Brite Payments Announces Its Proprietary Instant Payments Network

Brite Payments Announces Its Proprietary Instant Payments Network to Power Instant Payments and Payouts Across Europe

Brite IPN enables instant payments and payouts through open banking – helping close the gaps in Europe’s fragmented real-time payments landscape Stockholm – 22 May, 2023 – Brite Payments, one of Sweden’s fastest growing fintechs and a leader in instant bank payments, today announced its Brite Instant Payments Network (IPN). Brite IPN is a proprietary network that leverages the capabilities of open banking to give merchants and businesses a complete, out-of-the-box instant payments and payouts solution. Uptake of open banking payments across Europe is increasing as businesses see benefits from an operational and cost perspective, while valuing the convenience and security they offer customers. However, the full potential of open banking payments is yet to be realised. Brite has taken an open banking-first approach to build a network that enables 24/7/365 instant payments processing, while helping address the limitations of SEPA Instant and the fragmented nature of real-time payments in Europe. Additionally, Brite IPN enables instant payments and payouts in markets and currencies outside the Eurozone. “Open banking has enormous untapped potential but businesses need easy-to-integrate products that deliver real and immediate value. Brite IPN is the ‘engine’ that enables us to process payments instantly and equip businesses with a true out-of-the-box solution,” said Lena Hackelöer, Founder & CEO, Brite Payments. “We have been building our next-generation proprietary network since Brite was founded in 2019, and I am excited to announce Brite IPN as a significant step forward in our mission to support merchants and businesses with a faster, more convenient, and secure open banking payments solution.” Advantages of Brite IPN Brite IPN powers instant payments and payouts products that offer merchants significant advantages over traditional open banking payments (i.e. Payment Initiation Services or PIS) by taking full receipt of incoming funds and settling them rapidly on behalf of merchants across Europe. Supported by Brite IPN’s merchant FX capabilities, merchants can also fund or request settlement in a currency of their choice. Key benefits: The Brite IPN announcement follows significant growth over the past year, with the second-generation fintech more than doubling revenue and transaction volume on its platform in 2022, and increasing its headcount by nearly 100 percent during this period. Brite serves merchants and businesses across a wide range of verticals, in an ever-expanding number of markets across Europe. For more information about Brite, please visit: britepayments.com About Brite Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real-time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. The company currently operates across 24 markets in Europe and is connected to more than 3,800 banks within the EU.

