Pay by Bank

Explainer

All you need to know about Pay by Bank

What is Pay by Bank, and what do you need to know about it?

Pay by Bank describes payment methods we’re seeing more and more at checkouts online across Europe, the UK, and the world—but what types of payments does it represent?

And should your organisation offer it as part of its payment mix? Keep reading to find out all the details.

What is Pay by Bank?

Pay by Bank is the consumer-facing term for payment methods (including open banking-powered account-to-account payments) that enable a user to pay for goods or services directly with their bank account. This category of online payment is growing in popularity with consumers.

Its growth is part of a broader trend where consumers expect real-time interactions in all digital aspects of their lives, including payments. Pay by Bank is increasingly popular as a checkout option in e-commerce, bill payments, and other online transactions.

According to Brite Payments and YouGov data, Pay by Bank, as a payment option, is now among the top three preferred payment methods in key European markets, along with debit cards and digital wallets. But that’s not all…

What are the key factors driving Pay by Bank adoption?

A potent mix of technological advancements and changing consumer preferences are driving the adoption of Pay by Bank in Europe. Today, nearly three-quarters (73%) of consumers across key European markets are familiar with Pay by Bank as a payment category. This familiarity is exceptionally high in the UK (90%) and the Netherlands (97%). Across the select markets surveyed, more than a third of respondents aged 18-29 use Pay by Bank either daily or weekly, indicating it has a strong preference among younger demographics.

Reasons for Pay by Bank consumer adoption

Furthermore, the primary reasons consumers opt for Pay by Bank at checkout are speed and security. A significant 42% of users prefer it for its quick transaction processing, while 59% from the same survey cited security as a critical factor. The convenience of not needing to create new accounts or use additional apps further enhances its appeal, with 54% of respondents in the same Brite study highlighting ease of use.

Why now is the time to offer Pay by Bank

The payment method’s core strengths – especially when it is underpinned by open banking and secure bank APIs mandated by PSD2 – are its relatively low cost compared to traditional card payments (particularly credit cards), high security, and speed. These are reasons for its growth as a payments category.

Yet, the real beauty of Pay by Bank as a payment type is that it uses existing banking infrastructure and, in some cases, incorporates some of the best open banking technology available, such as instant account-account payments, like those offered by Brite Payments.

In this guide, we will analyse the payment method thoroughly and help you understand why now is the perfect time to offer Pay by Bank at the checkout.

Introducing Pay by Bank, or should that be open banking payments?

Pay by Bank is a relatively new term, but it has quickly become a more widespread ‘catch-all’ term to describe the growing use of account-to-account (A2A), open banking-powered, or other direct real-time bank (RTB) payment methods available in the checkout.

To put this into context, Brite offers open banking-powered instant A2A payments. Previously, these payments were presented to consumers differently at checkout depending on circumstances, industry, or market location. Additionally, it is technically correct to describe Brite’s type of payment as ‘open banking payments. ‘This term primarily highlights the underlying technology or payment rails rather than the payment method itself, and it is widely used across the industry.

However, Pay by Bank’s emergence as a consumer-facing checkout category is set to help unify checkout experiences and further develop consistency, which will ultimately help steer consumer expectations when selecting a payment method. This is all important when building trust, especially when introducing a new payment method.

Today, Brite offers an instant payments product that uses the latest open banking account-to-account payment technology, which is increasingly labelled as Pay by Bank at checkouts. This means that a consumer will more often than not encounter Pay by Bank as a category at checkout, the increasingly common consumer-facing term for the sort of payment method that Brite Payments offers.

However, it is essential to note that not all “Pay by Bank” payments are alike. As we have briefly mentioned, the technology they use can vary considerably.

What exactly is Pay by Bank then?

Indeed, the Pay by Bank category covers various technologies and platforms, including open banking platforms and types of API (application programming interfaces) – such as Brite IPN – and dedicated payment gateways that support direct bank transfers, which can include automated clearing house (ACH) payments as offered in the US.

Yet, across these methods, the big unifier is that for a customer to “pay by bank”, their bank typically needs to authenticate their identity and get payment confirmation before sending any funds. However, as with all payment methods, these nuances mean that not all Pay by Bank services are alike or offer the same payment experience for consumers and businesses.

Ultimately, the best form of Pay by Bank payment is powered by open banking technology and not reliant upon legacy payment infrastructure.

How does Pay by Bank work?

