End the Waiting Game with Instant Payments

Our real-time bank payments cut settlement delays, giving you faster access to cash and a smarter route to growth.

Our Products

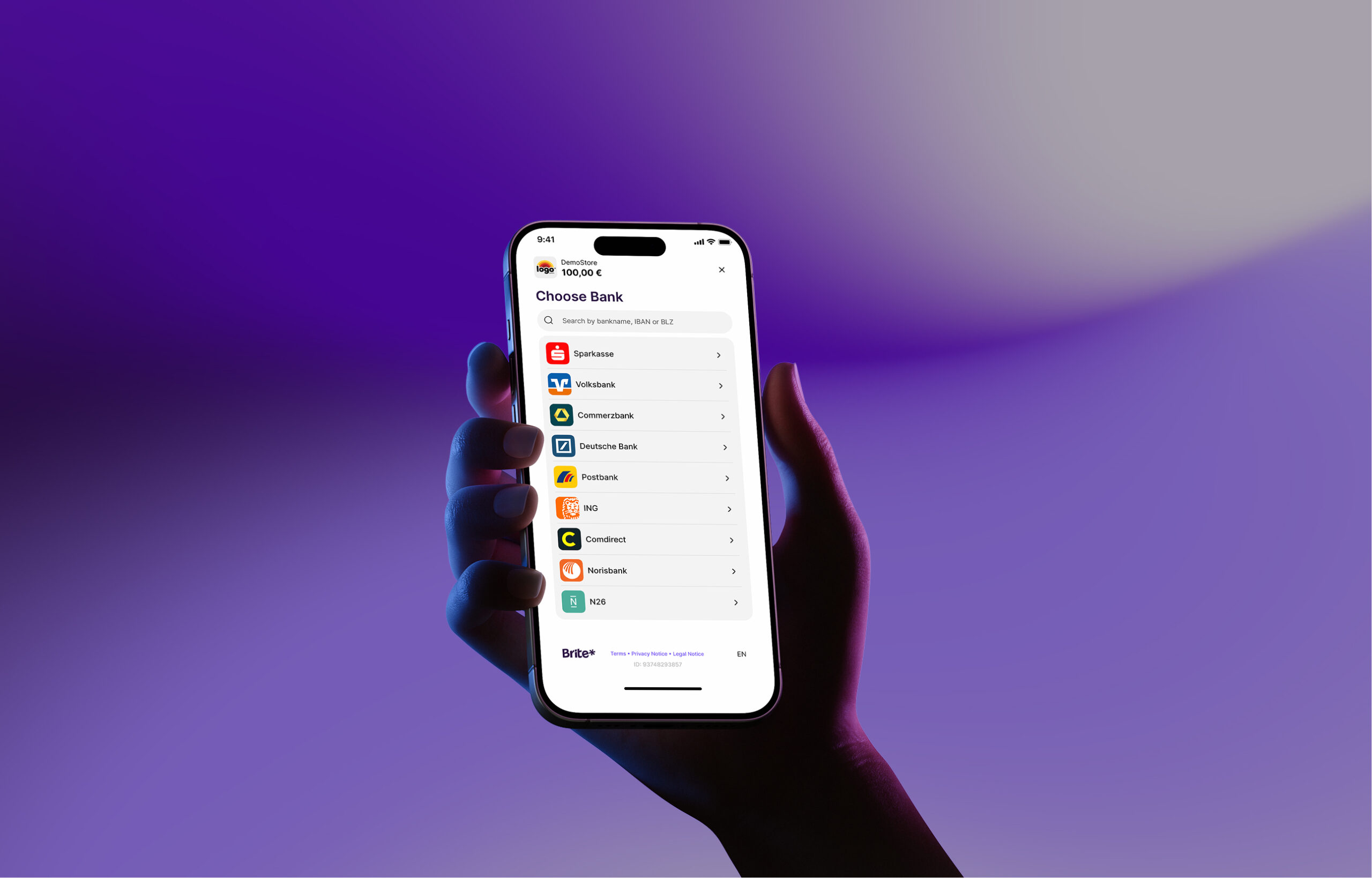

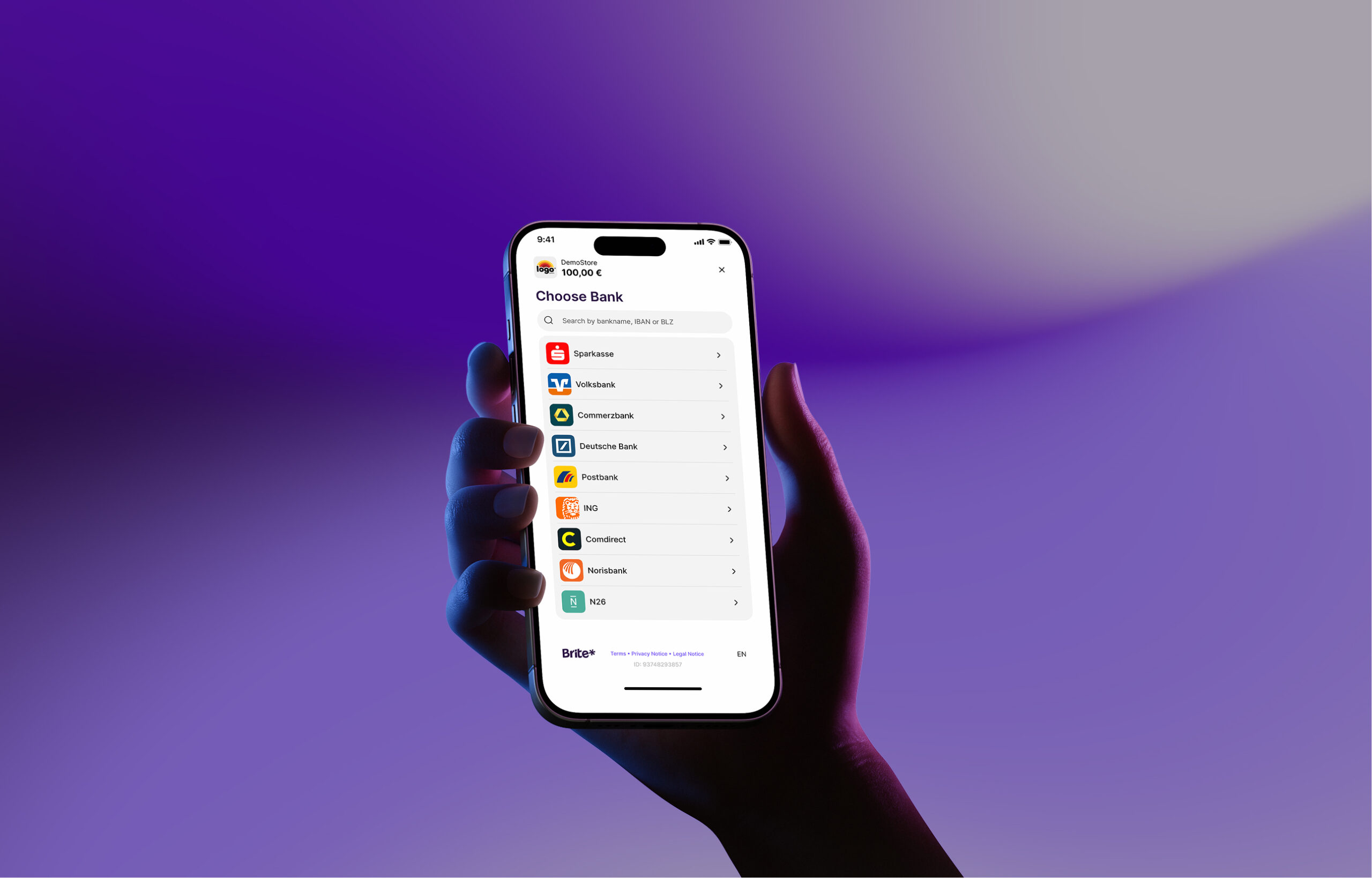

