Auction houses have long been at the heart of the circular economy. However, auctions are undergoing a significant technological transformation. In Europe, Auctionet is at the forefront of this change, providing a platform that not only streamlines demanding auction processes but also connects local auction houses with demanding global consumers.

Founded in 2011, Auctionet is one of Europe’s most trusted online marketplaces. Today, it caters for a wide range of items, including furniture, art, and collectables. And with over 2.8 million items sold and nearly 30 million bids received, Auctionet is a platform that has built a reputation for expertise and reliability, enabling a range of international buyers and sellers to exchange items confidently.

At the beating heart of Auctionet’s mission is its CTO, Albert Ramstedt. Brite Payments recently spoke to him to discuss the company’s mission, the challenges faced by auction houses, and the importance of operational efficiency. Plus, how Auctionet is set to further shape the future of online auctions in the circular economy.

What is the state of online auctions today? And how does Auctionet fit into it?

Albert Ramstedt, CTO at Auctionet: That’s a tricky question because I have many thoughts.

Auctionet is a company that aims to revolutionise the auction industry, which is very fragmented and differs significantly from city to city and, certainly, from one country to the next. The concept of online auctions today is broad. We primarily work with handling estates and the process of selling estate goods through auction. In Sweden, this is the traditional method for managing most estate items.

That’s not the case for all countries, but in Sweden, it’s customary to go to a realtor if you want to sell a house, and then for the estate goods, you contact an auction house, which comes to evaluate and manage them. We are focused on this part of the auction industry.

There are also different types of online auctions, such as those for cars or bankruptcy assets, but that’s not our area. We operate in this traditional, long-established business of handling estates and some sourcing from individuals. People often walk in to sell items, and we handle fine art or other valuables. Our average sale price is around 2,000SEK, but we cover a wide range, from inexpensive to very expensive items.

What makes how Auctionet operates so unique?

Albert Ramstedt: We started Auctionet — myself, the CEO, and a few others — after working at Bukowskis, the largest Swedish auction house. Bukowskis had the resources to build its own system and modernise its auctions online. We started Auctionet because we saw the potential to transform the entire auction industry, particularly in the art and design sectors connected to estate management and beyond.

A lot of small, local companies operate in each town, and these are the businesses people contact when they have an estate to settle or need to handle the goods of an estate. However, these companies are not large enough to build their own systems and establish a strong online presence.

Their only option is to use small-scale products. You can buy e-commerce packages, but the auction industry is so niche that it’s mostly just one-person operations managing auction administration, payments, and the entire system. It’s not very developed, essentially.

What can the process be like using these alternative products?

Albert Ramstedt: Quite cumbersome and not really fit for purpose, or for that matter, modern.

Most of these systems were built by one person who ran an auction house and had to create something useful just to survive, often not even full-time programmers. They’re generally not very advanced compared to platforms like eBay or similar, are usually limited in functionality, and don’t handle finances, admin, or payments.

