In today’s instant economy, international money transfers remain challenging for millions of individuals, especially migrants sending money back home. High fees, slow processing times, and a lack of transparency hinder financial inclusion. This is where Vivowire steps in.

Vivowire aims to redefine remittance services, offering a seamless, cost-effective, and highly secure platform for instant cross-border payments. Founded to address the inefficiencies in traditional money transfer systems, Vivowire focuses on empowering individuals with faster, more affordable transactions while maintaining compliance with international financial regulations.

Brite sat down with Ahmed Ismail, Vivowire’s Co-Founder and CEO, and Ali Ahmed, Co-Founder and CTO, to discuss their journey, the challenges they aim to solve, and how their collaboration with Brite Payments enhances their service. From regulatory hurdles to technological innovations, they shared insights into how Vivowire hopes to transform the global remittance landscape.

Read on to discover how Vivowire aims to set a new standard in cross-border payments and why instant A2A payments, powered by open banking, are essential to unlocking greater financial accessibility.

What inspired the creation of Vivowire?

Ahmed Ismail, Co-Founder and CEO at Vivowire: Vivowire was founded to address a critical gap in the remittance industry — high fees, slow transactions, and limited financial inclusion.

Many migrants, especially those from East Africa, where Vivowire currently focuses, struggle with expensive and inconvenient ways of sending money home.

We saw an opportunity to build a seamless, secure, cost-effective platform that empowers individuals to transfer funds quickly and affordably.

How do you differentiate yourself from other international money transfer providers?

Ahmed I: Our mission is to provide an accessible, low-cost, and user-friendly money transfer service while maintaining high-security standards. This is how we differentiate ourselves.

Unlike traditional remittance services, we focus on financial inclusion, which includes transparent pricing and integrating advanced technology to streamline our payments.

How do you ensure regulatory consistency across Europe while maintaining clarity?

Ahmed I.: Of course, there are always challenges. However, we collaborate with our partners in different parts of the world to find common ground and ensure we meet every regulation we need. We actively engage in various activities tailored to meet our needs in each country.

What are your customers’ most common pain points when sending money internationally?

Ahmed I: Customers often deal with high fees, long processing times, and a lack of transparency.

You mentioned regulations – how does Vivowire solve these problems?

Ahmed I: Vivowire solves this by offering direct peer-to-peer transfers, eliminating hidden costs, and providing real-time tracking for transactions. With Brite, we enhance this further by enabling instant payments, reducing delays, and increasing convenience.

What are some of the biggest technological challenges of cross-border payments?

Ahmed I.: The key challenges include high costs, a lack of interoperability between payment systems, and regulation compliance.

We address this through cutting-edge APIs, partnerships like Brite Payments for transactions, and a robust compliance framework to ensure secure and efficient money transfers.

How does Vivowire ensure regulatory compliance across different countries?

Ahmed I.: Vivowire is a licensed registered payment service provider that operates under Swedish financial regulations and adheres to PSD2 standards for secure transactions. We implement strong Know Your Customer (KYC) and anti-money laundering measures while also complying with local regulations in the markets we serve. Our primary focus, however, is on our processes in Sweden and within the European Union.

How easy was it to set up and get started with Brite?

