Brite Play

Zahlung und Registrierung in einem Schritt

Kombinieren Sie Zahlung, KYC und Kontoerstellung in einem einzigen Prozess: Für vollständig verifizierte Kunden und Guthaben, das sofort bereitsteht.

Was ist Brite Play?

Brite Play verwandelt komplexe Registrierungsprozesse in einen einzigen High-Conversion-Flow.

Kontoerstellung und Einzahlung verschmelzen zu einer optimierten User Journey – entwickelt für maximale Aktivierungsraten.

Ein Zahlungsflow. Viele Vorteile.

Überspringen Sie komplexe Formulare, ohne auf Compliance zu verzichten.

Brite Play bietet den schnellsten Weg, neue Nutzer zu aktivieren und Daten automatisch zu erfassen – in einem reibungslosen Flow.

Höhere Conversions

Mehr Transaktionen

Effizientes Onboarding

Beschleunigen Sie Ihr Kundenonboarding durch automatisierte KYC-Daten und minimale Reibungsverluste.

Optimierte UX

„Viele Unternehmen verlieren wertvolle Conversions durch langwierige Formulare und KYC-Abbrüche. Brite Play löst dieses Problem: Verifizierung, Datenerfassung und Einzahlung verschmelzen zu einem einzigen, nahtlosen Flow, der nur Sekunden dauert.

Ohne zusätzliche Dokumente. Ohne Medienbrüche. Mit sofortiger Verifizierung und zufriedenen Nutzern.“

