Instant Payments

Zahlungen in Sekunden abwickeln

Vorteile, die sich sofort auszahlen

Mit Brite verbessern Sie Ihren Cashflow durch Zahlungsabwicklung in Echtzeit und bieten Ihren Kunden eine nahtlose Zahlungserfahrung, die Vertrauen schafft und die Wiederkaufsrate steigert.

Ein Zahlungserlebnis, das Kunden bindet

Zahlungen in Echtzeit, ohne Kompromisse

Zuverlässigleit bei jeder Transaktion

Lokale Payments – europaweit skaliert

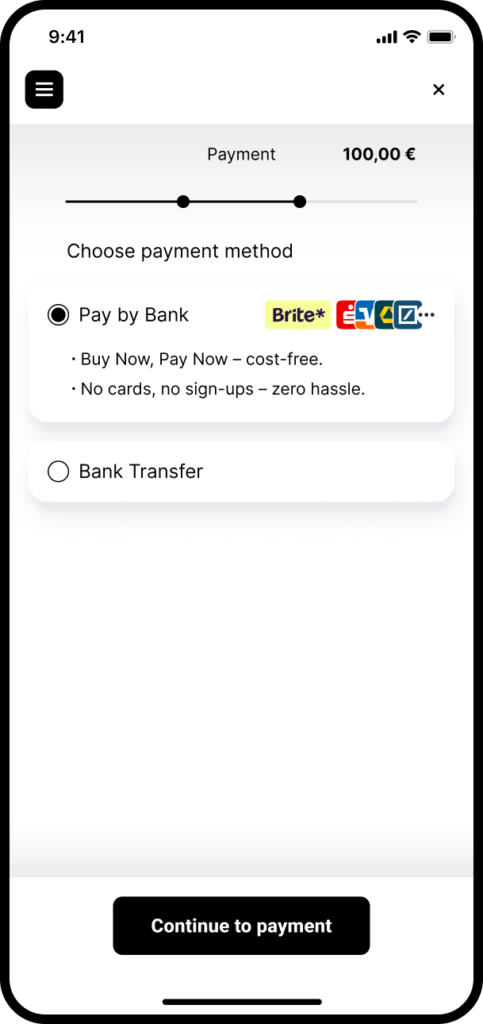

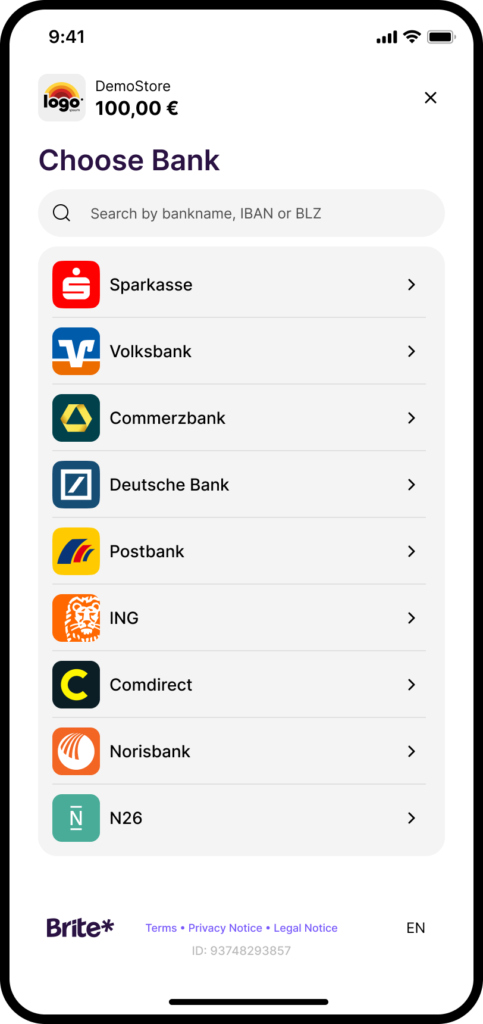

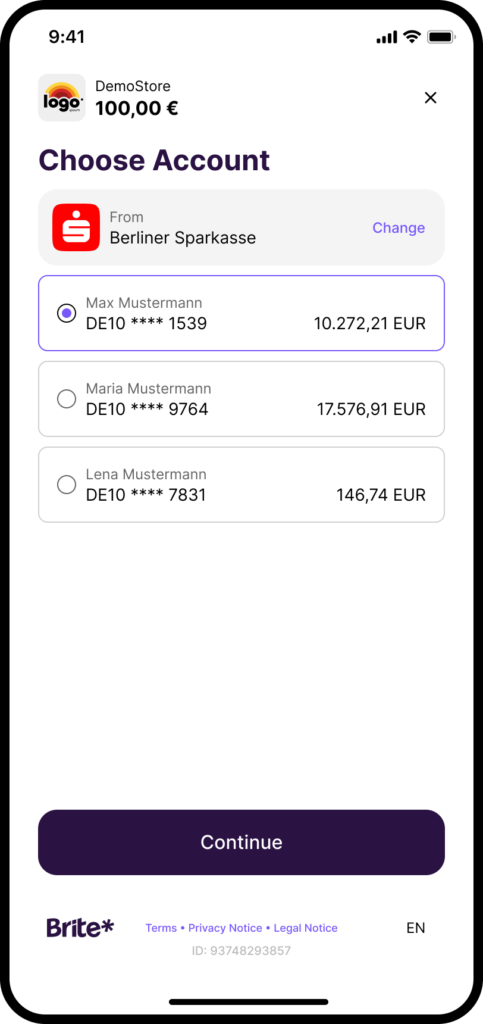

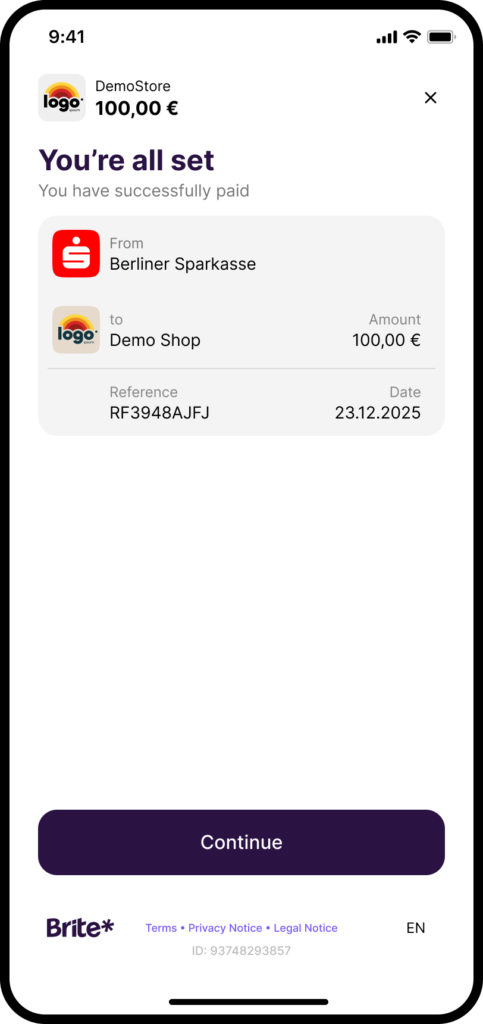

Instant Payments in nur 4 Schritten

Brite Performance

90%+

< 30 Sek.

95%

Key feature

Die Technologie hinter Instant Payments

Unser Netzwerk verarbeitet Zahlungen europaweit innerhalb von Sekunden – 24/7 an 365 Tagen im Jahr. Mit Brite gehören Clearing-Zyklen und Cut-off-Zeiten des traditionellen Bankwesens der Vergangenheit an.

Payment-Features für überlegene Prozesse

Schnellere Zahlungen für wiederkehrende Kunden

Gleiches Konto, weniger Klicks – ideal für hohe Conversion-Raten.

Automatisierte Abstimmung

Aggregierte und detaillierte Transaktionsberichte liefern klare Informationen zu Rückerstattungen, Verrechnungen und Gebühren.

Rückerstattungen in Echtzeit

Stärken Sie das Vertrauen Ihrer Kunden, indem Rückerstattungen genauso schnell erfolgen wie Zahlungen.