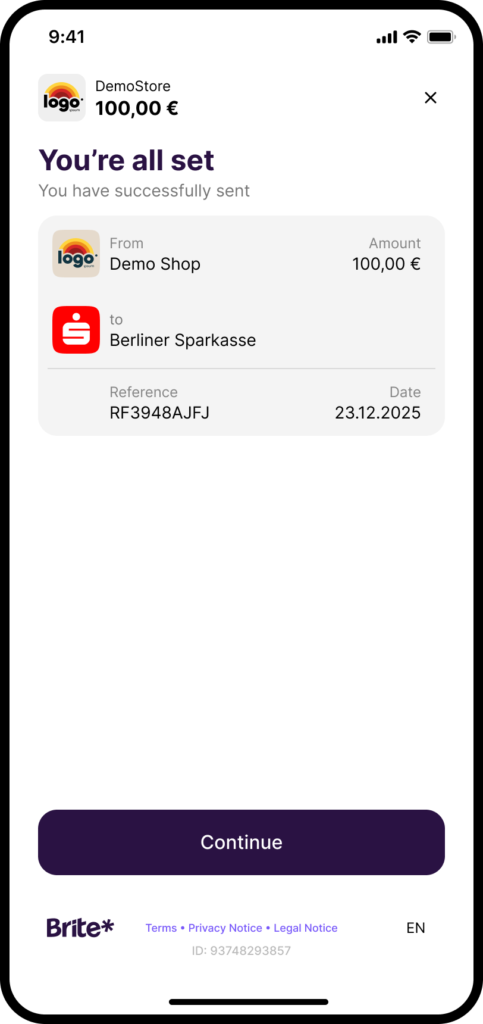

Instant Payments

Payments that settle in seconds

Learn More →

Instant Payouts

Pay anyone, instantly

Learn More →

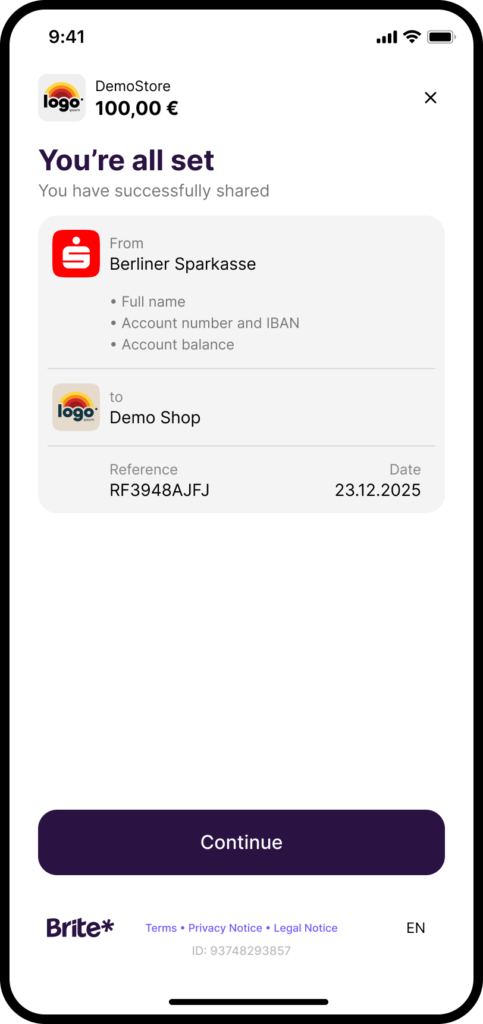

Data Solutions

Insights that give you the edge

Learn More →

Speed. Reliability. Support. Solved.

Fast In. Fast Out.

We’re defining what instant means for Pay by Bank. Consistent settlement in seconds not days.

UX Refined

Real Support

We care about every payment. Fast response times and a 95% customer satisfaction score*.

