Update 2023-04-21 P27 Nordic Payments gives up – 700 million has been lost. Bankgirot’s owner P27 Nordic Payments withdraws its application to the Financial Supervisory Authority for a new clearing operation. This means that the dream of a co-Nordic, state-of-the-art payment system is now over. “Our vision was too ambitious and complex,” says CEO Paula da Silva. P27 will no longer be able to transform trade in the Nordics.

Update 2023-04-19 The future of P27 Nordic Payments is now looking uncertain, with top bank managers expressing doubts about the project. Denmark’s central bank is even preparing for closure. The owner banks are now seeking an emergency solution for the investment, as the project’s original concept no longer exists. The problems with P27 have led to a crisis meeting, where Swedbank and SEB suggested investing only in Sweden and leaving out Finland and Denmark. It remains to be seen if this drastic backup plan will be enough to salvage the project’s prestige.

How P27 Will – No Longer – Transform Trade in the Nordics

Original article

The Nordic Region is famous for many things. Moody crime fiction, hygge, and cinnamon pastries are just a few of its exports. Let’s now add to that list a forward-thinking payments sector that lays the foundations for not only cashless societies but also cardless ones.

It’s no secret that cash usage has plummeted in recent years. Anyone living in or visiting Nordic countries will struggle to spend notes and coins. This article looks at the bank-owned initiative P27 Nordic Payments. What are the potential benefits of a more streamlined payment system in the region?

The Spirit of Collaboration

The Nordic countries of Denmark, Finland, Norway and Sweden often work closely together. The foundations of Nordic cooperation are interaction and mobility and several historic treaties have passed to further collaboration between the nations. One example is the Nordic Passport Union, established in 1952 to ease travel restrictions.

Over the years, pan-Nordic cooperation has led to numerous economic benefits. These include high living standards and relatively low income disparity.

P27 is an example of this collaborative spirit. We expect it to have a significant societal impact going forward.

What is P27 Nordic Payments?

P27 is a secure, multicurrency, real-time clearing system, so named because of the region’s 27 million citizens. Six of the largest banks in the area are behind the project: Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB and Swedbank.

A clearing system protects the parties involved in a transaction by recording the details and validating the availability of funds. By streamlining this process between the banks, P27 will help cut the cost of cross-border financial transactions for millions of customers and thousands of businesses.

The Nordic Region will go from nine clearing solutions to one. Moreover, it will have a more uniform payment format, the ISO 20022 XML. This is the standard that European banks use for the exchange of banking data. Basically, once a merchant has used the XML format they can reuse most of the template. This saves time and effort.

XML support is one of the reasons that will make Bankgirot obsolete. Instead, P27 will support payments that comply with new payment laws. Notably, ISO 20022 and ones designed to improve traceability, like EU Regulation 2015/847.

Potential Benefits

A potential benefit of a single pan-Nordic payment infrastructure is increased trade.

People will be able to use the same payment across the participating countries. Buying goods and services from domestic retailers will be as easy as from neighbouring ones. Faster clearing will mean merchants can quickly verify the reception of funds and send out products ordered online. At the end of the day, all of these factors will improve customer experience and encourage further spending.

The standardisation of payments and improved processes will reduce financial and operational risks. If successful, P27 will remove friction created by current payment systems. Liquidity will improve as banks can move money instantly. This also frees up cash flow for businesses and improves the buying experience for consumers.

