Across Europe, there is a rising demand for frictionless and secure online checkout experiences. Meeting this demand head-on is the continuing adoption and development of account-to-account (A2A) payments.

According to YouGov and Brite research, A2A Payments (often called Pay by Bank, or other local consumer-facing terms) today ranks as one of the top three preferred online payment methods in Europe. But is your business ready to unlock the growth offered by A2A payments?

In this article, we will explore why businesses need to offer Instant A2A Payments as part of their checkout payment mix. The topics we will touch on include:

- Why are A2A Payments on the rise across Europe?

- Open banking powered instant A2A payments

- What about “Pay by Bank”?

- How can A2A payments benefit European merchants?

- How do A2A payments benefit merchants more than credit cards?

- Addressing potential concerns about adopting A2A payments

- The security of A2A Payments

- Ease of integration with existing checkouts

Why are A2A Payments on the rise across Europe?

Among the key findings from Brite Payments’ recent Instant Economy Payment Insights report on online payments was an awareness – and growing preference – for using Pay by Bank, or A2A payments.

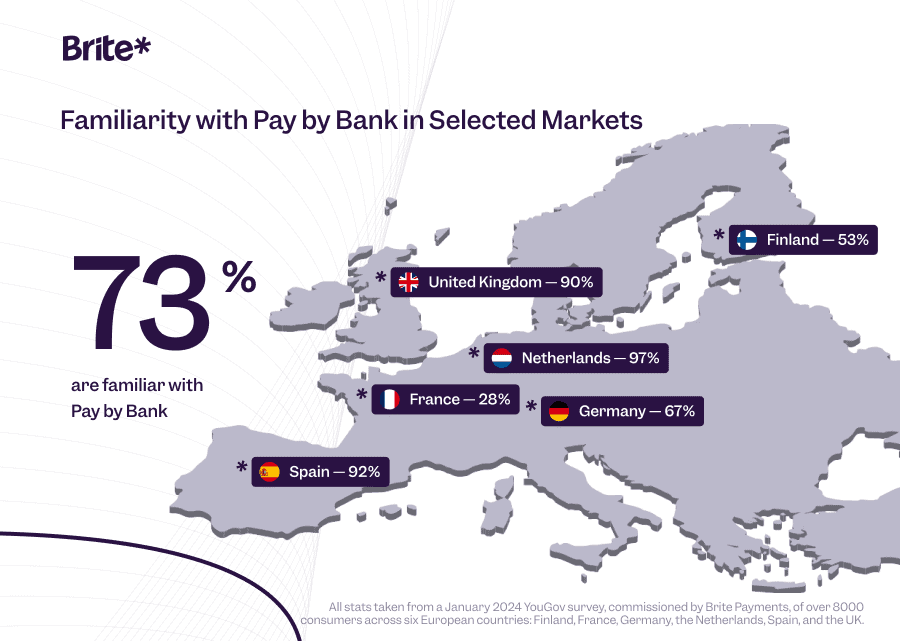

According to 8000+ respondents, across six European bell-weather markets (Finland, France, Germany, Spain, the Netherlands and the UK), 73% were familiar with Pay by Bank. Or indeed, it’s local variation, whether that is Bizum in Spain or iDEAL in the Dutch market. In fact, Brite discovered that 97% of those questioned in the Netherlands are familiar with the payment method – the most of any of the nations questioned.

Additionally, it has been predicted by a 2024 Global E-commerce Report by Boku that there will be a significant shift towards local payment methods, including A2A payments. The report suggests that by 2028, local payment methods will make up 58% of all e-commerce transaction values worldwide. This trend not only highlights the massive expansion of e-commerce markets but indicates a change in payment preferences across different regions, influenced by demographic and economic factors.

Indeed, The Paypers’ Global Payments and Fintech Trends Report 2024, specifically, highlights the evolution of A2A payments in Europe, noting their significant growth. Showing that A2A payments are increasingly shaping the payment industry in Europe, and that they are influenced by technological innovations, regulatory changes, and demographic shifts.

Furthermore, according to Brite and YouGov data A2A payments, or Pay by Bank, are emerging as a popular method among Generation Z, competing closely with digital wallets and debit cards. Moreover, A2A payment usage is highest among the younger demographics (18-29 years), with 36% using Pay by Bank at least weekly, according to Brite’s Instant Economy report.

Open banking powered Instant A2A Payments

Tethered to this rise in adopting A2A payments is the growth of open banking across Europe and the UK. According to a Stastica report, the value of open banking transactions worldwide reached 57 billion US dollars in 2023, and it is expected to increase sharply over the next few years. Indeed, open banking-powered A2A payments, such as those offered by Brite, are predicted to flourish in this open banking payment reality.