4 Reasons Why Lenders Should Adopt Instant Payout Solutions

Did you know there’s a hidden opportunity within European consumer lending? At present, only 10% of payments in the EU are instant payments. This means, despite being approved for access to credit, most borrowers have to wait before they receive their funds. Proactive lenders can stand out from the competition by adopting instant loan payout solutions and offering quick and easy access to financial services. However, this opportunity to gain a competitive advantage may be fleeting. Instant payments are gaining traction across the globe, so consumer lending firms need to act to stay relevant in this changing market. Learn more about the barriers to and the benefits of delivering instant loan payouts and where you can find reliable third-party providers below. The hidden opportunity in consumer lending Instant payments were once a novelty, but as adoption has risen across the world, this is no longer the case. As of March, 83 countries have some sort of instant payouts/payments infrastructure. However, uptake in the EU specifically remains low. Official figures show only 10% of all EU credit transfers in 2021 were instant payments. Estonia is the only EU country where instant payments account for more than 50% of all payments. India, on the other hand, is light years ahead; accounting for 46% of all instant payments globally in 2022. In response, the European Commission is proposing to make instant payments more affordable, convenient and safe to drive adoption. Instant payouts have the potential to transform financial services for the better by giving customers quick and easy access to credit. With the value of instant payouts in consumer lending being clear, there is a hidden opportunity for lenders that provide them. 4 benefits of instant payouts in consumer lending 1. Faster loan disbursements Traditional payment rails, like wire transfers and BACS payments, can take up to five days to settle. Unfortunately, these delays can put customers off from applying if they need credit quickly. For example, for payday loans. By contrast, instant loan payouts can take as little as five seconds. By adopting instant payouts, consumer lending firms can generate new business by servicing customers’ credit needs more effectively. 2. Smoother application process Online credit intermediary platforms can populate parts of the loan application with the borrower’s data. Accordingly, the modern loan application process is exceedingly quick. However, online credit intermediary platforms can only go so far, as customers still need to enter some data manually. Instant payouts make the entire borrowing process as efficient as possible. And instant loan payout solutions powered by open banking help consumers share their bank account details quickly and accurately. This can prevent users from making data entry errors via manual inputs and causing accidental delays in the application process. As soon as the application is approved, customers can receive their funds, allowing customers to benefit from their loans more effectively. 3. Higher borrower satisfaction With minimal friction across the customer journey, lenders can improve their satisfaction ratings. As a result, lenders can build a reputation for offering quick and easy access to loan products and other types of financial support. Lenders can also leverage this reputation to attract new customers and retain existing ones. Lenders can also use targeted advertising solutions to offer reliable borrowers more attractive deals and build stronger relationships over time. 4. Enhanced market competition Consumer lending firms can’t afford to wait until an instant payment mandate takes effect. The legislative proposal was announced by the European Commission in October 2022 and will take some time before a mandate is passed and then takes effect. What’s more, an instant payment mandate doesn’t necessarily guarantee that customers will benefit from more effective instant payout services. For example, SEPA Instant Credit Transfers – an instant payment method within the EU – were launched in 2017. Unfortunately, the payment method has amassed less than 14% of all SEPA-based credit transfers in the EU. The technology for instant loan payouts already exists, meaning consumer lending firms should act now to capitalise on this hidden opportunity and innovate their services. Barriers to adopting instant payouts in consumer lending Consumer lending regulations The legacy of the 2008 financial crash can still be felt strongly within the financial services industry. As such, some business leaders remain concerned about adopting instant loan payout solutions, due to consumer lending regulations that are designed to control easy credit access. This viewpoint is not 100% accurate though, as lenders still need to conduct affordability assessments on borrowers. However, borrowers should be able to receive their funds as quickly as possible once they’ve passed the required lending criteria. The cost of developing an instant payout network Developing an instant payout network is a notoriously time and resource-intensive process. And it is not easy either: 70% of digital transformation projects end in partial or total failure. For consumer lending firms, such technological projects are understandably outside their area of expertise. That’s why consumer lending firms can benefit from working with third-party instant payout providers, such as Brite Payments. Brite offers a readily-available, all-in-one API that can deliver instant payouts to borrowers. Integration within your existing consumer decision engine is easy and comes with bank-level security, meaning payments are secure as well as fast. Brite can also helps businesses take payments quickly and securely, meaning we can support every stage of the lending process and help deepen customer relationships. Access instant loan payout solutions, and more, from Brite The opportunity in the European consumer lending market is ripe for the taking. Consumers have come to expect quick and easy access to financial services via mobile apps and digital touchpoints. By delivering instant loan payouts, lenders can exceed customer expectations and retain customers long term. By working with third-party providers like Brite, you can access a fully-compliant, highly secure Instant Payouts network. Our powerful all-in-one API can even help you streamline your application process by helping customers share account details quickly and accurately. So, if your business wants to provide Instant Payouts, and more, let’s talk.

