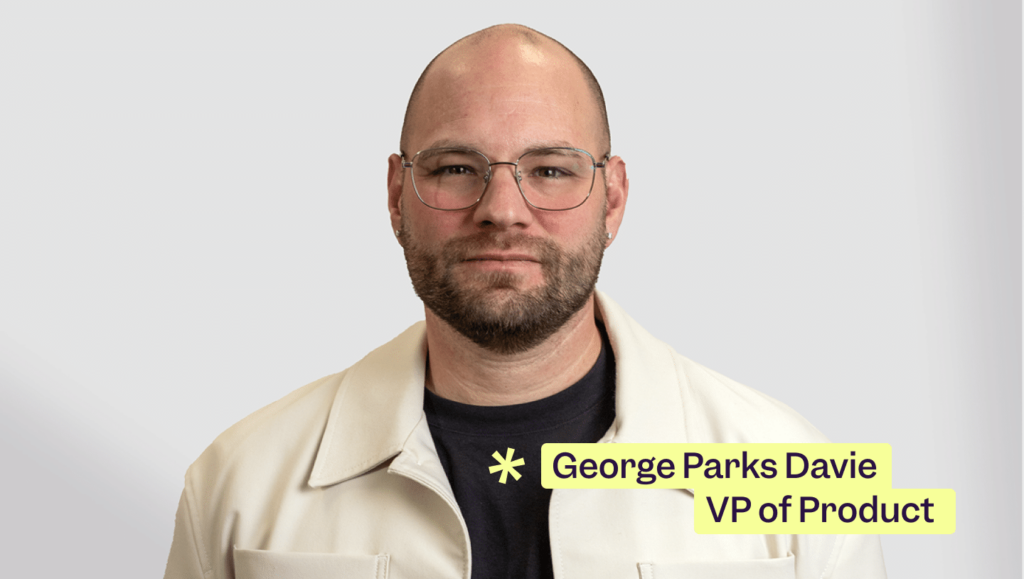

Brite Payments Appoints Open Banking Expert George Parks Davie as VP Product

Stockholm – 22 January, 2025 – Brite Payments, a leader in instant bank payments, has announced that George Parks Davie has been appointed VP Product. Bringing more than 15 years of fintech experience in account-to-account (A2A) payments and open banking to the role, Davie will help expand Brite’s product offering in existing and new geographies, with a strong focus on user experience. As part of the role, Davie will also lead the newly-created Payments Domain within Brite. George Parks Davie joins Brite Payments from Klarna, where as Product Director he oversaw the development of its open banking platform, Klarna Kosma, and helped hundreds of fintechs to scale their businesses across Europe, as well championing the use of open banking within the company. Davie also played an active role in shaping PSD2, which underpins open banking in Europe today, through the European Banking Association’s Working Group on APIs under PSD2. In addition to his background in open banking, Davie brings with him extensive knowledge of the German market, having been instrumental in the development of Sofort’s A2A payments product, including its mobile interface, before the company was acquired by Klarna in 2014. Brite launched its Instant Payments offering in Germany in 2024, where research indicates that two-thirds of consumers are already familiar with A2A payments – in part due to the legacy of early A2A innovators such as Sofort – and are open to trying new online payment methods. “I have been following Brite Payments for some time, and with an ever-growing number of use cases for open banking payments, now is the perfect time to join and play a part in creating customer-centric payment products that deliver real value for merchants,” said George Parks Davie, VP Product, Brite Payments. “I’m excited to help Brite deliver on its promise of becoming Europe’s leading provider of instant payments and payouts, drawing upon my experience in building product teams that are closely aligned with the company’s strategic direction, and setting them up to succeed during rapid growth.” Brite Payments enables instant account-to-account (A2A) payments and payouts, leveraging Europe’s open banking infrastructure to build a fully-featured Pay by Bank solution, backed by its own proprietary network – Brite Instant Payments Network (Brite IPN). Fresh funding, announced in late 2023, is being invested in product development and scaling the business to serve a growing number of markets across Europe. “George combines deep expertise and technical knowledge of open banking with a very user-centric approach to product development. He’s been at the forefront of account-to-account payments in Europe and his product leadership will be enormously valuable to our team as we continue to scale rapidly,” said Lena Hackelöer, Founder & CEO, Brite Payments. “We’re thrilled to have George on board, and with his specific knowledge of the German market, we are in a strong position to take advantage of the opportunities in Europe’s largest economy.” “2025 is going to be an important year for open banking in Europe – the instant payments regulation is opening up new opportunities and will be a catalyst for A2A payment adoption, while PSD3 is taking shape and promising to bring improved standardisation. Brite Payments is perfectly positioned to benefit from these developments, with a complete instant payments offering that reduces operational complexities for merchants and addresses many of their long-standing pain points,” concluded Davie. For more information about Brite, please visit: britepayments.com ABOUT BRITE Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. Brite is connected to more than 3,800 banks within the EU and its offering is currently available in 27 European markets.

