How Octany uses Brite’s Data Solutions to drive a 24% increase in successful donation signups

Benefits

24% Conversion Lift

Superior Data Integrity

Broad Market Reach

Reduced Support Overhead

Background

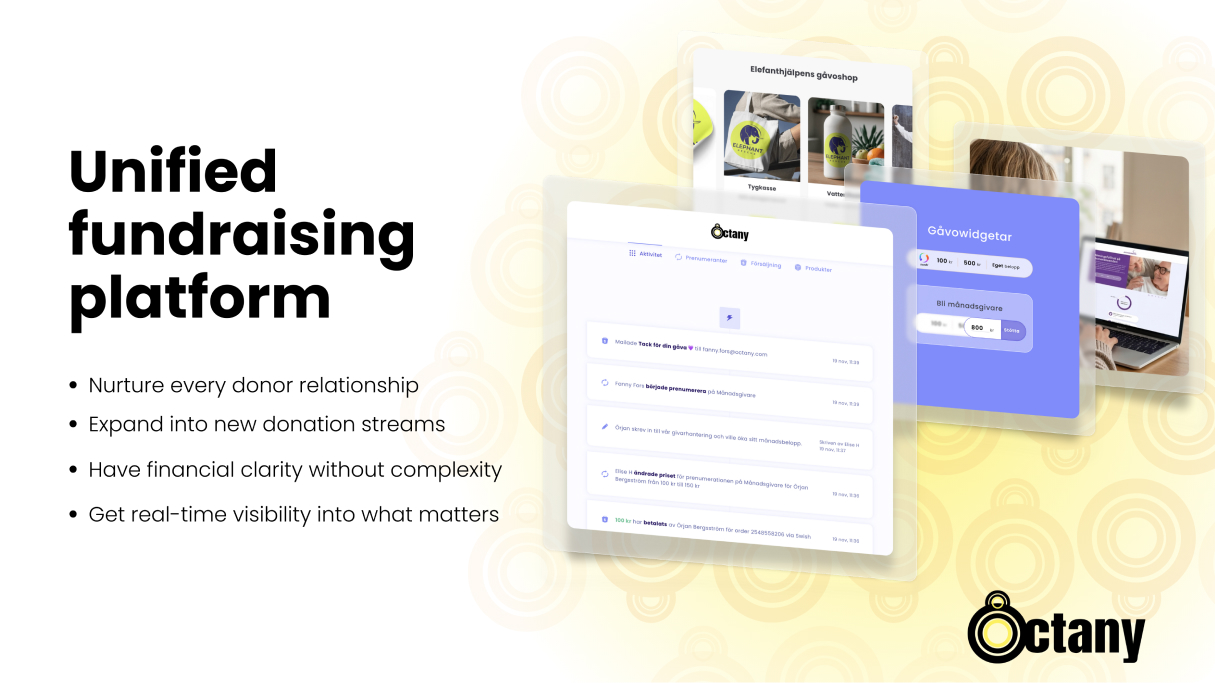

Octany was born in 2017, when a major Swedish non-profit approached the team to solve a critical issue: fragmented donation journeys. At the time, data for a single donor was often scattered across multiple systems depending on whether they gave via card, invoice, direct Debit or Swish.

Officially launched as a dedicated product in 2017 and scaling rapidly since 2019, Octany was “born and raised” specifically for the third sector. Unlike generic e-commerce tools, Octany is designed to meet the unique compliance and other specific needs of charities. Today, the platform manages the entire donor lifecycle, from initial checkout to long-term CRM management and automated bookkeeping for finance managers.

Challenge

Within the digital fundraising landscape, the primary hurdle for charities is “donor anxiety” triggered by convoluted checkout flows and complex form filling. While recurring gifts are vital for a non-profit’s long-term planning, setting up an Autogiro (Direct Debit) has traditionally been a point of high friction. Many legacy platforms rely on manual data entry, requiring donors to provide clearing and bank account numbers – specific details that few people know by heart and which often lead to abandoned donations.

Octany recognised that for their charity clients to thrive, this manual process had to be replaced by a more intuitive experience. Their previous technical provider, however, operated as a “black box,” offering no visibility into the donor journey or where signups were failing. This lack of transparency was compounded by frequent instability in major banks and limited coverage of smaller institutions, which effectively restricted the reach and revenue potential.

Solution

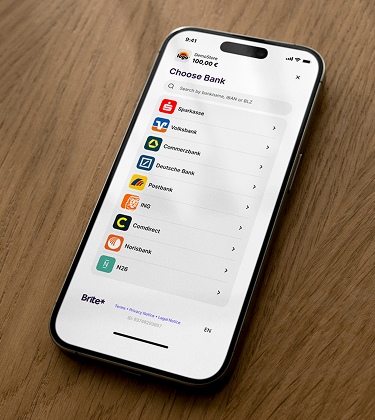

To solve these issues, Octany integrated Brite Data Solutions. This allowed them to replace manual data entry with an Open Banking-powered flow that utilises Mobile BankID. Now, instead of hunting for bank details, donors simply authenticate through their banking app, and their account information is automatically and accurately fetched.

The integration provided Octany’s tech team with the transparency they had been lacking. They gained clear updates for every step of the donor journey, ensuring that any friction could be identified and addressed. Furthermore, Brite’s extensive bank coverage ensured that the solution was inclusive of all donors, regardless of their banking institution.

Results

Achieved Significant Conversion Lift

By providing a more stable connection and eliminating “black box” technical errors, Octany saw a 24% increase in successful Autogiro signups within the first month. This stability ensures that charities can capture donor intent immediately without the risk of system-driven drop-offs.

Fulfilled the Promise of Frictionless Onboarding

The integration replaces lengthy, intimidating manual forms with a bank-native identification method. Donors can now set up recurring gifts in seconds using familiar authentication, keeping donor momentum high and eliminating the “anxiety” of manual data entry.

Guaranteed 100% Data Accuracy

By fetching account details directly from the bank via an API, the risk of “fat-finger” errors is entirely removed. This ensures that the first payment – and every subsequent recurring gift – is processed successfully, protecting the long-term revenue streams of Octany’s clients.

Secured Enhanced Security and Trust

Utilising familiar security protocols, such as BankID, ensures that sensitive financial data is shared securely under the donor’s explicit consent. This transparent, high-integrity process builds essential long-term trust between the supporter and the non-profit organisation.

Scalable Nordic Operations

Automated data retrieval provides the technical flexibility for Octany to expand its services across the Nordics. The platform can now support a broader range of regional banks without increasing the administrative or customer support burden on its internal teams.

Reduced Administrative and Support Overhead

The stability of the Brite integration resulted in a significant decrease in support tickets related to failed bank connections. Additionally, automated data fetching streamlines the non-profits’ bookkeeping, allowing them to focus on their social mission rather than manual file management.