Drivers and opportunities in the European remittance market

Opportunities in the European remittance market are growing, as transaction activity reached €25 billion in 2021. And, as long-term financial commitments, remittance payments offer a reliable revenue source to service providers. Read on to learn more about this understated market in digital remittance payments and discover ways to simplify your remittance payments for both senders and receivers. What does the European remittance market look like? Drivers for migration and remittances in the EU Free movement of persons is a cornerstone of the European remittance market. Under this right, people can live, work and travel across 30 countries with almost no restrictions. As a result, it’s common for people to explore career opportunities and build a life in other member states. For example, 1.4 million people migrated from one member state to another in 2021. So, the number of EU citizens living in another member state is now ~4% of the total population. This represents a ~17% increase from the previous year, meaning the EU’s cross-border remittance market size is growing. Open banking makes remittance in banking easier, which has enhanced the EU’s cross-border remittance market size. The landmark 2018 legislation has helped to improve the safety, speed and style of payment options available across the EU. EU cross-border remittance market size The single market now consists of almost 450 million consumers, representing nearly a fifth of global GDP. And in 2021, Eurostat data showed total transfers between resident and non-resident households reached around €25 billion. Of this figure, roughly 56% of outflows and 53% of inflows were intra-EU payments, meaning most remittance payments occurred within EU borders. While the Euro is the dominant currency, remittance payments can also include other currencies. For example, the Danish and Norwegian krone or Swiss franc. So, remittance providers may need to provide competitive exchange rates and fast, safe, and secure remittance payments. Money flows of intra-EU remittance payments Research from Eurostat showed that EU money transfers reached historical highs in 2021 – but where is this money going? Well, migration and remittances overlap. So, money flows are more common from western EU member states to their eastern neighbours (mirroring migration patterns). For instance, Croatia, Latvia and Romania were the EU states most dependent on remittances in 2021. And Switzerland was the main source of employment-based remittance payments during the same year. However, the European remittance market is a little more complex than a west/east divide. Western member states were both the main senders and receivers of intra-EU remittance payments in 2021. For example, Germany accounted for 16% of EU internal remittance payments and money outflows (money leaving the single market entirely). Similar rates were also seen in Luxembourg (11%), France (10%) and the Netherlands (10%). Since major economies attract capital too, some of the same member states had the highest rates of receiving remittance payments: France (22%), Germany (14%) and Belgium (10%). Examples of remittance transfers in the EU market Most of the money flows identified above come from seasonal and cross-border work opportunities. Receivers then use the funds to cover medical, school or housing expenses back home and sometimes simply to put food on the table. In addition to this, many people study in other EU states, including as part of the Erasmus programme. Eurostat data suggests that, in 2020, 43% of foreign students in the EU were from other European countries. Remittance transfers in the EU therefore cover a number of different use cases. These can range from long-term remittance payments from migrant workers to short-term transfers, like covering medical emergencies. How to simplify your remittance payments It’s clear that the European remittance market presents unique growth opportunities to remittance service providers. Free movement has helped to expand the number of intra-EU transfers and drive the EU’s cross-border remittance market volume to around €25 billion in 2021. However, remittance service providers need a comprehensive offering that enables both parties to send and receive money easily. Remittance payments are an essential form of recipients’ income; meaning senders need safe, secure and fast transfers. Remittance payments are also, for many senders, a long-term financial commitment, meaning they look for ease of use, too. By partnering with Brite Payments, remittance service providers can get paid and pay out money instantly to their customers. With bank-level security, Brite Payments ensures senders and receivers can be confident their money will arrive. In fact, Brite Payments can deliver instant payments in six European markets (Sweden, Finland, the Netherlands, Estonia, Latvia, Lithuania, and soon Belgium). Instant Payouts provided by Brite, offer a unique opportunity in the remittance market. So, if you have a remittance business and you’re looking to improve your services… let’s talk.