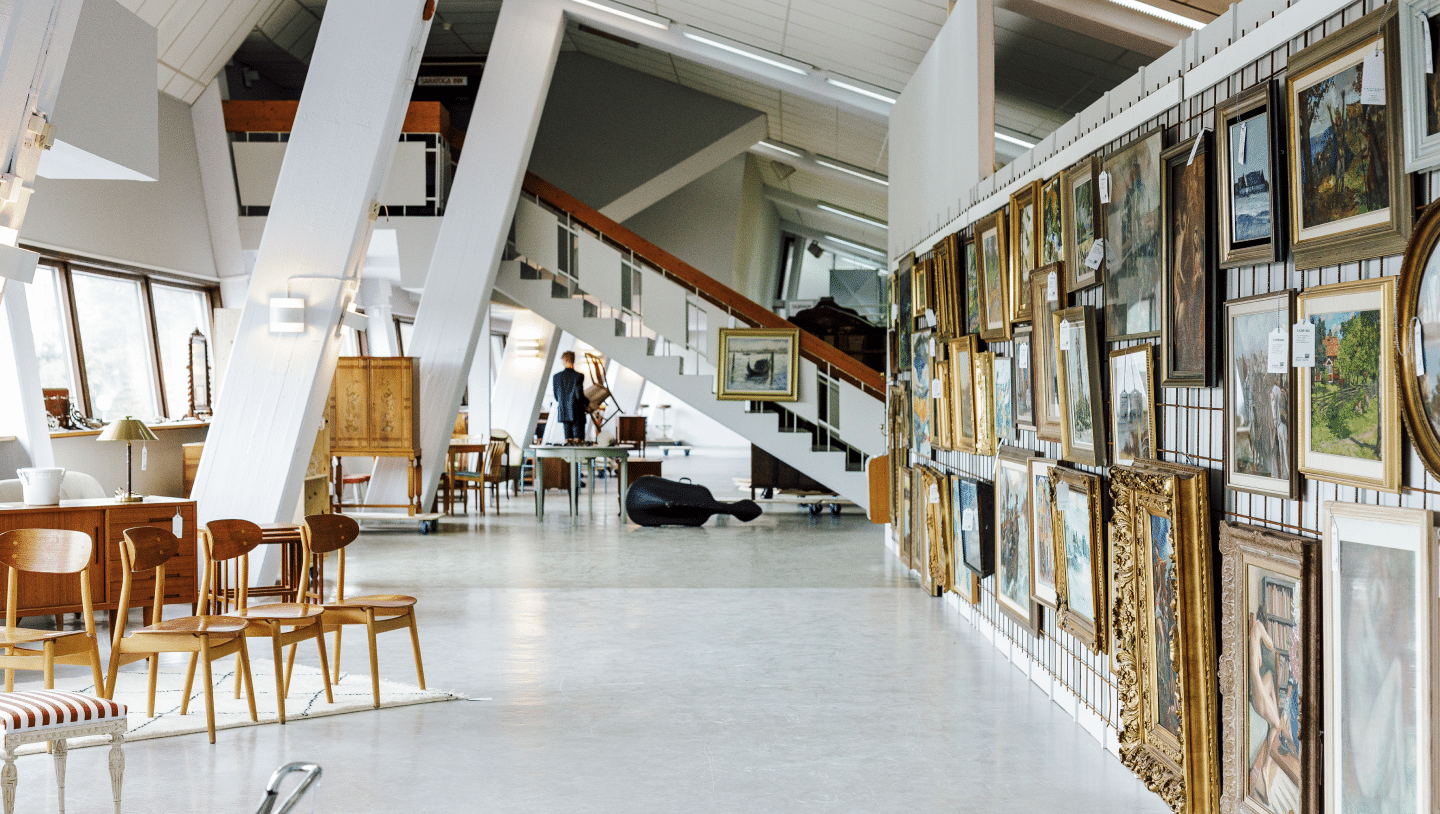

Therefore, we set out to create what we did for Bukowskis but as a platform — a smart and efficient marketplace for auction houses to use. This includes admin and back-office work like cataloguing and the marketplace aspect for consumers so that they can find all items from auction houses across Sweden in one place – and across Europe as we expand.

How does Auctionet compare to other auction platforms?

Albert Ramstedt: We do have some competitors, but they don’t offer the same comprehensive solutions. In Europe, there are a few larger competitors, but we are the only ones providing a complete system — from financial admin and logistics to cataloguing, storing photographs, listing, auctioning, invoicing, payments, and post-sale shipping. We offer a fully-fledged service that makes it easy to run an auction house.

Our competitors usually offer only one part — perhaps the system or an ad listing site. But we’re different in that we offer the entire marketplace and everything needed to operate. We’re a one-stop shop for auctions.

What makes Auctionet particularly unique as an online marketplace?

Albert Ramstedt: We have extensive experience in running auction houses ourselves too. That’s actually one of our biggest selling points when we explain what we offer to auction houses – particularly in the UK, where we are expanding.

Another unique aspect of our business is that we aim to make all processes continuous and online, from hammer auctions to building up inventory, conducting a single-day auction, and then shipping everything out in batches.

We have a concept called “Continuous Online Auctions”, which is more like timed online auctions, similar to eBay. Unlike those sites, however, our auctions are much like live auctions in that they follow the same flow of a big batch ending at specific dates and times. When an item arrives at the auction house, it’s catalogued, photographed, and immediately listed on the marketplace for about seven days before it’s auctioned, processed, and shipped.

This approach contrasts with the traditional method of stocking items for three months and then holding a large auction. It’s inspired by lean principles, like the Toyota Way, we aim to revolutionise the auction industry by helping auction houses manage a continuous flow of items.

How does this help the auction houses you work with?

Albert Ramstedt: It allows them to turn over more items, generate a steady cash flow, and use their premises more effectively.

In the old model, you stock items for a long time, incurring ongoing costs for staffing, rent, and other expenses. Then, when you finally hold the auction, you rely heavily on that one event to generate revenue. If, for any reason, that event doesn’t go well or is cancelled, the business can face severe financial strain or even bankruptcy, as everything depends on that single event. This approach also underutilises the space, as items are stored for extended periods.

Moving to a continuous flow of selling provides a more stable income, creating a predictable financial future. It also allows auction houses to better manage their expenses, be more predictable, accelerate business, and pay their employees.

What is the biggest challenge of working in the circular economy?

Albert Ramstedt: In the circular economy, our main challenge actually revolves around the circulation of items. It’s the biggest issue we, and others, have, and it’s the handling of second-hand goods.

The fact is logistics can be challenging. You’re dealing with unique, valuable, and often precious items to the people bringing them in. They’re not packaged in uniform brown boxes and are easy to store; they’re often fragile and come in widely varying dimensions.

So, what auction houses do is manage this highly unpredictable stock. They need to handle it within their location and then manage the logistics for shipping, even internationally.

For example, many Chinese buyers are interested in Swedish-owned Chinese ceramics from the 1700s or 1800s and are buying them back now, creating a significant logistical challenge.

I imagine the buyer’s location, the item’s fragility, and its value create significant challenges?

Albert Ramstedt: Yes, exactly. Sometimes, the items are far more valuable than people realise, maybe ten times what they expect due to specific trends or interests in China, for instance.