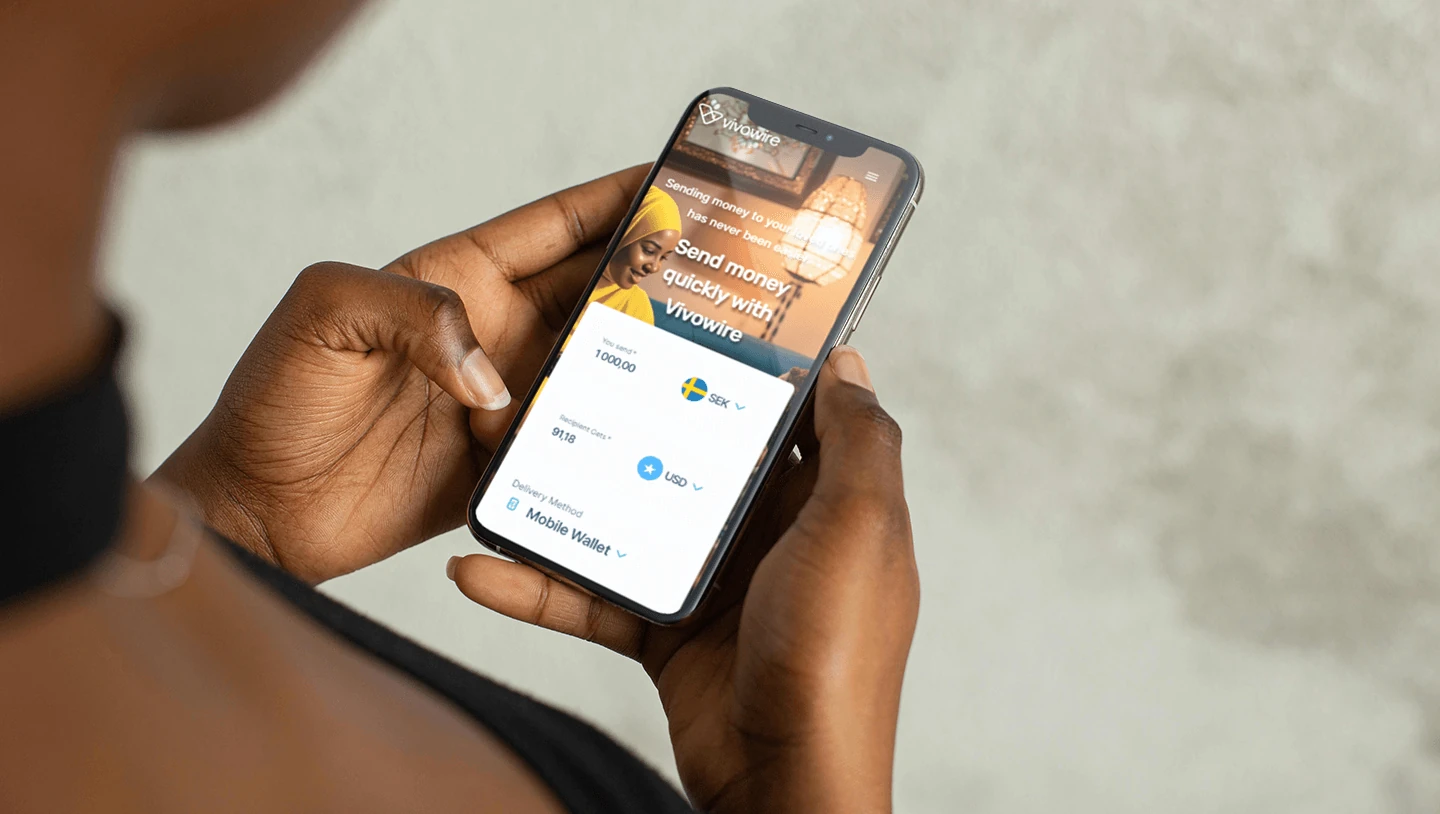

Ali Ahmed, Co-Founder and CTO at Vivowire.: We were among the first customers to implement this type of integration with Brite, and the process was relatively straightforward. The Brite API was well-designed, requiring minimal effort for implementation, and the user experience was smooth. Since we did not need to download apps or complete registrations, this integration perfectly aligned with Vivowre’s goal of making transactions as effortless as possible. Overall, our experience with the Brite integration was very pleasant.

How does Brite give you a competitive advantage within international money transfers?

Ali A.: Something that’s very important to us is processing transactions very quickly. For example, Brite instant payment technology allows us to process those set transactions in seconds, reducing delays and improving customer satisfaction.

What do most internal money transfer consumers typically have to endure?

Ali A.: They must ensure they have the time to transfer. Transferring money through the banking system can take days to reach the recipient. Today, using Brite, we can reduce that time to a few minutes or even seconds, which is incredibly important.

How does Brite help you reduce your operational costs?

Ali A.: Cooperating with Brite makes certain things very easy for us. Brite eliminates the need for intermediaries, which reduces costs related to card payments or bank transfers. This efficiency allows us to offer lower fees while maintaining profitability. It also minimises transaction failures and chargebacks, improving operational efficiency.

Ahmed I: The good thing about Brite is that they understand young entrepreneurs or young startups. They can understand the vision, meet you halfway and help you. In our experience, we don’t see that in many other companies.

Brite listens, understands needs, and offers a service that fits your business’s requirements. They were able to help us in a way that maybe only another younger company could.

Ali A.: At the beginning, we had very productive discussions. Since Brite and our company were new, we could cooperate effectively and establish partnerships that benefited both companies. We maintained regular contact with Brite, who quickly assisted us whenever we encountered any issues. This support made it much easier for us to progress with our processes.

What was it that made you choose Brite over other providers in particular?

Ali A.: Our mission is to reduce costs for our customers and offer quick transactions. We were looking for a partner who could help us provide real-time transactions.

Since our customers can easily pay with Brite Instant Payments, we can take our payments directly without delays. This meant we could offer real-time transactions and high security using Brite’s client, making it very user-friendly for our customers.

How important is a reliable payment service for your customers?

Ali A.: Throughout our collaboration with Brite, we’ve had the chance to shape various aspects of the services we wanted.

Since completing our integration with Brite, we have not encountered any issues. We can confidently say that Brite delivers very high uptime and fast processing speeds. This has allowed us to reduce transaction failures and delays, ensuring that Vivowire customers no longer experience long hold times or unexpected fees.

Another important factor we’ve discussed that affects our service is our customers’ conversion rate. When the payment process is seamless, it reduces drop-offs and increases successful transactions. This is crucial for us, as it helps retain customers and minimises the number of people who abandon their purchases.

How does Brite assist you in your approach to payment security and compliance?

Ahmed I.: We have a strong relationship with Brite and Axel within the Brite commercial team. For instance, our CFO, Awat Eftekhari, communicates well with Axel, allowing them to discuss various aspects of our processes, compliance issues, and the legality of any services.

Ahmed l: Brite and our team have a good relationship. Axel has been invaluable with Vivowire.

Finally, can you summarise Brite in three words?

Ahmed Ismail: Fast, secure, and seamless.