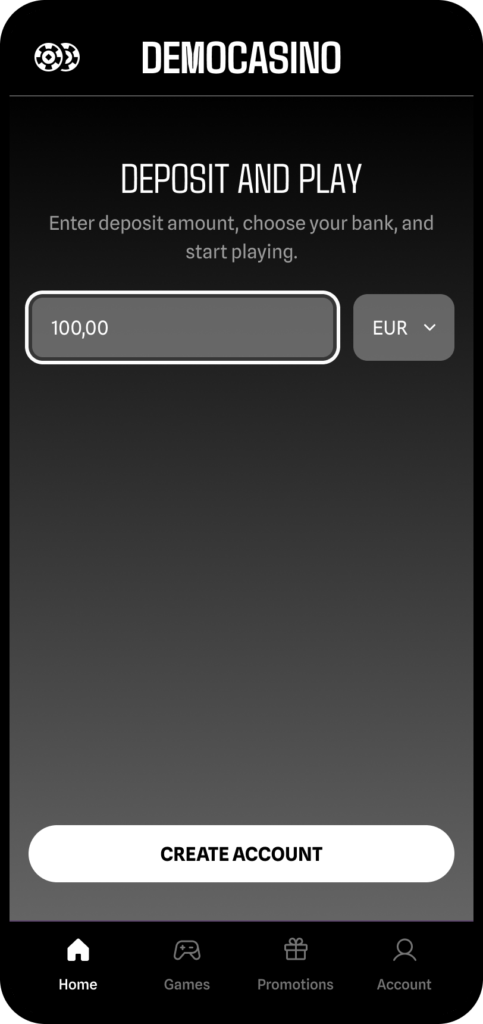

Brite Play

From Payment to Sign-Up in Seconds

Combine user account creation and payment into one flow, delivering a verified account and funded consumer instantly.

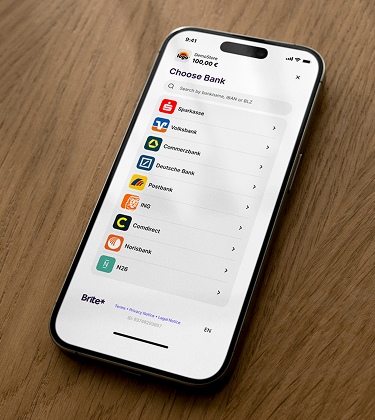

What is Brite Play?

Brite Play condenses minutes of form-filling into a single, high-converting flow. Full account creation and funding in a user journey designed for maximum conversion.

One Flow. Multiple Benefits.

Skip the complex forms without skipping KYC. Brite Play is the fastest way to acquire high-value consumers and automate your data collection – all in one journey.

Accelerate Conversion

Eliminate the single biggest barrier to entry—the registration form.

Drive High-Value Payments

Gain a proven uplift in the average payment value across consumers.

Smoother Onboarding

Speed up your consumer acquisition with specific KYC data and minimal friction.

Deliver Great UX

An onboarding and payment flow that inspires long-term retention from the start.

“The truth is, merchants are losing consumers at the KYC wall – watching them fail to convert at sign-up. Brite Play is the essential fix for that acquisition leak. It eliminates the friction by combining forms, verification, and payment into a simple flow that takes seconds. Enabling merchants to stop demanding paperwork, and instantly acquire a verified, compliant, and crucially happy consumer.”

