Opportunities in the European remittance market are growing, as transaction activity reached €25 billion in 2021. And, as long-term financial commitments, remittance payments offer a reliable revenue source to service providers. Read on to learn more about this understated market in digital remittance payments and discover ways to simplify your remittance payments for both senders and receivers.

What does the European remittance market look like?

Drivers for migration and remittances in the EU

Free movement of persons is a cornerstone of the European remittance market. Under this right, people can live, work and travel across 30 countries with almost no restrictions. As a result, it’s common for people to explore career opportunities and build a life in other member states.

For example, 1.4 million people migrated from one member state to another in 2021. So, the number of EU citizens living in another member state is now ~4% of the total population. This represents a ~17% increase from the previous year, meaning the EU’s cross-border remittance market size is growing.

Open banking makes remittance in banking easier, which has enhanced the EU’s cross-border remittance market size. The landmark 2018 legislation has helped to improve the safety, speed and style of payment options available across the EU.

EU cross-border remittance market size

The single market now consists of almost 450 million consumers, representing nearly a fifth of global GDP. And in 2021, Eurostat data showed total transfers between resident and non-resident households reached around €25 billion. Of this figure, roughly 56% of outflows and 53% of inflows were intra-EU payments, meaning most remittance payments occurred within EU borders.

While the Euro is the dominant currency, remittance payments can also include other currencies. For example, the Danish and Norwegian krone or Swiss franc. So, remittance providers may need to provide competitive exchange rates and fast, safe, and secure remittance payments.

Money flows of intra-EU remittance payments

Research from Eurostat showed that EU money transfers reached historical highs in 2021 – but where is this money going?

Well, migration and remittances overlap. So, money flows are more common from western EU member states to their eastern neighbours (mirroring migration patterns). For instance, Croatia, Latvia and Romania were the EU states most dependent on remittances in 2021. And Switzerland was the main source of employment-based remittance payments during the same year.

However, the European remittance market is a little more complex than a west/east divide. Western member states were both the main senders and receivers of intra-EU remittance payments in 2021. For example, Germany accounted for 16% of EU internal remittance payments and money outflows (money leaving the single market entirely). Similar rates were also seen in Luxembourg (11%), France (10%) and the Netherlands (10%).

Since major economies attract capital too, some of the same member states had the highest rates of receiving remittance payments: France (22%), Germany (14%) and Belgium (10%).

Examples of remittance transfers in the EU market

Most of the money flows identified above come from seasonal and cross-border work opportunities. Receivers then use the funds to cover medical, school or housing expenses back home and sometimes simply to put food on the table.

In addition to this, many people study in other EU states, including as part of the Erasmus programme. Eurostat data suggests that, in 2020, 43% of foreign students in the EU were from other European countries.

Remittance transfers in the EU therefore cover a number of different use cases. These can range from long-term remittance payments from migrant workers to short-term transfers, like covering medical emergencies.

How to simplify your remittance payments

It’s clear that the European remittance market presents unique growth opportunities to remittance service providers. Free movement has helped to expand the number of intra-EU transfers and drive the EU’s cross-border remittance market volume to around €25 billion in 2021.

However, remittance service providers need a comprehensive offering that enables both parties to send and receive money easily. Remittance payments are an essential form of recipients’ income; meaning senders need safe, secure and fast transfers. Remittance payments are also, for many senders, a long-term financial commitment, meaning they look for ease of use, too.

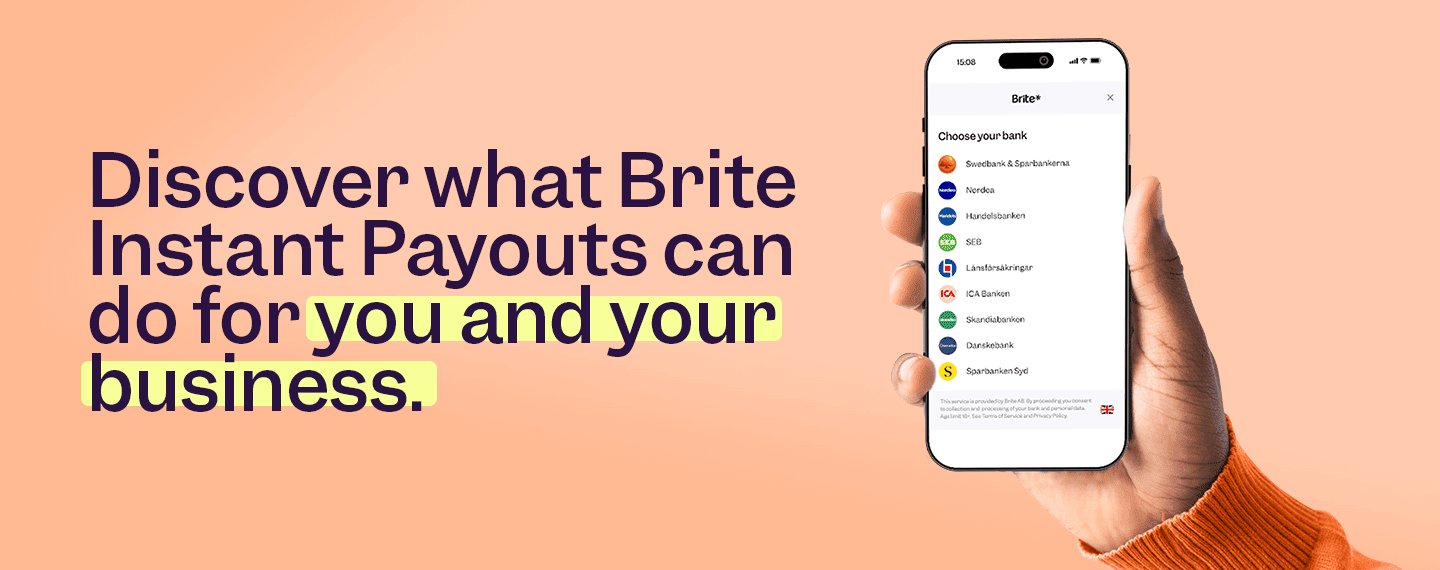

By partnering with Brite Payments, remittance service providers can get paid and pay out money instantly to their customers. With bank-level security, Brite Payments ensures senders and receivers can be confident their money will arrive. In fact, Brite Payments can deliver instant payments in six European markets (Sweden, Finland, the Netherlands, Estonia, Latvia, Lithuania, and soon Belgium).

Instant Payouts provided by Brite, offer a unique opportunity in the remittance market. So, if you have a remittance business and you’re looking to improve your services… let’s talk.