Financial Solutions for Innovators

Build the Future of Finance. Instantly.

Do More, Ask for Less

Fast for Everyone

Raise the Limit

Benefit from bank transaction limits that meet your most valuable consumers’ needs.

Simplify Treasury

Our Customers

Financial Services

Financial Services

Financial services

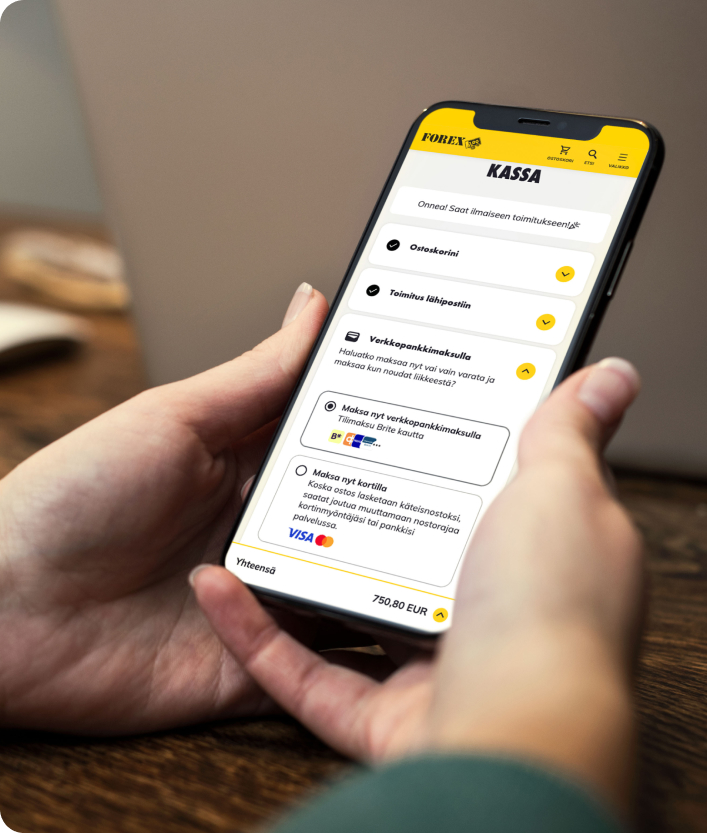

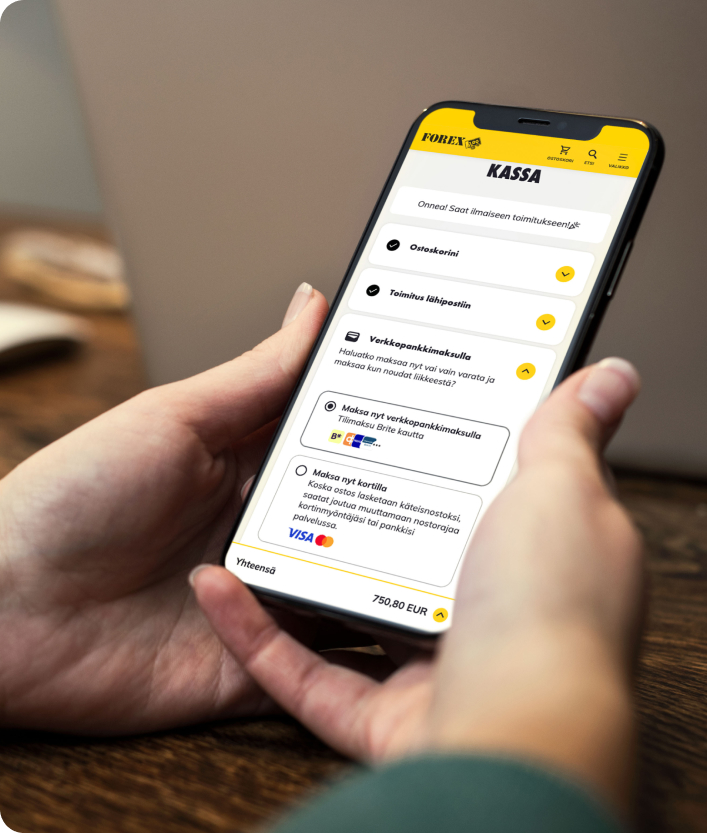

FOREX

Key feature

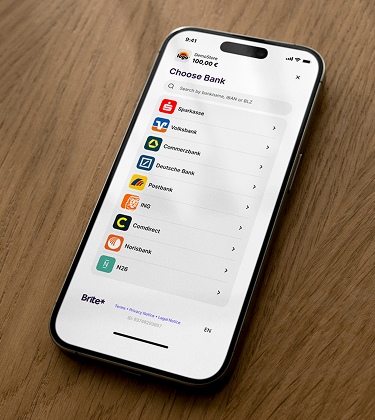

Brite IPN, Built for 24/7 Reliability

Our Instant Payments Network is more than just a network of banks. It’s the resilient backbone of our platform and the engine that enables instant payments, faster customer acquisition, and ultimate user trust.