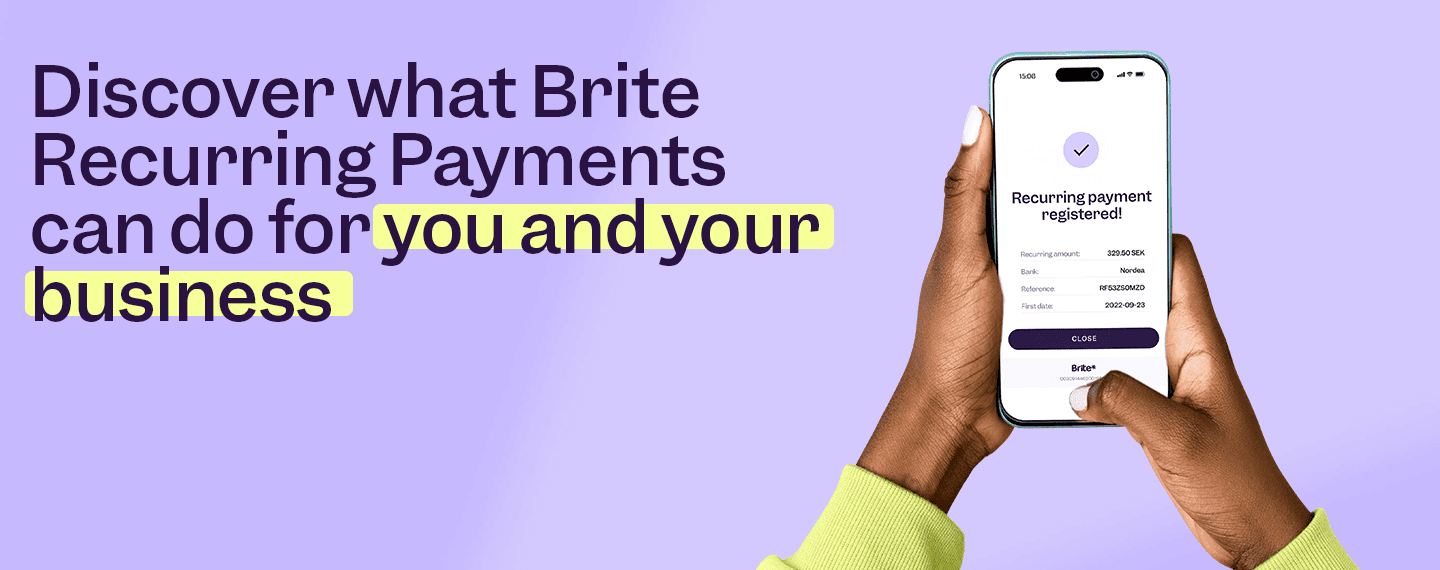

Faster Payments with Brite

Speed is high on P27’s agenda. Open-banking-powered instant payments create significant value for people across the region. The use of instant payments will be a game-changer for the Nordic Region.

Brite Payments already provides businesses around the EU products like those mentioned in this article: instant payments and recurring payments. All Brite products facilitate the movement of funds across borders and include many of the benefits of P27:

- automatic settlement

- bank-level highest security

- reduced checkout friction

- superior customer experience

With Brite Instant Payments, merchants can use open banking-payment rails to securely and instantly receive money across borders.

Future-proof your payments with Brite

P27 will roll out in stages with the full release likely to come after 2025. “The P27 project will be ongoing for several years, in many different stages. The first part of the migration relates to payments in SEK within Sweden and will run between 2022 and 2025,” according to Handelsbanken.

P27 will go live in Sweden first, and Swedish banks will need to start moving their customers from Bankgirot services like Autogiro to alternative solutions. The best way to deal with any issues arising from the phasing out of Bankgirot and Autogiro is to choose Brite Recurring Payments. Our technology is based on open banking and does not utilise a direct debit mandate. It is a future-proof solution for all your monthly payments.

This solution was designed from the ground up for a good user experience. Your customers only need to sign up once with top-of-mind information using their usual ID methods. Moreover, it doesn’t rely on cards that can expire, you can rest assured that your payments will go through on time – every time.

Brite Recurring Payments will put you ahead of the competition and protect your payments against future regulations. The advantages of using Brite include automatic reconciliation for less admin, the highest levels of security, increased conversion, and better customer experience.

If you want to future-proof your recurring payments…let’s talk!