Partner Hub

Partner With Brite For Next Generation Payments*

Instant account-to-account payments are

transforming the payment industry. Embrace

the growth of Pay by Bank.

Brite partnership

Great minds think Brite

A2A payments that work for you with a fully customisable

open banking API.

Why partner with Brite?

Brite Instant

Payments Network

Broaden your payment mix, enhance efficiency, and provide instant liquidity. Brite IPN provides instant processing 24/7, 365 days a year, sending and receiving payment across Europe.

Instantly,

anytime

Skip bank delays and waiting. Our payments are processed in seconds, around the clock – with the added benefit of real-time reconciliation and compliance screening on every payment.

Made for

growth

Provide merchants with access to thousands of banks via a single integration, enabling quicker go-to-market launches and expansion possibilities.

Talk to our partnership team

Providing merchants with flexible and future-proof solutions is at the core of our DNA. Partnering with Brite Payments gives our merchants a new payment method that is perfect for the fast-changing world of online commerce.

Alexey Pronin

General Manager EMEA, Shopware

OUR REACH

Brite in numbers

Connecting the dots to faster payments since 2019.

Banks connected

0

European markets

0

Customer reach

0

m

Brite Partner Benefits

What makes us unique?

Use the latest open banking infrastructure – not held back by legacy technologies. Our secure and streamlined payments remove the need for local settlement accounts and eliminate the requirement to manage refunds or reconcile manually.

Seamless payments

Trace every transaction. No need for local bank accounts – we take care of that thanks to our extensive network.

Maximise conversion

Accept and settle in any local currency across Europe, we cut the complexity of currency conversion.

World-class support

Brite provides prompt and effective resolution of any issue for end-users, merchants and partners.

Want to add Brite?

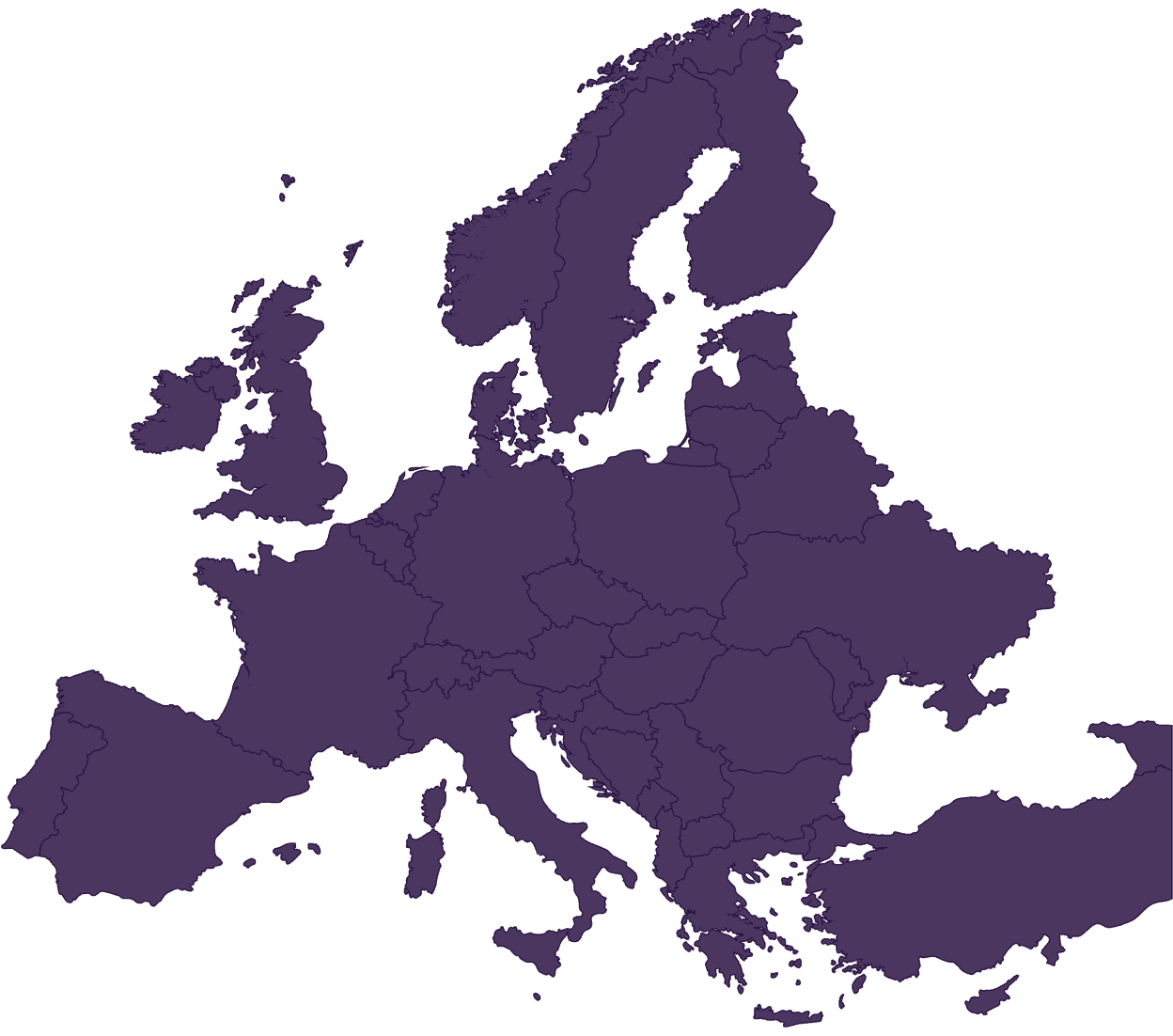

Local expertes. Global Reach.

Brite across Europe

Instant payments and payouts across Europe, 24/7, 365 days a year.

Ireland

Sweden

Germany

Spain

Italy

France

Netherlands

Portugal

Belgium

Luxembourg

Austria

Malta

Greece

Cyprus

Slovenia

Slovakia

Lithuania

Latvia

Estonia

Finland

Croatia

Romania

Hungary

Denmark

Switzerland

Norway