The challenges facing FinTechs, from PSD3 to AI and fundraising

How to Improve Remittance Services for Digital Nomads

A multitude of factors have given way to the popularity of working remotely and increasingly abroad as digital nomads. Remote working has become a global phenomenon, with some even calling it “the greatest human migration in history.” In essence, a digital nomad is someone who is location-independent and uses technology to perform their job. It applies to professionals who work and live in another country – often for short periods. Today, there are an estimated 35 million digital nomads in the world. Popular occupations for digital nomads include programmer, website or app developer, social media marketer, digital entrepreneur, and customer support representative. In this article, we look at how remittance service providers can improve remittance services for digital nomads. For all instances they want send money home to loved ones, save for a rainy day, and even invest. Digital Nomads Are Everywhere. Literally! “The rise of remote work has opened up a world of possibilities for a new generation of workers”, say recruitment experts. “Today’s workforce isn’t limited to working from traditional office spaces. They can work from their apartments, local cafes, and even across countries.” Travel bloggers Matthew and Ashley list the top 5 reasons most people become a digital nomad: Here’s a list of 17 destinations welcoming remote workers with special visas and other benefits. According to The Digital Nomad Index, the best countries to be a digital nomad are Canada, UK, Romania and Sweden. The index is based on things like rent prices, the global happiness index and the cost of living. We’d add to that list the cost of sending money across borders. Sending Money Across Borders While migrants living in the European Union send upwards of 60 billion per year to their families in developing countries, less is reported about intra-EU transactions by, among others, digital nomads. The European Migration Network found that people living abroad send an average of 15% of their income back home. While many migrant workers use remittance in banking to send remittances to low-income countries, digital nomads may use remittance service providers to send money to other European ones. But, the downside has been that international payments are often more expensive, slower, less accessible and not as transparent as domestic payments. The International Monetary Fund lists how a typical remittance transaction takes place: Costs of sending money internationally will include a fee charged by remittance service companies. Typically, the sender pais for this fee. And a currency-conversion fee for delivery of local currency to the beneficiary in another country. How to improve remittance services Do you want to improve your remittance services? Account-to-account transfers like Brite’s Instant Payments and Instant Payouts are becoming the go-to option. It works for people of all ages who prefer speedier and more convenient transacting. In order to make a payment, the remittance service company simply enters the recipient’s information (such as their email address or phone number) and the amount they wish to send. Finance Monthly describes how the recipient will then receive a notification that they have been sent money and can choose to accept or reject the payment. If the payment is accepted, the receiver can securily identify via bank identification, and select the bank account to receive the funds. The funds will instantly be transferred from the sender’s account to the recipient’s account. Fast, Simple And Secure International Payments Using instant payments from Brite, remittance service companies can offer their customers a fast, simple and secure way to send money straight from their accounts and into the recipients’s account in seconds. With one simple, powerful API, remittance service companies have everything they need to offer faster, safer, simpler payments for their customers. They can authenticate, collect account details, and transfer funds in one click. Speeding up payments and improving sales is good for their customers and their business. Brite uses enriched data, PEP, and sanction screening to confirm identities and reduce risk. It’s not just the seamless experience. Brite cuts cost and increase sales, all while making sure customers keep coming back. Moreover, there’s no downloads or registration required, hence, remittance customers get to the point of payment faster, and remittance service providers get better conversion rates. In summary, Instant Payments and Instant Payouts give remittance service providers the tools to offer digital nomads a way to send money home to loved ones, save for a rainy day in a bank account in their home country, and even invest in projects or companies back home. Are you a remittance service provider looking to offer digital nomads fast, simple and secure international payments? Let’s talk!