Unsere Kunden

E-commerce

Financial Services

Financial services

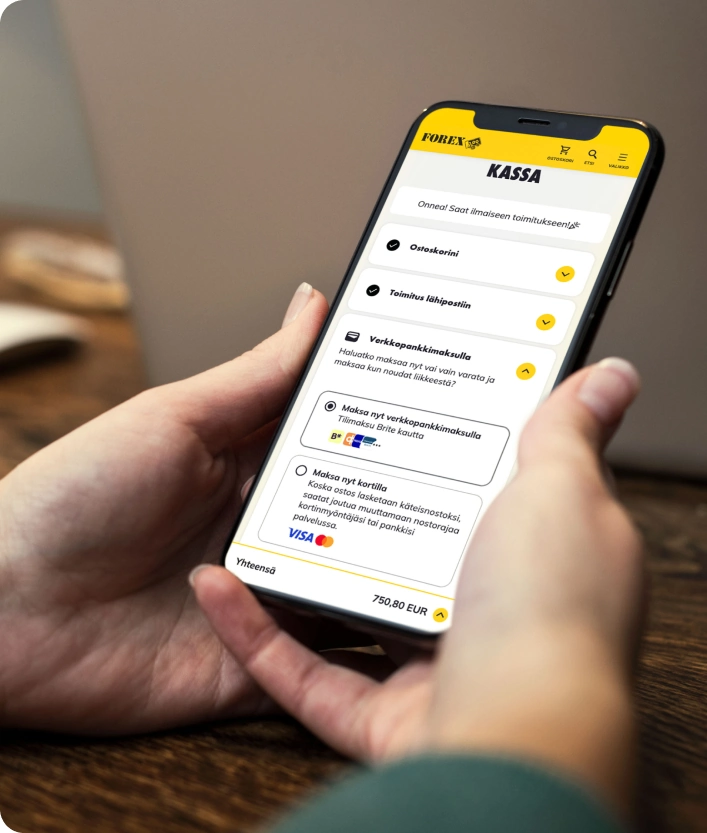

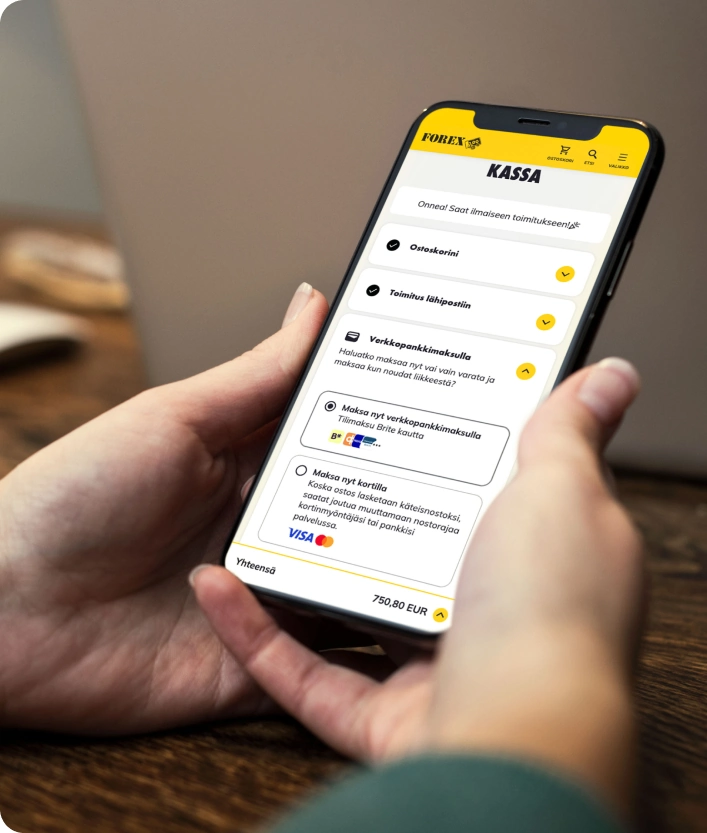

FOREX

Endlich. Eine API, auf die Sie sich verlassen können.

Unsere API ist klar dokumentiert, einfach zu integrieren und läuft auf einer Infrastruktur mit maximaler Verfügbarkeit – die verlässliche Basis Ihres Wachstums.

Aktuelles

Antworten auf häufige Fragen zu Instant Payments

Sie haben noch weitere Fragen?

Wie funktionieren Instant Payments mit Brite?

Instant Payments mit Brite sind schnell und sicher. Kunden wählen im Checkout einfach Brite als Zahlungsmethode aus, selektieren ihre Bank aus der Liste und loggen sich sicher mit ihrem gewohnten Identifizierungsverfahren ein (z. B. Biometrie oder digitale ID). Die Zahlung wird daraufhin autorisiert und sofort verarbeitet – ganz ohne die Eingabe von Kartendaten oder eine vorherige Kontoregistrierung.