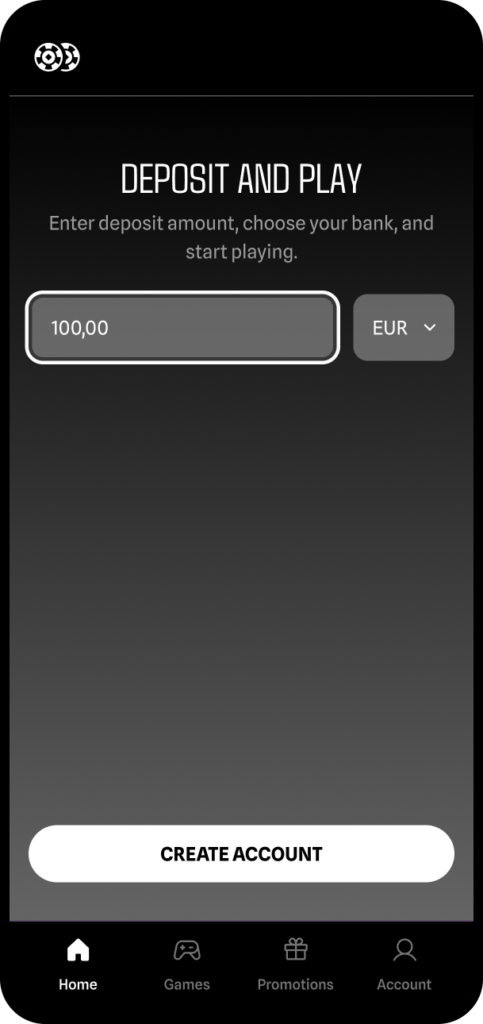

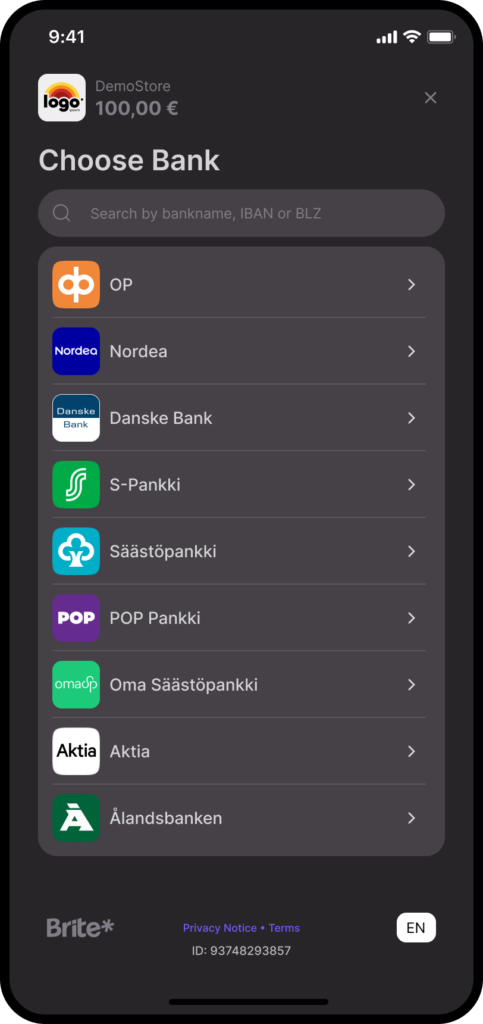

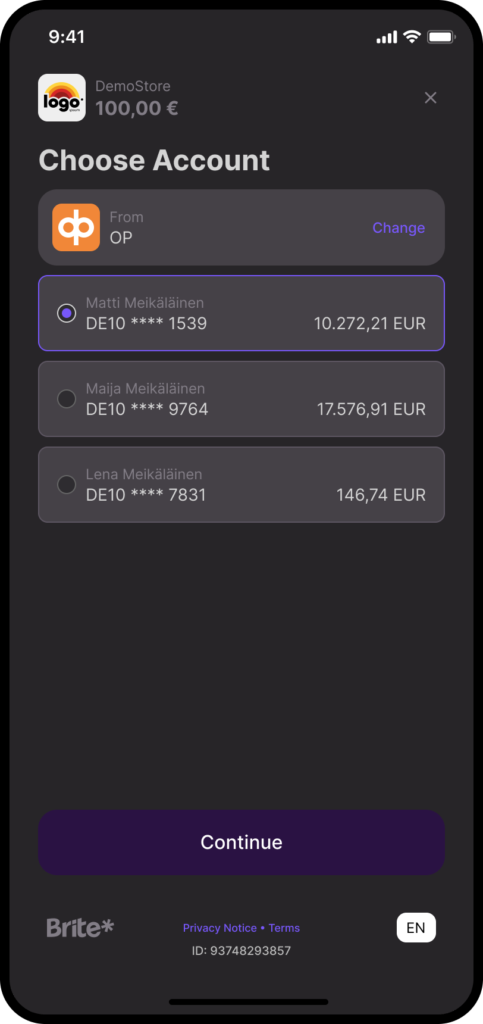

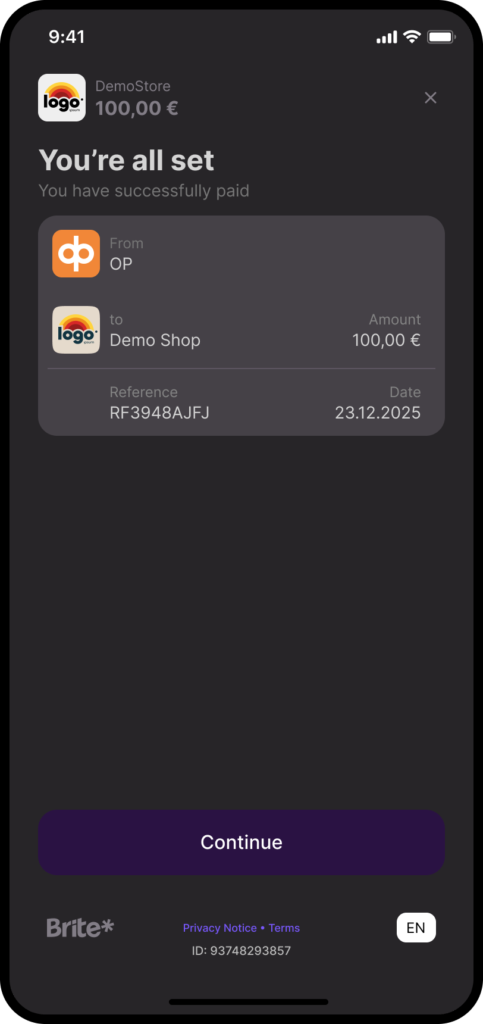

Der Zahlungsflow mit Brite Play

Features, die Nutzer langfristig binden

Brite Play is a complete customer acquisition and retention solution.

01 -- 05

Brite Performance

<60 Sek.

+7.7%

<20 Sek.

Der KYC-Schritt dauert weniger als 20 Sekunden, wenn er direkt mit der Einzahlung kombiniert wird.

Unsere Kunden

Gaming

Gaming

Rhino Entertainment

Minimaler Aufwand. Maximale Datentiefe.