The growing maturity of open banking, coupled with a new generation of instant account-to-account (A2A) or Pay by Bank solutions, is helping address merchant pain points and cater to consumer appetite for payment methods suited to the instant economy and online commerce. It is clear that this, coupled with consumer-led demand will yet further adoption of the payment method.

For more information on instant A2A payments, download Brite’s recent Account-to-Account Payments Explainer.

What about Pay by Bank?

A brief side segway into the English language term that more and more consumers are coming across in their checkouts. In the fast-moving world of payments, the English term consumers are most likely to come across is Pay by Bank for an A2A payment. The term indicates the category of payments based on the direct transfer of funds between bank accounts – hence the other (and declining, I may add) consumer-facing term, direct bank transfer.

Pay by Bank refers to a broad category of payments that involve the transfer of funds from one bank account to another without the involvement of card networks or other intermediaries – an A2A payment. User experience can vary widely with Pay by Bank payments, as can the underlying technology used to power them (for example, Brite’s instant A2A payments powered by open banking).

It is important to note that some Pay by Bank or A2A payments are not, by default, in real-time. However, open banking-powered instant A2A payments do enable instant processing. Today, “Pay by Bank” is still finding its way into the mainstream consumer consciousness – even if it is already quite well known to many consumers.

How can A2A payments benefit European merchants?

As mentioned previously there is a growing list of benefits for merchants when adding A2A payments as part of a payment mix at checkout. These benefits include:

1. Reduced costs and increased profitability

A2A payments stand out for their cost efficiency, offering a compelling alternative to traditional credit card transactions. By avoiding the card network pathways, businesses can dodge various charges, including merchant service fees, card terminal rental, and chargeback expenses. This shift not only slashes operational costs but also bolsters profitability. The appeal of A2A payments lies in their streamlined approach, removing intermediary expenses and significantly reducing transaction fees. Consequently, businesses should enjoy a higher retention of earnings from each sale, underscored by the substantially lower processing fees than credit cards.

2. Streamlined checkouts and higher conversion rates

That’s right, A2A payments significantly enhance the checkout process by offering a faster, more secure, and more convenient payment experience. By facilitating direct transactions from a consumer’s bank account to a merchant’s account, A2A payments eliminate the need for entering extensive card details or undergoing lengthy sign-up processes. Such efficiency not only reduces checkout friction but also minimises the likelihood of cart abandonment, potentially leading to higher conversion rates for merchants. The seamless nature of A2A payments, especially on mobile devices, appeals to consumers and positively impacts a merchant’s bottom line by maintaining customer engagement through the checkout process.

3. Enhanced customer satisfaction and loyalty

Security and speed are paramount for European consumers (as demonstrated in Brite’s Instant Economy report), and A2A payments perfectly embody this by offering a seamless checkout experience. These payments not only facilitate instant transfers, making transactions swift and convenient, but also incorporate robust security measures like multi-factor authentication, which reassures users of their safety during transactions. The direct nature of A2A payments also supports local businesses by reducing the high fees associated with card transactions, fostering a stronger bond between merchants and customers. This can enhance customer loyalty due to the mutual benefits and trust in the transaction process.

4. A2A payments (and Pay by Bank) are what consumers want in a new payment method

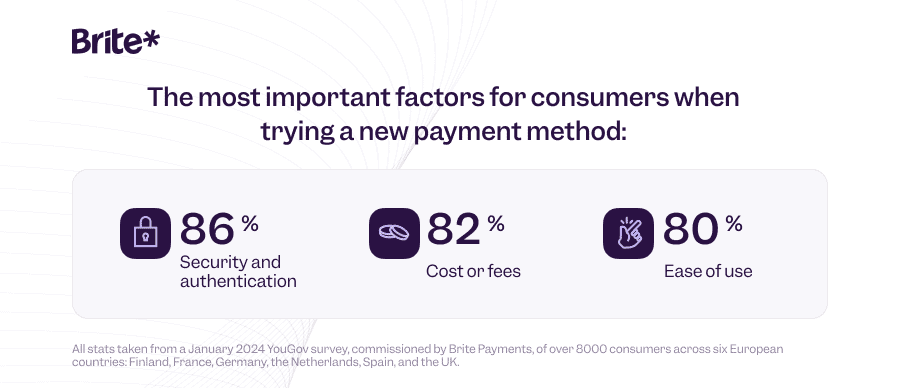

Lastly, A2A payments cover exactly what consumers want in an online payment method. Security, low cost or no fees, and ease of use are the top three factors that consumers consider. And it doesn’t stop there, in terms of speed of payment, not using a separate account and other usability issues highlighted in Brite’s Instant Economy report, A2A payments rank highly too.

