Data Solutions

Insights that Give You The Edge

From verification to affordability, use bank account information to create an accurate picture of your consumer with ease.

A Suite of Data Solutions

Our products are built to solve your most complex risk and onboarding challenges. We do the hard work so you get clean, actionable data.

01 -- 06

From 'Who?' to 'Known' in Seconds

Keep Risk in Check

Assess affordability and source of funds in seconds. Giving consumers fast access and you confidence.

Stop Fraud at the Source

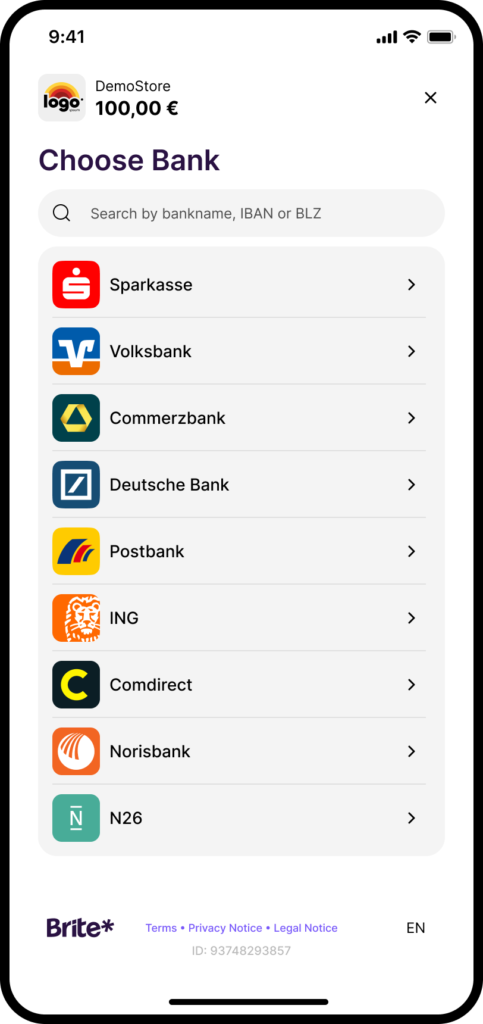

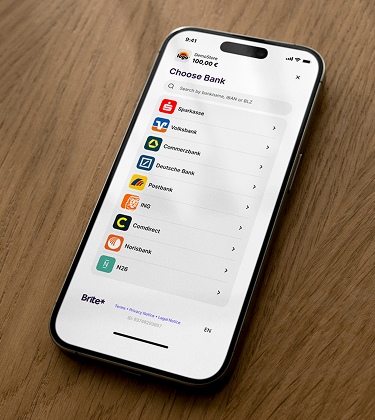

Do more, Ask for Less

Maximise conversion by replacing clunky forms and manual uploads with a simple 4-step user journey.

Transparent Pricing

One journey for multiple scenarios

Brite Performance

We deliver the data you need, when you need it, with speed and reliability you can depend on.

40%

of users abandon sign-up when faced with manual KYC form uploads. Brite reduces verification time from days to seconds.

90%

+17%

More Than Just Data - Actionable Intelligence

Configurable Categorisation

We’ve built the categories, you control the setup. Tweak the config based on your data needs, not ours.

Single API

Access all products using one API. Save time solving consumer challenges, not integration ones.

PDF Reports

For use cases where a PDF is essential -– reports delivered via manual download or API.

Our Customers

Utilities

Financial Services

Charities

Octany

One API. All the Data You Need.

We turn complex bank data into a simple, actionable API response. Explore our developer portal and see how easy it is to get started.

Essential Resources

Your Data Solutions Questions Answered

How does Brite handle data privacy and GDPR compliance?

Brite treats data privacy as foundational. Our process is strictly compliant with GDPR (General Data Protection Regulation) and PSD2 (Payment Services Directive 2). Data access is always limited to the information necessary to provide the service (e.g., identity verification or affordability checks) and cannot be used for other purposes without the consumer’s explicit consent, as per GDPR standards.