Ihre häufigen Fragen zu Brite Play

Sie haben noch weitere Fragen?

Was ist Brite Play?

Brite Play ist eine Komplettlösung von Brite, die Kontoverifizierung und Ersteinzahlung in einem einzigen, konversionsstarken Prozess vereint. Mit Brite Play wird das mühsame Ausfüllen von Formularen sowie das manuelle Hochladen von Dokumenten überflüssig. Das Ergebnis ist ein vollständig verifiziertes Nutzerprofil inklusive getätigter Einzahlung – und das in Sekundenschnelle.

Welchen Einfluss hat die Nutzung von Brite Play auf den durchschnittlichen Bestellwert (AOV) im Vergleich zu regulären Zahlungsprozessen?

Unsere Daten zeigen über verschiedene Branchen hinweg, dass Brite Play den durchschnittlichen Bestellwert (Average Order Value – AOV) signifikant steigern kann. Im Vergleich zu regulären Zahlungsmethoden konnten wir Steigerungen des AOV von bis zu 31 % beobachten – über alle Händler hinweg liegt die durchschnittliche Steigerung bei 7,7 %.

Dies ist auf ein optimiertes Nutzererlebnis und das hohe Vertrauen zurückzuführen, das durch Zahlungen über die vertraute Bankumgebung entsteht. (Hinweis: Da präzise Ergebnisse ohne spezifische A/B-Tests variieren können, belegen Branchendaten deutlich, dass Optimierungstools den AOV massiv steigern können.)

Wie viel schneller ist der Onboarding-Prozess mit Brite Play im Vergleich zu regulären Registrierungs- und Zahlungsprozessen?

Brite Play reduziert Reibungsverluste drastisch: Der Registrierungs- und Zahlungsprozess wandelt sich von einer zeitintensiven Aufgabe mit vielen manuellen Einzelschritten zu einem schnellen Prozess in einer einzigen Sitzung (Single-Session), der weniger als 60 Sekunden dauert. Diese Geschwindigkeit wird durch die gleichzeitige Nutzung bankverifizierter Daten und die sofortige Zahlungsabwicklung ermöglicht.

Welche technischen Auswirkungen (API-Aufrufe/Overhead) hat die Kombination von Nutzerdatenbereitstellung und Einzahlung in einem einzigen API-Flow?

Der technische Vorteil liegt in der erheblichen Vereinfachung und dem reduzierten Overhead. Anstatt separate API-Integrationen für die Nutzerdatenbereitstellung, die Kontoerstellung und die Zahlungsabwicklung verwalten zu müssen, bündelt Brite Play diese Schritte in einem einzigen API-Flow. Dies minimiert die technische Komplexität sowie den Testaufwand für Ihr Entwicklungsteam.

Wie funktionieren Closed-Loop Auszahlungen mit Brite? Ist dieses Verfahren für alle Auszahlungen verpflichtend?

Das Closed-Loop-Auszahlungssystem ist eine zentrale Maßnahme zur Geldwäscheprävention (AML) und Sicherheit. Dabei werden Auszahlungen ausschließlich auf das Bankkonto zurückgeführt, das für die ursprüngliche Einzahlung verwendet wurde. Dieser Mechanismus ist für Brite Play entscheidend, da er die verifizierte Identität untrennbar mit dem Zahlungsfluss verknüpft. So wird Geldwäsche und Betrug durch Kontoübernahmen (Account Takeover) effektiv unterbunden.

Ob dieses Verfahren für Sie verpflichtend ist, hängt von den regulatorischen Anforderungen Ihrer Branche ab. Falls Ihre Branche diese Vorgaben vorschreibt, unterstützt Brite Play Sie dabei, diese Compliance-Richtlinien einzuhalten.

Erfüllt Brite Play unsere KYC-Anforderungen vollständig oder sind weitere Verifizierungen erforderlich?

Brite Play stellt zum Zeitpunkt der Einzahlung bankverifizierte Nutzerdaten bereit, die Sie für Ihre eigenen KYC-Anforderungen erfassen können. Brite ist jedoch kein KYC-Anbieter und ersetzt Ihre eigenen KYC-Prüfpflichten nicht. Sie sind allein dafür verantwortlich, Ihre individuellen KYC-Anforderungen zu bewerten und deren Einhaltung sicherzustellen.

Sie haben noch weitere Fragen?