Innovative features for Financial Services

01 -- 05

Payment products designed for FinServ growth

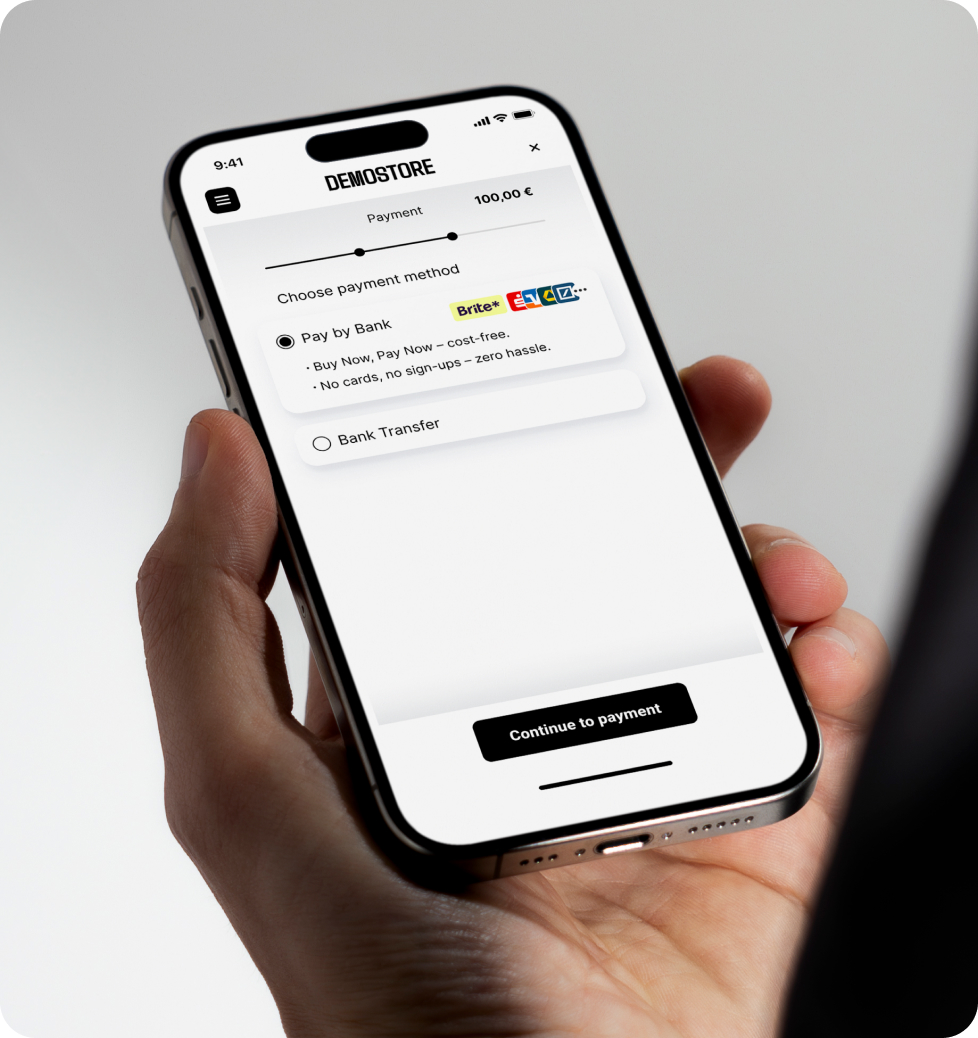

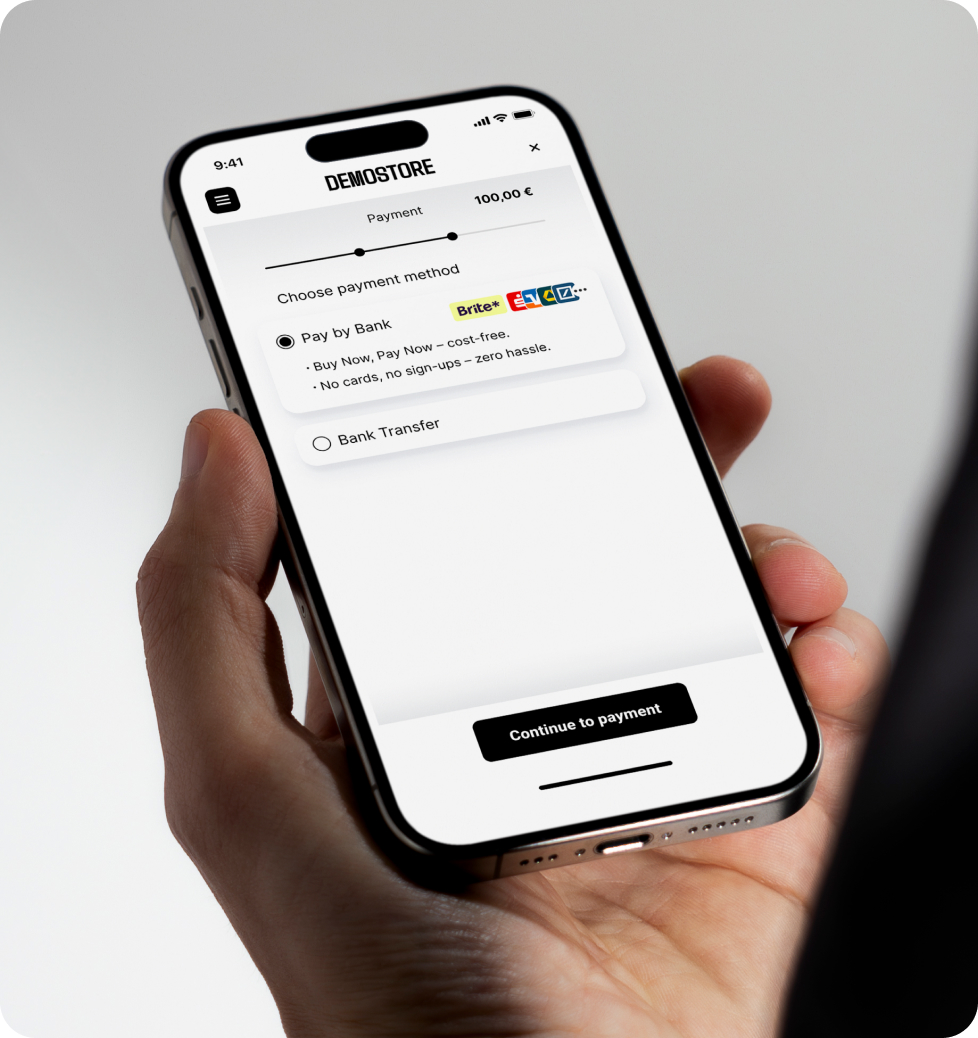

Keep Payments Simple

24/7 Real-Time Withdrawals

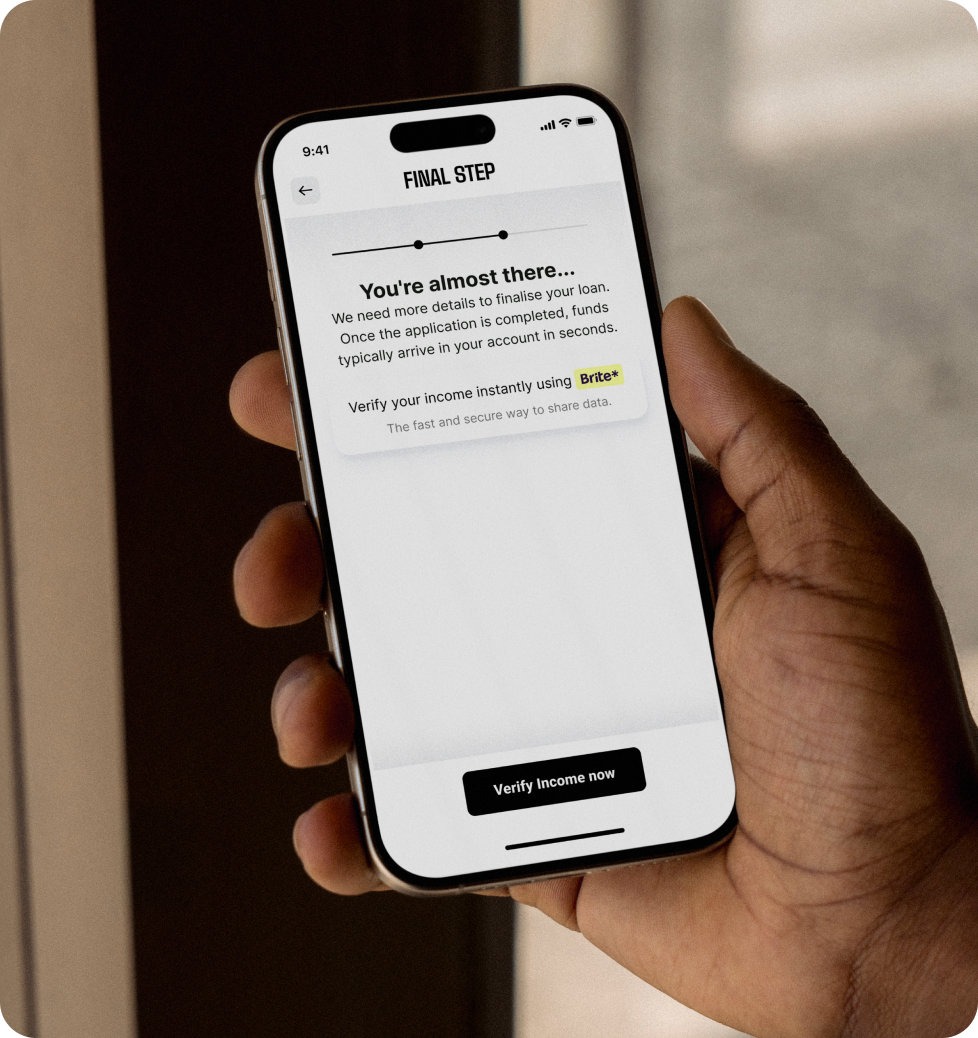

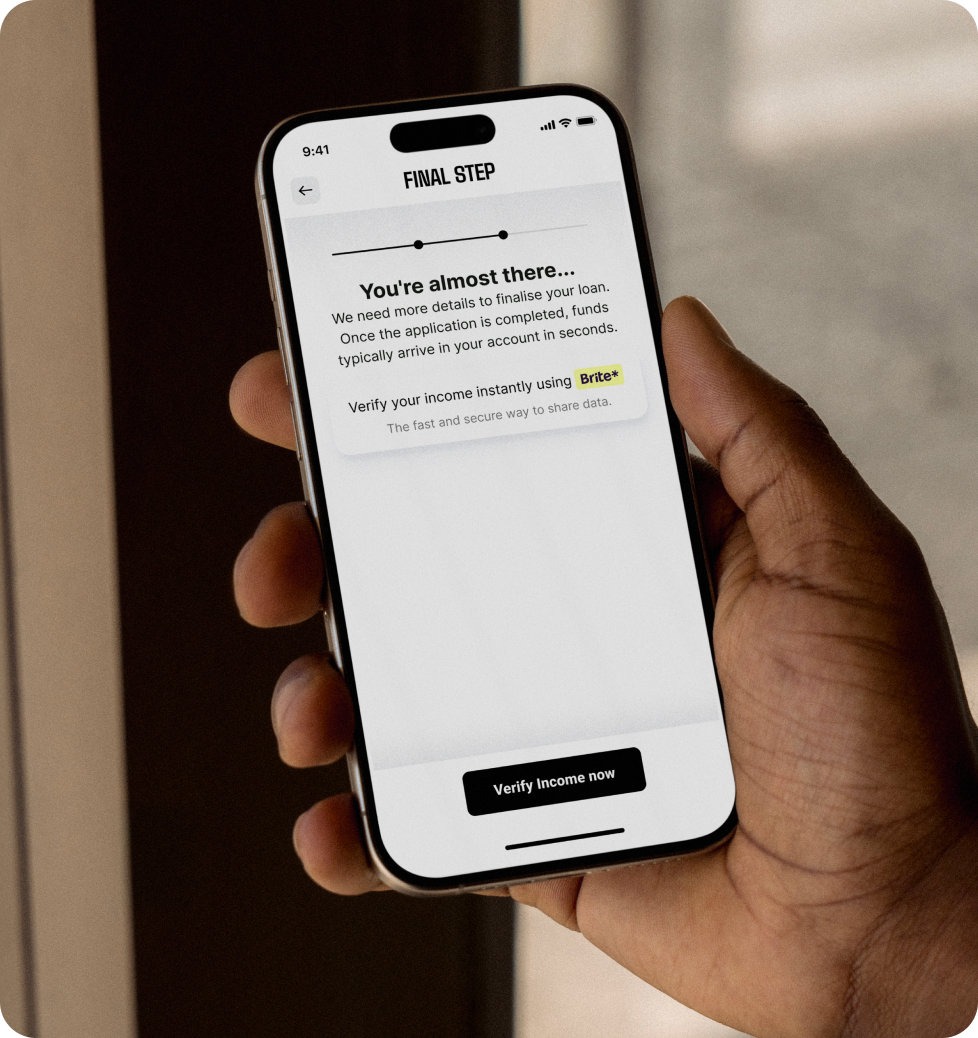

Build standout services using verified data

Strong foundations: stable and compliant

Operational Resilience

Engineered for continuous operation our architecture supports 24/7/365 real-time processing, giving you a competitive advantage over legacy systems that restrict customer access.

Fund Security and AML Control

All deposits are bank-verified via Strong Customer Authentication (SCA), eliminating chargebacks and card fraud. Our Data Solutions automate bank-grade KYC and Account Verification, ensuring funding identity is verified upfront for better AML protocols.

Compliance Excellence

Regulatory confidence is our standard. Built for strict adherence to PSD2 and AML regulations, reducing your regulatory burden and risk exposure.

Build What's Next in Finance

Essential Resources

Your Financial Services Questions Answered