For clarity, we will approach this from the perspective of an open banking-powered A2A payment. Other forms of Pay by Bank payment may perform slightly differently.

In this example, a consumer selects Pay by Bank at checkout, and the provider, using open banking-powered A2A payments, transfers funds from the payer’s bank account to a business or merchant account. At Brite, funds are transferred to our account, not the merchant account, which means we are able to offer instant and smart reconciliation and provide businesses with funds immediately.

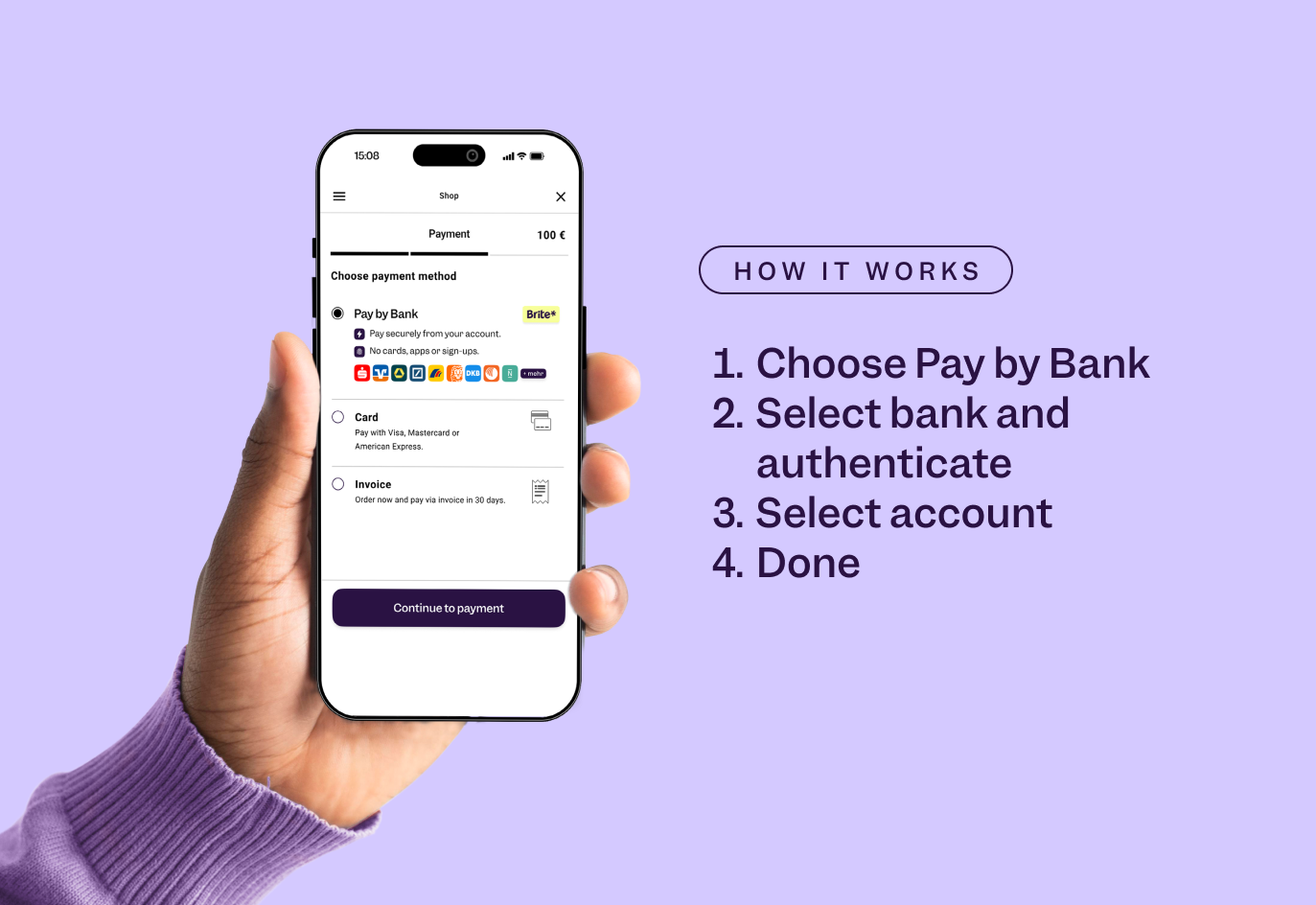

This process for consumers can be broken down into the following key steps:

1. Choose Pay by Bank at checkout

Customers select the “Pay by Bank” option. Next, first-time users are presented with a dropdown menu where they can choose their bank from a list of supported institutions. For returning users, a more streamlined process is available with the users’ bank pre-selected.