What Will Move the Needle for Open Banking Payments in 2025?

Can Pay by Bank Solve the $41 Billion Card Fraud Crisis?

Brite Payments to Explore Consumer Payment Preferences and Rise of Pay by Bank in Upcoming Webinar

Stockholm – 13 September – Brite Payments, a leading provider of open banking-based instant payments, will host its upcoming webinar Payment Insights 2024 at 15:00 CEST (14:00 BST) on Thursday, 26 September. Drawing upon exclusive survey data and findings from the 2024 Instant Economy Payment Insights report, leading payments experts will provide businesses with essential insights into the evolving landscape of online payments across Europe, with a particular focus on the rise of Pay by Bank. In today’s fast-paced digital economy, understanding consumer payment preferences is crucial for businesses aiming to optimise their payment strategies. Contextualising the findings of a survey of more than 8,000 consumers across six major European markets, the webinar promises a comprehensive look into the current state of online payments and what is driving consumer choice. Webinar attendees can expect actionable insights on the following; The Payment Insights 2024 webinar on 26 September will be led by seasoned experts from the payments industry. Luke Trayfoot, Chief Commercial Officer at Brite Payments, has more than a decade of ecommerce and payments experience at companies including Mangopay and PayPal, and brings a wealth of knowledge on how merchants can navigate the dynamic online payments landscape. Manfred Schulz, Head of Merchant Solutions at Brite Payments, draws on his background from Klarna and Unzer and shares how market trends can be translated into effective payment strategies. Lisa Calderwood, Communications Manager at Brite Payments, will moderate the discussion. For more information and to register for the webinar, please visit: https://goodthings.britepayments.com/webinar-payment-insights-2024 About Brite Payments Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. Brite is connected to more than 3,800 banks within the EU and its offering is currently available in 27 markets across Europe.

Brite Payments Builds Momentum with Market Expansion and Key Executive Appointments Amid Industry Accolades

