Is My Money? » (WIMMO) support tickets, allowing your customer service teams to focus on high-value user queries rather than payment tracking.

What are typical transaction limits in A2A payments?

Unlike many legacy payment systems, Account-to-Account (A2A) payments generally accommodate high-value transactions, which is crucial for wealth and investment platforms. While limits are often subject to the end-user’s bank and Brite’s internal risk settings, the A2A architecture itself supports transactions significantly higher than typical consumer card payment limits.