Brite Payments: Why the future of payments is up for grabs

How PSPs will be a growth catalyst for A2A payments

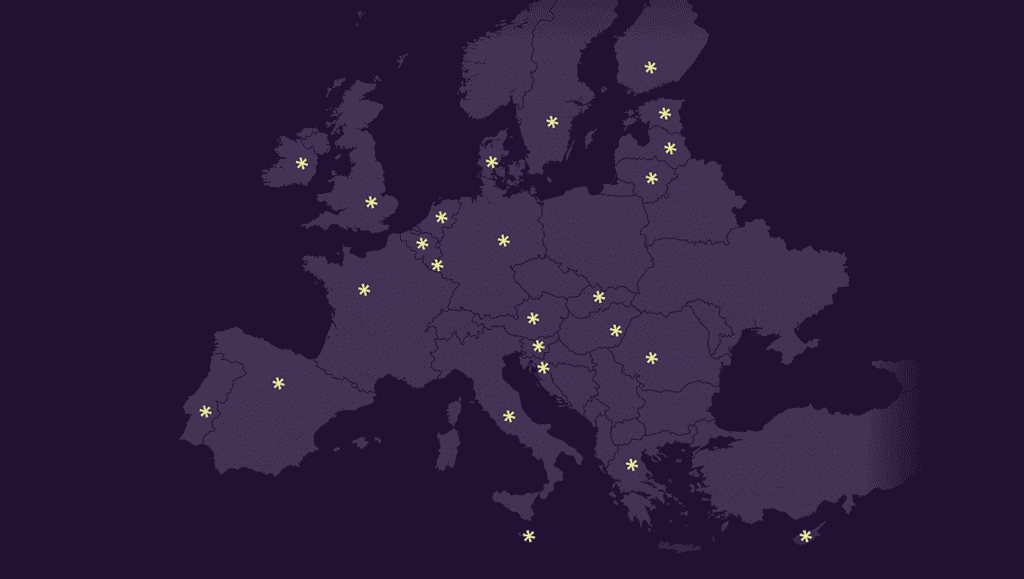

Brite Payments Extends Payouts Coverage to New Markets in Central and Eastern Europe

Stockholm – 15 March, 2023 – Brite Payments, one of Sweden’s fastest growing fintechs and a leader in instant bank payments, has today announced expanded coverage across Central and Eastern Europe. Brite, which has built its instant account-to-account (A2A) payments offering on the European-wide open banking infrastructure, now offers its payouts solution in Croatia, Romania, and Hungary. The addition of these markets means that Brite now offers payouts coverage in a total of 24 markets across Europe. Instant processing has become an important proposition within payments, most notably across markets within Europe that are undergoing rapid digital transformation in many parts of their economy. Brite’s expansion is a response to increased demand from international merchants as well as the opportunity to support businesses in these dynamic domestic markets. Brite facilitates the rapid receipt of funds from merchants to consumers through its payouts solution, across diverse sectors, including eCommerce marketplaces, consumer finance, online trading, travel, ticketing, insurance, and gig work platforms. Reliable and timely payouts in these sectors is a key factor in building trust with consumers. Immediate access to funds has become increasingly important for consumers, who are currently dealing with rising living costs and a challenging economic environment. Pairing fast payouts with the convenience and security of open banking further enhances the end user experience. Additionally, Brite’s unique Time2Money feature ensures that users have full transparency and visibility into exactly when they will receive their money, further helping to build trust. “Croatia, Romania, and Hungary represent some of the Europe’s most dynamic and fast-growing markets, as well as being popular markets for expansion for established international businesses. By adding these countries to our network of payouts coverage, we take another step forward on our mission to bring fast, easy and secure payments to merchants and consumers across Europe,” said Lena Hackelöer, Founder & CEO, Brite Payments. “Brite has quickly become a payment provider of choice for many businesses that want to prioritise seamless and transparent payments and payouts.” Expansion into new markets and currencies follows Brite’s tremendous growth over the past year, with the company more than doubling revenue and transaction volume on its platform, and increasing headcount by nearly 100 percent. The company’s most recent coverage expansion also follows its full product rollout across the Baltic region. ABOUT BRITE Brite Payments is a second-generation fintech based in Stockholm. The instant payments provider leverages open banking technology to process account-to-account (A2A) payments in real-time between consumers and online merchants. With Brite, no signup or credit card details are required as consumers authenticate themselves with top-of-mind details using their bank’s usual identification method. The company currently operates across 24 markets in Europe and is connected to more than 3,800 banks within the EU.

Brite Payments expands into three new European markets