Stockholm – 30 July, 2024 – Swedish fintech, Brite Payments, continues to solidify its position as a leader in account-to-account (A2A) payments, also known as ‘Pay by Bank’, with a number of milestones in the first half of 2024 amid widespread industry recognition. Brite Payments appointed its first Chief Commercial Officer, Luke Trayfoot, in April 2024, and the company’s commercial function is growing strongly, in line with future expansion plans. Trayfoot, who previously built high-performing commercial teams at PayPal and Mangopay, has a deep understanding of the payments sector and internationalisation strategy. Brite has also bolstered its Merchant Solutions and Engineering leadership, as it continues to invest in building its own proprietary instant payments network – Brite IPN – to process payments between consumers and online merchants in real time. Founded in 2019, the Stockholm-headquartered fintech has pursued market expansion in early 2024, with the launch of Brite Instant Payments in the German market. High familiarity with bank-based online payment methods, combined with lower card penetration compared to other European markets, signals a significant opportunity for Brite’s out-of-the-box Pay by Bank solution. Recent research conducted by Brite Payments and YouGov reveals consumer appetite for better security and convenience for online payment methods in Germany, with security (83.5%) and user convenience (77.8%) ranking as key factors when deciding to use a payment method for the first time. “The launch of Brite Instant Payments in Germany represents a significant milestone for the company, with our full product portfolio now available in the EU’s largest economy – a market with significant untapped potential,” said Lena Hackelöer, Founder & CEO, Brite Payments. “We will further extend our product coverage through the rest of 2024, which we’re strongly positioned to do, having bolstered our commercial and engineering teams with a number of key hires. All the pieces are in place to drive the next phase of our growth.” Brite Payments’ recent successes in scaling up, following a $60 million fundraise in October 2023, are reflected by a number of recent industry accolades: Lena Hackelöer, Brite’s founder and CEO, has received individual recognition, with ‘Founder of the Year’ at the Hustle Awards and ‘Director of the Year’ at the Europe FinTech Awards. Brite Payments was also named on the Sifted B2B SaaS ‘Rising 100’. “We’ve noticed a significant shift in the market in the first half of 2024; there’s consensus in the wider fintech sector that Pay by Bank – with the growing maturity of open banking acting as a catalyst – is reaching an inflection point,” continued Hackelöer. “Our recent industry recognition has reaffirmed that Brite Payments is firmly at the forefront of these developments as the pace of adoption accelerates, and that we’ve struck the right balance between merchant benefits and a first-class end-user experience.” Brite Payments leverages Europe’s open banking infrastructure to process instant payments and payouts, which are proving attractive to businesses in a wide range of verticals, especially those where legacy payment methods create unnecessary friction in the payment process or increase fraud risk. For more information about Brite, please visit: www.britepayments.com About Brite Payments Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. Brite is connected to more than 3,800 banks within the EU and its offering is currently available in 27 markets across Europe.

Embracing the instant economy: The rise of Pay by Bank

Money20/20 Europe unveils six incredible FinTech startups and industry disruptors

Inside fundraising in today’s climate with Brite payments and Dawn Capital

True North: Is It Possible To Maintain Culture When Scaling Up?

Brite Payments Founder & CEO Lena Hackelöer Honored at Women in Payments EMEA Awards

Stockholm – 3 May, 2024 – Lena Hackelöer, Founder & CEO of Brite Payments, has been recognised by Women in Payments with the ‘Inspiration Award’ at the recent Women in Payments EMEA Awards. The awards, which were presented as part of the Women in Payments EMEA Symposium, recognise payment industry professionals for their leadership, innovation, commitment to strengthening the industry, and for advocating for the success of women in the payments ecosystem. “The Women in Payments Inspiration Award honours a woman who serves as a beacon of motivation through thought leadership, mentorship, or acting as a role model for others in her organisation or industry,” said Kristy Duncan, Founder and CEO of Women in Payments. “Since founding Brite Payments, Lena has embodied the vision and leadership that propels our industry forward. Her ability to inspire her team and foster an environment where everyone feels valued makes her a true pillar of strength and innovation. We congratulate Lena on this well-deserved recognition.” Brite Payments is a leading provider of instant bank payments, headquartered in Stockholm, Sweden. Lena Hackelöer founded the company in 2019, and under her leadership, Brite Payments has become one of Sweden’s fastest-growing fintechs. Boosted by a $60 million fundraise in late 2023, Brite Payments is expanding its product portfolio in key markets across Europe. Most recently, Brite announced the launch of Brite Instant Payments in Germany, where there is significant untapped potential for Pay by Bank (also known as account-to-account or A2A payments). “I’m humbled to receive this recognition from Women in Payments, which brings together so many talented payment professionals and creates such a supportive and welcoming community,” said Lena Hackelöer, Founder & CEO, Brite Payments. “It is inspiring to see first-hand the impact that female leaders are having across the payments sector, and I am incredibly proud of the fact that Brite Payments is contributing to the betterment of the sector with our approach to open banking-powered instant payments.” Brite Instant Payments leverages direct connections to bank APIs to let consumers pay instantly from their bank using only top-of-mind information. With no need for registration, app downloads, or additional passwords, Brite reduces checkout friction and eliminates redirects. For more information about Brite, please visit: www.britepayments.com ABOUT BRITE Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. Brite is connected to more than 3,800 banks within the EU and its offering is currently available in 26 markets across Europe.