Können Kunden Instant Payments mit Brite zurückholen (Chargebacks)?

Nein, Chargebacks wie bei Kartenzahlungen sind ausgeschlossen. Bei Brite Instant Payments handelt es sich um Account-to-Account (A2A) Payments, die unter Verwendung der vorgeschriebenen Sicherheitsprotokolle der Bank (SCA – starke Kundenauthentifizierung) autorisiert werden. Die Authentifizierung durch den Kunden macht die Zahlung unwiderruflich und eliminiert das Haftungsrisiko kartenbezogener Chargebacks für Händler.

Wie lange dauert der Bezahlvorgang mit Brite Instant Payments und wie schnell steht das Geld auf meinem Konto zur Verfügung?

Der gesamte Bezahlvorgang dauert für Nutzer in der Regel weniger als 60 Sekunden – von der Auswahl der Zahlungsmethode bis zum erfolgreichen Bestellabschluss. Sobald die Zahlung autorisiert wurde, erfolgt das Settlement (die Abrechnung) üblicherweise innerhalb von Sekunden.

Brite nutzt sein eigenes Netzwerk (Brite IPN), um Zahlungen auf dem effizientesten Weg zu routen und die Abhängigkeit von traditionellen Bank-Clearing-Zyklen zu minimieren. Dadurch ermöglichen wir eine Zahlungsbestätigung in Echtzeit und sorgen für einen verbesserten Cashflow.

Wie funktionieren Instant Refunds mit Brite und wie kann ich diese veranlassen?

Rückerstattungen werden genauso schnell verarbeitet wie die ursprüngliche Zahlung.

Sie initiieren die Rückerstattung einfach über Ihr Händlersystem oder per API und Brite kümmert sich um die sofortige Auszahlung. Unsere Instant-Refunds-Funktion stellt sicher, dass die Gutschrift innerhalb von Sekunden auf dem Bankkonto Ihrer Kunden eingeht. Dies steigert die Kundenzufriedenheit und reduziert gleichzeitig Ihren Aufwand im Support.

Meine Kunden nutzen überwiegend Kartenzahlung: Wird das Anbieten von Brite Instant Payments meine Conversion-Rate beeinträchtigen?

Brite Instant Payments können Ihre Conversion-Rate positiv beeinflussen.

Untersuchungen von YouGov und anderen Forschungsinstituten zeigen, dass Verbraucher Pay by Bank zunehmend bevorzugen, da die Zahlungsmethode schneller und sicherer als herkömmliche Kredit- oder Debitkarten ist. Durch den Wegfall mühsamer Eingaben langer Kartennummern reduziert unsere optimierte UX Reibungsverluste und steigert so die Erfolgsquote im Checkout.

Zudem macht unsere „Pay Faster Next Time“-Funktion den Bezahlvorgang für wiederkehrende Kunden noch schneller und bequemer.

In welchen Märkten sind Brite Instant Payments verfügbar?

Brite Instant Payments ist in 27 europäischen Märkten verfügbar. Wir sind mit mehr als 3.800 Banken verbunden. Diese umfassende Reichweite ermöglicht es Ihnen, Ihren Zahlungsverkehr und Ihr Treasury über eine einzige Integration zu zentralisieren.

Märkte, in denen Instant Payments bereits verfügbar sind:

Belgien, Dänemark, Deutschland, Estland, Finnland, Frankreich, Lettland, Litauen, Niederlande, Schweden

Was ist das „Pay Faster Next Time“-Feature und welchen Vorteil bietet es wiederkehrenden Kunden?

„Pay Faster Next Time“ ist unsere Lösung zur Maximierung der Kundenbindung und zur Steigerung von Folgekäufen, indem der Checkout-Prozess beschleunigt wird.

Es ist das Open-Banking-Äquivalent zum One-Click-Payment: Wiederkehrende Kunden können ihren Einkauf mit nur einem einzigen, optimierten Authentifizierungsschritt abschließen. In Kombination mit unserer automatischen Bankenauswahl lässt sich der gesamte Bezahlvorgang in wenigen Sekunden über das bevorzugte Bankkonto abschließen.

Sie haben noch weitere Fragen?