How do A2A payments benefit merchants more than credit cards?

For merchants, the advantages of consumers preferring A2A payments over credit cards are clear. But how do they directly compare to credit cards?

Indeed, alongside Brite’s recent report, Juniper Research forecasts that A2A payments are set to directly challenge credit card payments in e-commerce across Europe in 2024. A shift is partly due to the lower costs, faster transactions, and reduced fraud risks associated with A2A payments.

What’s the difference between a credit card transaction and an instant A2A payment?

Credit Card:

When a consumer uses a credit card, the transaction goes through a multi-step process. The card information is sent to the payment network (Visa, Mastercard etc.), which verifies it with the issuing bank. The bank then approves or declines the transaction. Finally, the funds are transferred to the merchant’s bank account from the consumer’s bank, minus any interchange fees. This process can take several business days to settle.

Not ideal at all.

A2A Payment:

A2A payments are much more direct. The money moves straight from a consumer’s bank account to a merchant’s account, bypassing credit card networks and intermediaries. This results in a near-instant or real-time settlement, especially when using a powerful, single API (Application Programming Interface) service such as Brite Instant Payments Network.

Ideal.

What are the benefits of A2A payments in comparison to credit card payments?

But apart from the payment flow, there are more benefits for merchants too:

1. Reduced Transaction Fees

When it comes to cost, A2A payments offer a clear advantage. Traditional credit card transactions incur interchange fees, essentially a cut taken by the card network (like Visa or Mastercard) and issuing banks for each swipe. These fees can add up quickly for businesses and consumers alike. In contrast, A2A payments typically involve lower processing fees since they bypass these intermediaries, making them a more cost-effective way to transfer funds.

2. Mitigating Chargeback Risks

Credit card chargebacks, where a customer disputes a transaction and their bank reverses the funds, can be a significant headache for businesses. Not only do they result in lost revenue, but merchants often incur additional fees for disputed transactions. A2A payments offer a welcome relief from this burden. The risk of fraudulent chargebacks is significantly reduced because they rely on direct bank transfers between accounts. This is because the customer’s identity and account information are verified upfront, making it more difficult for unauthorised transactions to occur.

3. Faster Settlement Times

Compared to credit cards, A2A payments outstrip cards in speed. Traditional credit card transactions can take several business days to settle, leaving merchants waiting to access their funds. This delay can disrupt cash flow and hinder business operations. A2A payments, on the other hand, offer a significant improvement. Direct bank transfers facilitate near-instant or real-time settlements, ensuring merchants receive their funds almost immediately. This faster access to capital can be a game-changer for businesses of all sizes.

4. Enhanced Security

A2A payments also elevate security for both businesses and consumers. Unlike credit card transactions, where merchants store sensitive customer card data, exposing themselves to potential data breaches, A2A payments rely on secure bank-grade authentication. This means the banks employ robust customer verification protocols, minimising the risk of unauthorised access. With A2A payments, merchants never handle sensitive financial information, offering greater peace of mind for everyone involved.

Addressing potential concerns about adopting A2A Payments

However, while A2A payments offer numerous advantages, it’s natural to have questions about adopting a new technology. Here, we’ll address two common concerns: security and integration.

Security of an instant A2A payment:

Some may wonder if instant transfers compromise safety. However, A2A payments leverage the robust security infrastructure of banks. Transactions require strong customer authentication through multi-factor verification measures employed by banks. And unlike credit cards, where merchants store customer data, A2A payments minimise risk by keeping sensitive information within the secure environment of financial institutions.

Ease of integration with existing checkouts:

Integrating A2A payments with existing checkout systems might seem daunting. Fortunately, the process is often streamlined. Many payment processors offer A2A solutions with APIs (Application Programming Interfaces), such as Brite, for easy integration into existing infrastructure, ensuring a familiar and user-friendly experience for your customers while enabling them to benefit from the speed and convenience of instant A2A payments quickly and efficiently.

Discover more payment insights with Brite’s latest report

Want to know more about online payment preferences and why consumers select the payment methods they do? Then download our Instant Economy Payment Insights report for 2024. Featuring 8500 respondents across six key European markets, it looks at everything from the time consumers expect to receive a payout to what different demographics look for when trying a new payment method for the first time.

Download now and learn more about the rise of Pay by Bank and A2A payments.