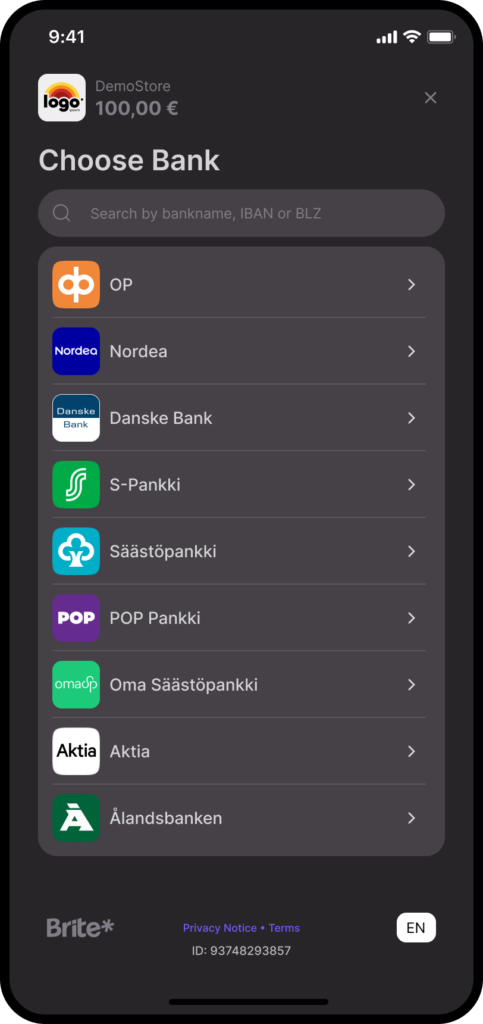

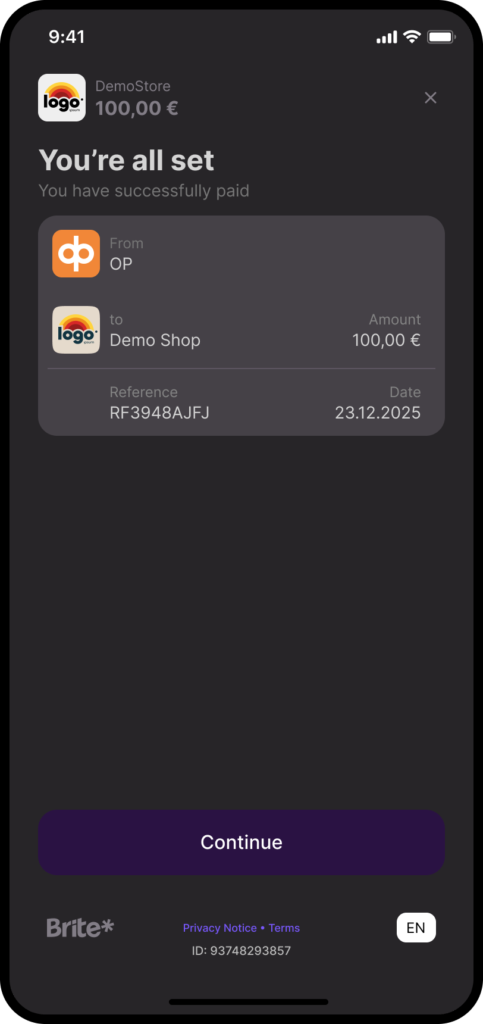

The Brite Play Experience

Features to Keep Consumers Coming Back

Brite Play is a complete customer acquisition and retention solution.

01 -- 05

Brite Performance

Full compliance doesn’t require sacrificing speed or conversion; gain the fastest route to a fully verified and funded consumer.

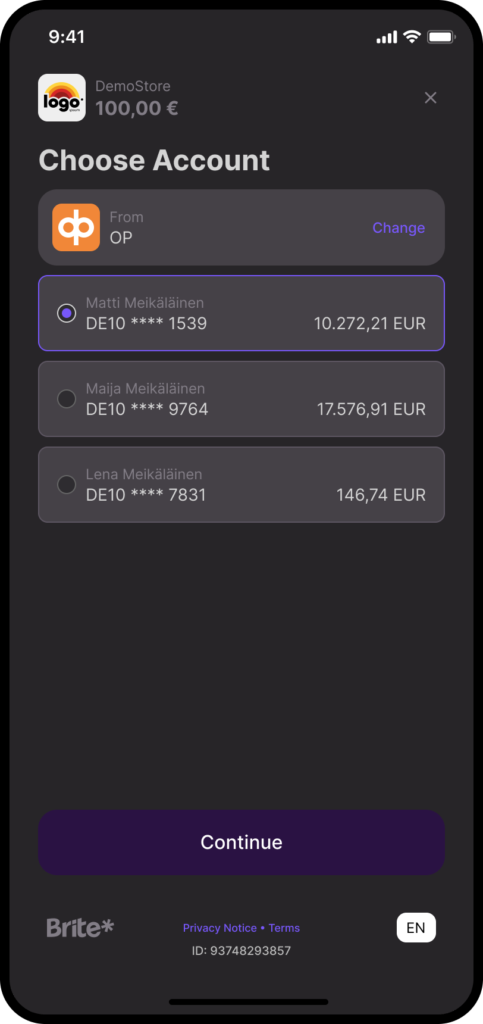

<60s

To pay and sign-up: Allow consumers to verify, register, and fund their balance in seconds, not days.

+7.7%

Higher AOV: Proven average uplift in payment value per transaction across merchants using Brite Play.

<20s

KYC can be a lengthy process. Receive valuable data combined with a payment within less than 20 seconds.

Our Customers

Gaming

Gaming

Rhino Entertainment

Minimal Calls. Maximum Insights.

Built on a high-efficiency API design, Brite Play reduces friction for both your consumers and your servers. Explore the docs and see the technical advantage.

Your Brite Play Questions Answered

What is Brite Play?

Brite Play is Brite’s all-in-one unified solution that supports the complex processes of KYC/account verification and adds the first payment/deposit into a single, high-conversion flow. It reduces the need for manual form-filling and document uploads, delivering a verified and funded consumer in seconds.

What impact can we expect on our Average Order Value (AOV) using Brite Play compared to standard payment flows?

Internal Brite data across various merchants has shown that Brite Play can deliver a significant average order value (AOV) uplift. We’ve seen up to a 31% increase in AOV and an average of 7.7% increase across all merchants using Brite when comparing Brite Play deposit amounts to regular payments.

This is attributed to the optimised, low-friction experience and the strong consumer trust generated by paying directly through their bank environment. (Note: While we can’t provide a precise figure without a specific A/B test, industry data shows optimisation tools can increase AOV significantly.)

How much faster is the Brite Play onboarding process compared to traditional registration and payment flows?

Brite Play dramatically reduces friction, transforming the sign-up and payment process from a multi-step, minutes-long task into a fast, single-session flow that takes less than 60 seconds. This speed is achieved by leveraging bank-verified data and instant payment initiation simultaneously.

What is the technical impact (API calls/overhead) of combining KYC and deposit into one API flow?

The technical benefit is significant simplicity and reduced overhead. Instead of managing separate API integrations for data provisioning to support your KYC, account creation, and payment processing needs, Brite Play consolidates these steps behind a single, clean API flow. This minimises the technical complexity and testing burden on your development team.

How does Brite’s closed-loop payout system work? Is it a mandatory requirement for all payout transactions?

The closed-loop payout system is a key measure in view of AML and security controls where payouts are restricted exclusively to the bank account used for the initial payment. This mechanism is important for Brite Play as it confirms the verified identity is tied to the movement of funds, preventing money laundering and account takeover fraud.

The industry in which your business operates will abide by regulations that dictate whether this process should be mandatory. If so, Brite Play is here to help you stay compliant.

Does Brite Play fully satisfy our initial KYC/AML requirements, or is further verification needed?

Brite Play provides bank-verified user data at the point of funding which you may need to collect for your own KYC requirements. It does not replace your KYC requirements and Brite is not a KYC provider. You are solely responsible for assessing your KYC needs.