2. Select bank and authenticate

The consumer enters top-of-mind bank login details. They then authenticate using a form of strong customer authentication (SCA), which could involve receiving a code on their phone or using biometric verification, ensuring the transaction’s security.

3. Select account

The consumer chooses the specific bank account from which the payment will be taken.

4. Confirmation and transfer (AKA Done!)

Next, they confirm the payment details, including the amount and recipient. Depending on the underlying technology, the transfer can be near instantaneous, with the customer and merchant receiving confirmation of the successful transaction.

Note: This method offers users and merchants a convenient and supremely secure payment experience. It is also easy to use, eliminating the need to enter lengthy card details or remember complex passwords.

To learn more about instant A2A payments, read our latest explainer:

What are the potential differences between Pay by Bank products?

Regulations and scope of Pay by Bank

Open Banking

Not all Pay by Bank products follow the same rules or use the same technology. For example, a simple bank transfer product (where you might write in account details) differs significantly from one powered by open banking.

Open banking regulations, such as Payment Services Directive 2 and 3 and the UK’s Open Banking initiative, mandated that banks open up their payment services and customer account data (with consent) through secure APIs. The result was a game-changer in enabling payment service providers (PSPs like Ayden or Stripe) and third-party providers (TPPs such as Brite) to facilitate fast, low-cost, and secure payments.

Instant A2A payments using open banking are a subset of services enabled by these open banking frameworks. They allow TPPs, such as Brite, to initiate payments directly from a customer’s bank account via APIs. Adhering to these regulatory frameworks also helps enforce standards on data security, customer rights, and interoperability.

Yet, while many Pay by Bank offerings use open banking infrastructure, this may not be the case with all providers. Some payment providers or banks may offer their own form of direct bank transfer, aka Pay by Bank product. This could mean there are specific limitations to any service dependent on the Pay by Bank provider.

Indeed, Pay by Bank services in the US are quite different from EU/UK product offerings, and while the EU is striving for harmonisation, we’re likely to see somewhat different versions of Pay by Bank emerge around the world.

Payment initiation processes and Pay by Bank

Open Banking A2A Payments

Payment initiation services (PIS) payments are initiated by (TPPs) by connecting directly to a customer’s bank via open banking APIs. The customer authorises the payment through their bank’s authentication process, and the transaction is executed directly between bank accounts.

However, again, not all open banking-powered A2A payments are alike…

Instant A2A payments

Indeed, some payment providers, such as Brite, use a proprietary network that leverages the capabilities of open banking to offer a single banking API that covers all the banks in its network.

For example, the Brite Instant Payments Network (Brite IPN) offers businesses distinct advantages over traditional open banking payments (i.e. typical Payment Initiation Services or PIS) as it takes full receipt of incoming funds and settles them rapidly on behalf of merchants.

The benefits of such a system are clear:

24/7/365 processing – there is no reliance on traditional bank clearing cycles or cut-off times, thus reducing risk and mitigating fraud.

Automated reconciliation and reporting – this helps reduce operational costs considerably.

Smart routing – payments are optimised for speed and use the most efficient routing available, which is not typical of most PIS payments.

Merchant FX – a proprietary network, such as Brite IPN, exchanges FX upon request, helping to bridge the gap between Europe’s instant payment schemes.

Finally, and unique to Brite IPN, end-to-end payment visibility – Brite can provide insights into the payment status of every transaction initiated through its network. Brite offers a Time2Money feature, which showcases when a user or merchant can expect a payment to drop into their account.

Note: Some Pay by Bank systems may be offered via white labelling; these can sometimes be a branded service offered by a payment provider or bank, which might utilise open banking APIs or other methods to facilitate direct bank transfers. Additionally, the branding and user interface can vary depending on the provider, offering different or potentially more customised experiences. At Brite, we only offer our Pay by Bank / instant A2A payments as Brite payments.

Pay by Bank using Brite Payments explained

What are the Benefits of Pay by Bank?

Pay by Bank’s popularity as a payment category is rising not only due to its enhanced security and ease of use but particularly because it offers reduced transaction fees compared to traditional card payments.