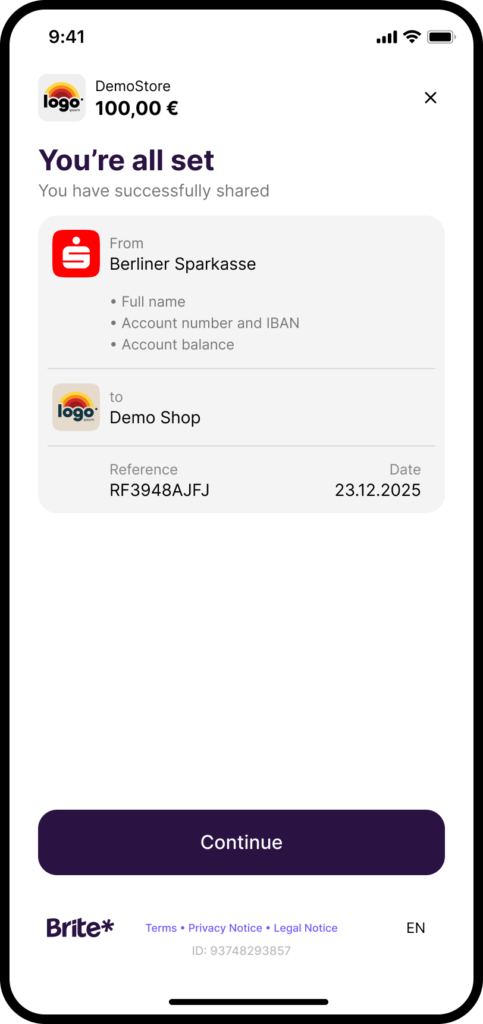

What is the consent process for my customers when using Brite Data Solutions? Will it add friction to my sign-up flow?

The consent process is designed to be fully transparent and add minimal friction. The consumer is directed to their own bank to authenticate securely and grant permission for data sharing. This happens quickly within a few clicks. The process replaces the high friction of manual document uploads and form-filling, typically leading to increased conversion rates at the account creation stage.

How does Brite’s Account Verification work to prevent fraud?

Account Verification leverages Open Banking APIs to perform bank-grade identity matching. The system checks that the name provided during your account creation process (e.g., for KYC) matches the name registered on the linked bank account. This prevents identity fraud and account takeover (ATO) by confirming the person funding the account is the rightful owner with real-time, tamper-proof bank data.

Can I use Brite’s Source of Funds solution to support our risk and compliance checks?

Yes. Our Data Solutions provide structured, classified financial data (such as income, expenditure, and transaction history) that is essential for automating complex risk and compliance checks. This allows you to:

Source of Funds (SoF): Simplify AML/EDD requirements by instantly verifying the legitimacy of client wealth.

Can I verify a customer and take their first payment in a single, unified flow using Brite?

Yes, this is a core feature benefit. The process can be integrated into a single, unified flow (like Brite Play) that simultaneously handles account creation and the initial payment. This eliminates the need for separate steps, maximises conversion, and delivers a fully verified, funded consumer instantly.

How can we determine which Data Solutions product is the best fit for our needs?

The best fit depends on your specific compliance and business needs:

If your priority is fraud prevention at deposit, Account Verification should be considered.

If you require compliance for money laundering/EDD, Source of Funds may be a good fit.

We recommend consulting with our solutions team to tailor the API integration to match your exact risk model and regulatory requirements.

How long does consent to access a consumer's data last once provided by Brite?

In the European Union, consent for Account Information Services (AIS) typically lasts for 180 days from the time the consumer grants permission via their bank’s Strong Customer Authentication (SCA). The consumer always retains control and can withdraw this permission at any time.

In which markets is Brite Data Solutions available?

Brite Data Solutions are initially available in Finland, with more markets such as Germany and Sweden being added in 2026.