Why are Brite solutions well-suited to Financial Services?

Brite solutions are built for the resilience, speed, and compliance demands of modern finance. This combination means we’re well-positioned as a trusted partner to the current and next wave of Financial Service innovators.

Our platform enables instant funding and real-time withdrawals, critical for asset managers and trading platforms. We also integrate Data Solutions to streamline KYC, Affordability, and AML checks, ensuring you can innovate without compromising regulatory integrity.

How does Brite’s platform help me meet my specific regulatory and compliance (KYC/AML) obligations?

Our integrated Data Solutions help merchants speed up compliance during onboarding. We provide bank-grade verification of consumer identity, check for account ownership, and offer crucial insights for Source of Funds (SoF) and Affordability. This process minimises manual review, ensures adherence to PSD2 and AML rules, and provides a clear audit trail.

How are Brite's Instant Payments different or better than using SEPA Instant?

While SEPA Instant is a vital clearing standard, Brite’s proprietary network (IPN) offers significant advantages:

24/7/365 Availability: Our IPN is built to eliminate reliance on traditional bank cut-off times and batch cycles, ensuring instant settlement even on weekends and holidays.

Unified API: We provide one simple integration for 27 European markets, addressing the “fragmented nature” of SEPA and simplifying multi-region operations and treasury management.

How much faster is Brite’s Onboard and Pay process compared to traditional registration and payment flows?

Brite helps reduce the multi-day delays caused by manual KYC and traditional funding methods (like SEPA or card processing). By combining user authentication and payment initiation into one frictionless flow, we reduce the onboarding time from days to seconds, allowing your customers to fund their accounts and act on market movements instantly.

Research suggests the time to onboard and pay within Financial Services can range from a few minutes to a number of days. With Brite, we typically see the same process taking less than 90 seconds to complete on average, which is a significant improvement.

What does Brite’s developer support and technical onboarding process look like for a FinServ partner?

Technical onboarding is prioritised for speed and stability. You receive access to a clean, well-documented API built on our full-stack infrastructure. Our onboarding process includes direct access to Brite merchant solutions experts who specialise in complex FinServ use cases, ensuring efficient integration and minimising reliance on third-party aggregators.

What is Brite’s Time2Money feature, and how does it help my customer support team?

Time2Money provides the consumer with the estimated time of arrival (ETA) for their payout. This feature builds trust and drastically reduces the volume of “Where Is My Money?” (WIMMO) support tickets, allowing your customer service teams to focus on high-value user queries rather than payment tracking.

What are typical transaction limits in A2A payments?

Unlike many legacy payment systems, Account-to-Account (A2A) payments generally accommodate high-value transactions, which is crucial for wealth and investment platforms. While limits are often subject to the end-user’s bank and Brite’s internal risk settings, the A2A architecture itself supports transactions significantly higher than typical consumer card payment limits.