Indeed, for many businesses, traditional payment players act as unwanted intermediaries, taking a little bite of every card payment made online, which swiftly adds up. Indeed, in 2020, merchants in the US alone paid about $110bn in processing fees for $7.6tn worth of card transactions, according to a Nilson Report.

A merchant offering an open banking-powered Pay by Bank service at checkout can enjoy many benefits, the key one being that it enables a business to securely take a payment directly from a customer’s bank account at a lower cost. Yet, the additional operational efficiencies it offers businesses and the value-added services that create further efficiencies cannot be underestimated.

Furthermore, using Brite as a payment method includes merchant FX, automatic reconciliation, and the bonus of instant payout technology as standard for any potential return or refund.

Another additional bonus of using open banking payment technology is that it also enables consumers to give financial providers access to their account information for other services, such as recurring payments or other payment products. Our article on the technology explains account information services (AIS) in more detail.

What is the state of play between Pay by Bank Vs. Credit Cards?

Pay by Bank, particularly instant A2A payments, enables merchants to receive payments directly from consumers, reducing the reliance upon cards. As mentioned, this shift threatens the lucrative fees traditionally earned by banks and large credit card companies such as American Express, Visa, and Mastercard.

Today, in many European countries, the card network duopoly is being openly questioned. Indeed, in the UK, the Payment Service Regulator (PSR) found that over the past five years, and after taking account of volume changes, Mastercard and Visa have increased their scheme and processing fees by more than 30% in real terms.

There is little evidence that the quality of service has improved at the same rate.

Yet, major financial institutions and card schemes are now pushing to collaborate more and focus on technology development. This is part of a broader movement towards adopting more of the benefits of open banking within their services.

This urgent change of tact is because, despite the deeply ingrained consumer habits, near ubiquity, and robust reward programs often associated with credit cards, the financial industry is positioning itself to be ready for a potential shift in payment preferences.

Merchants appreciate open banking-powered payments, such as instant A2A payments, because they reduce the cost of payment acceptance compared with cards while offering instant settlement of funds. A2A transactions are not intermediated by major card networks and, therefore, are not subject to interchange fees.

Legacy financial institutions are fighting a desperate battle to stay ahead of non-bank competitors, such as TPPs, to meet the needs of consumers and merchants in a rapidly changing economic landscape.

Why do consumers still use credit cards?

According to Brite Payments and You Gov data, 47% of online consumers in key European markets, including the UK, France, and Germany, use a credit card at least monthly. This makes paying by credit card the fourth most commonly used payment method online after debit cards, Pay by Bank, and digital wallets.

The reasons for this are clear: consumers still use them! The UX is well understood, with entering a card number and expiry date almost second nature to many online consumers.

Indeed, after 30 years of use, credit cards remain popular online because of their convenience, consumer protections, and widespread acceptance. Indeed, the same Brite survey found that using credit cards just out of habit is particularly common across some European markets.

Yet, they are a legacy payments product, and just because they are used out of habit doesn’t mean they are the ideal payment method for today’s businesses or consumers.

How can Pay by Bank win credit card users over?

Lower costs: Pay by Bank methods generally have lower transaction fees than credit card payments and do not charge monthly fees. Additionally, these types of payments eliminate the need for intermediaries, leading to lower processing fees and no interchange costs.

Enhanced security: Transactions are made within secure banking environments, minimising opportunities for fraud. They also use secure customer authentication (SCA) methods.

Faster transactions: Compared to credit cards, Pay by Bank payment methods, such as instant A2A payments, offer genuine instant payments, enabling businesses to receive funds instantly, unlike credit card payments. Due to batch processing, these payments often settle faster than credit card payments too.

Greater consumer control: By using a Pay by Bank method, consumers pay directly from a bank account, avoiding the need to use credit or purchase beyond their means. Pay by Bank also doesn’t require credit checks, making it more accessible for customers.

Lower chargeback risks: Pay by Bank payment methods have a lower risk of chargebacks due to secure authentication and reduced instances of unauthorised transactions. Dispute resolution is also simplified for businesses because transactions happen directly between the customer and their bank.

Cross-border compatibility: Many Pay by Bank and A2A payment systems work seamlessly across Europe, providing a more straightforward international payment experience than credit cards, which often have additional fees and more acceptance issues.

Inclusivity: Pay by Bank provides better financial inclusion for more consumers, particularly within European markets. According to World Bank data, 96% of European Economic Area (EEA) consumers have access to a bank account, compared to 42% who have access to a credit card.