News & Resources

- Article

In an increasingly digital landscape, financial data is everywhere, but much of it is messy,...

- Article

Product Marketing Steve Sutherland Payment Acceptance Rate versus Conversion Rate – confused? You’re not alone,...

- Article

When a customer makes a purchase, the transaction goes through a list of stages, including...

- Article

Money makes the world go round. But first, money must be able to go around...

- Company News

Stockholm – 6 May, 2025 – Brite Payments, a specialist provider of instant payments, today...

- Article

Whether you’re buying supplies online, transferring funds, or engaging in financial activities, it’s essential to...

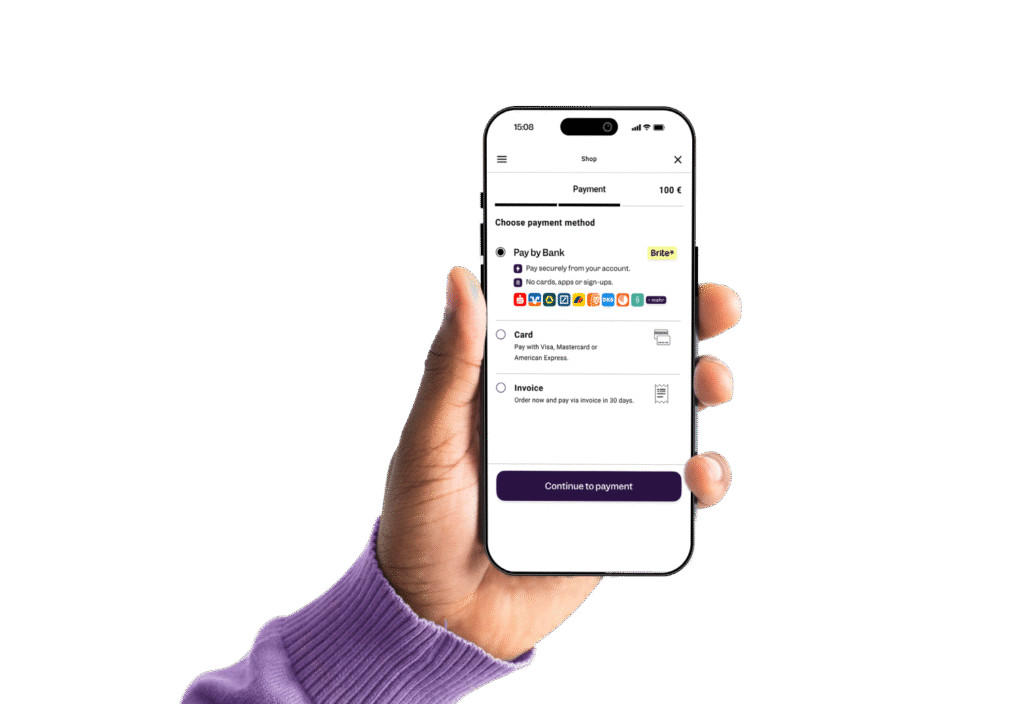

- Article

Choosing the best account-to-account payments (or Pay by Bank) provider for your business can be...

- Article

Significantly reducing credit card merchant fees is becoming increasingly critical. Indeed, it’s fair to say...

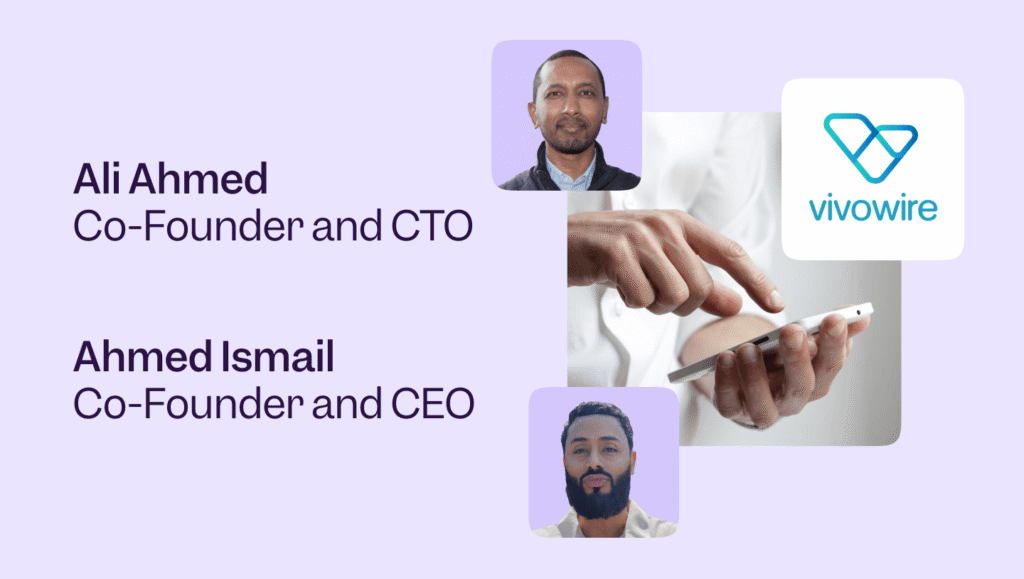

- Article

In today’s instant economy, international money transfers remain challenging for millions of individuals, especially migrants...

- Company News

Stockholm – 21 March, 2025 – Brite Payments, a leader in instant bank payments, has...

- Article

Have you ever had a payment rejected because your bank account had a foreign IBAN?...

- Article

Sustainable finance and sustainability in payments have never been so prominent. Rising temperatures worldwide and...

- Article

The Swedish Sea Rescue Society (Sjöräddningssällskapet, SSRS) is one of Sweden’s most trusted and beloved...

- Article

Whether you’re tracking personal expenses or optimising your business’s cash flow, managing multiple financial accounts...

- Article

A major change is coming into force in the EU payments landscape. From January 2025,...

- Article

Alongside the most recent update to the Payment Services Directive, PSD3, the Payment Services Regulation...

- Article

In a rapidly evolving financial landscape, Account Servicing Payment Service Providers (ASPSPs) are reshaping how...