Logistics is one of the biggest challenges for the circular economy, and many other businesses handling circular items face exactly the same issues.

How does this affect margins?

Albert Ramstedt: Margins are also a challenge across the sector. For example, we charge a commission of 25%; in the UK, many auction houses charge around 30%.

But, honestly, they’re not making a lot of money on that because auction houses are handling very challenging items. Most auction houses operate on the brink of survival. One bad batch and things can get very unpredictable.

Speaking of the different auction houses, how many are Auctionet partnered with currently?

Albert Ramstedt: It’s around 70, I think. We have most of the Swedish auction houses, and we’re currently focusing on expanding into the UK market.

The UK market is more than 10 times the size of the Swedish market, so there’s a lot of opportunity there. Currently, we’re adding about five new partner auction houses each quarter.

What is the volume of transactions Auctionet processes?

Albert Ramstedt: It’s very seasonal. If you adjust for the seasonal profile of our auctions, Auctionet is growing by about 20% every year, primarily because we’re adding more auction houses to our customer base.

Historically, it’s also hard to say how much an auction house grows because of the pandemic. During that time, growth hit 25% in some places since everyone suddenly wanted to go online and buy furniture and design their homes, where they were spending so much time. There was huge growth then, but afterwards, it shifted as people wanted to spend on travel or other experiences, so it stabilised at a lower level.

What payment options are available for buyers on your platform, and what’s essential for your customers and partners?

Albert Ramstedt: Payment options are less critical for us than a typical online merchant looking to optimise their shopping cart conversion. Users come to checkout as winners in auctions, so they’re already committed to the purchase.

However, one of Auctionet’s unique selling points is ensuring good payment options for our customers. Auction houses often struggle to provide suitable payment options, especially if the buyer isn’t local. We aim to offer good payment options for all buyers, but it’s challenging. We cover the card fees or payment fees ourselves, so we’re highly motivated to optimise that.

After exploring several banking payment providers, Brite’s instant account-to-account payments provided the best solution for us. Brite’s solution was effective and met our needs, which are more about our operational requirements than the customer’s.

Card payments are quite unpredictable in terms of costs, especially with cross-border payments or when people use corporate cards, which are expensive. In comparison, instant bank transfers are much more predictable in cost, and there are no hidden fees —what you see is what you get.

Is authentication and security in the payment process critical when dealing with higher-value transactions?

Albert Ramstedt: Absolutely. We have a distinct process for identifying buyers, especially high-value buyers. In the auction industry, we’re subject to anti-money laundering regulations, which require us to verify specific buyers who spend over a threshold annually. This is crucial for us on both the buyer and seller sides, and we have processes in place to verify buyers before they place large bids or once they win. Brite, for instance, offers an identity verification feature that we’re not currently using but is something we may consider in the future.

Additionally, card payments are more susceptible to chargebacks, whereas bank transfers are less problematic since you can’t dispute them in the same way. We use 3D Secure for card payments, making them quite secure as well.

Does Auctionet prioritise optimising security technology to reduce costs and ensure the use of the best possible security measures?

Albert Ramstedt: Yes. Identifying users from different countries is a challenge. If we only had Swedish users, it would be straightforward as then we would only ever use BankID. Internationally, identifying users, say, from China or elsewhere, is more complex. We often need to authenticate through passports and photographs, which is less automated and more generic.

Currently, we’ve implemented a service where users take a photo with a webcam to verify they’re live, then show their passport, and we compare the images. This approach works well across different countries as a starting point. However, improving security with localised authentication, like bank authentication through Brite, would be beneficial.

How easy was it to get up and running With Brite? Was it straightforward to integrate?

Albert Ramstedt: It went pretty smoothly. Every integration has unique aspects, especially with bank payments, which differ from card payments, even with a middle layer. But overall, it went well. We face a unique situation with auctions; we can’t just onboard Auctionet and be done. We need to onboard each of our new auction houses individually, and that can take time.

Fortunately, our cooperation with Brite in this regard has been excellent. We even changed our credit card provider because the KYC (Know Your Customer) and client checks were taking too long, delaying onboarding for card payments.

How would you rate the customer support you received from Brite?

Albert Ramstedt: Cooperation with the customer support at Brite is very smooth. We can onboard new customers fairly quickly now, which has been an issue with other card or payment providers in the past.

Has using Brite made a difference for you as a company?

Albert Ramstedt: Yes, definitely. Around 20% of our payments for the onboarded auction houses are through Brite, which is a good cost saving for us. We haven’t fully measured whether users are happier using Brite over cards, but we want to explore this to improve the user experience.

Looking ahead to 2025 – what’s the plan for Auctionet?

Albert Ramstedt: We’re expanding into the UK and looking into payment options that appeal to UK buyers. Our plan is to be fully established in the UK by 2025. We already have auction houses there, and we even own one auction house there.

Find out more about Brite Payments

If you would like to learn more about how Auctionet and Brite Payments work together checkout the case study here. If you would like to know more about the different payment services Brite offers, including our instant A2A payments then get in touch with one of our payments experts today.