Rock Solid

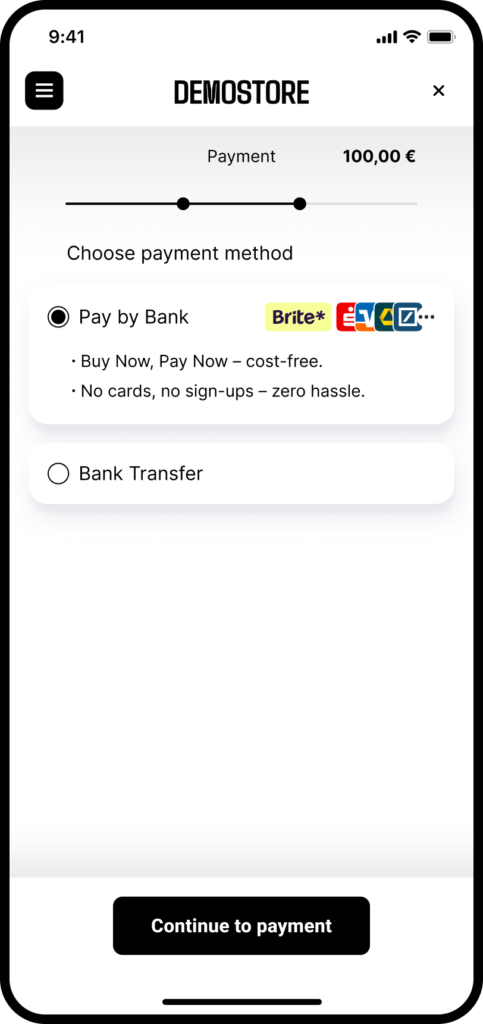

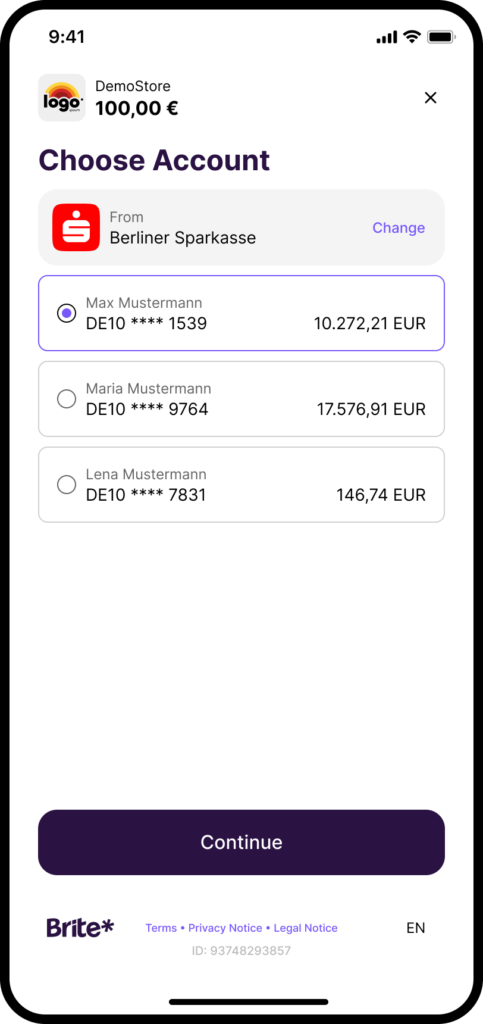

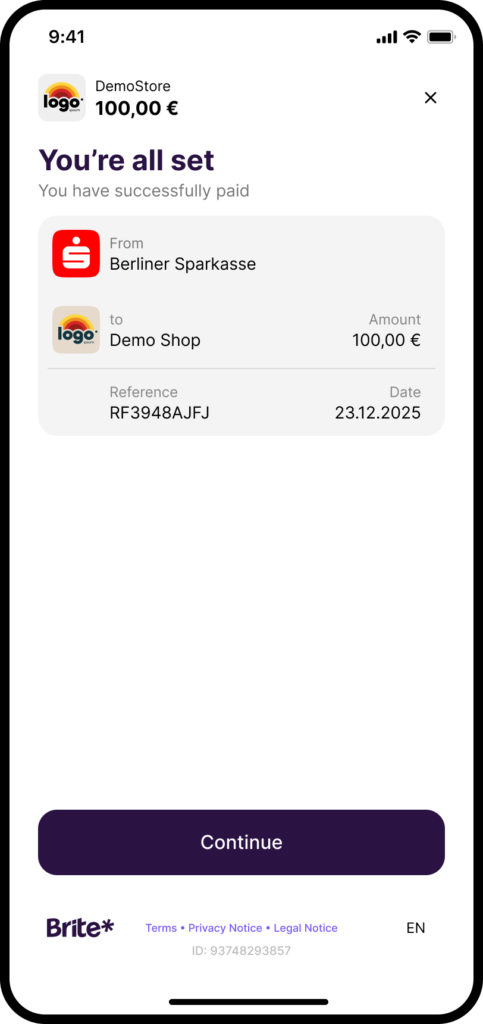

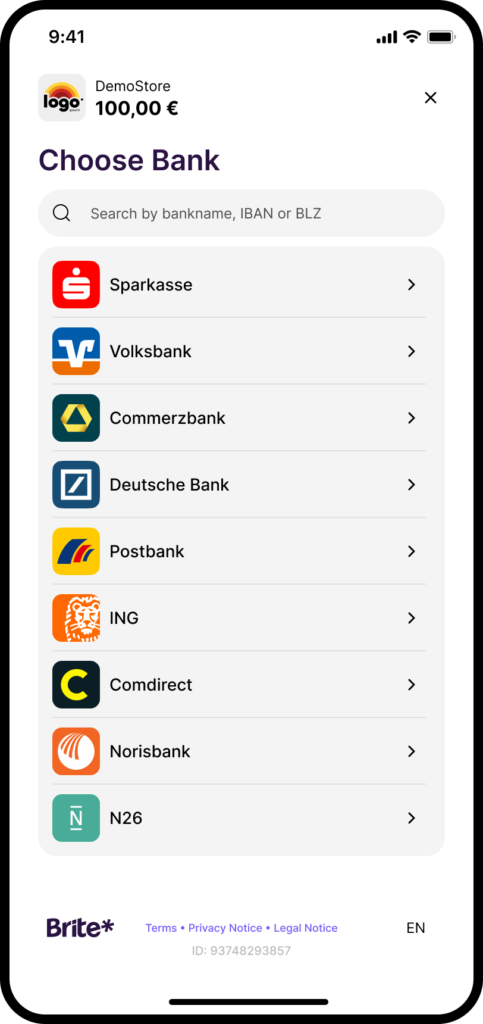

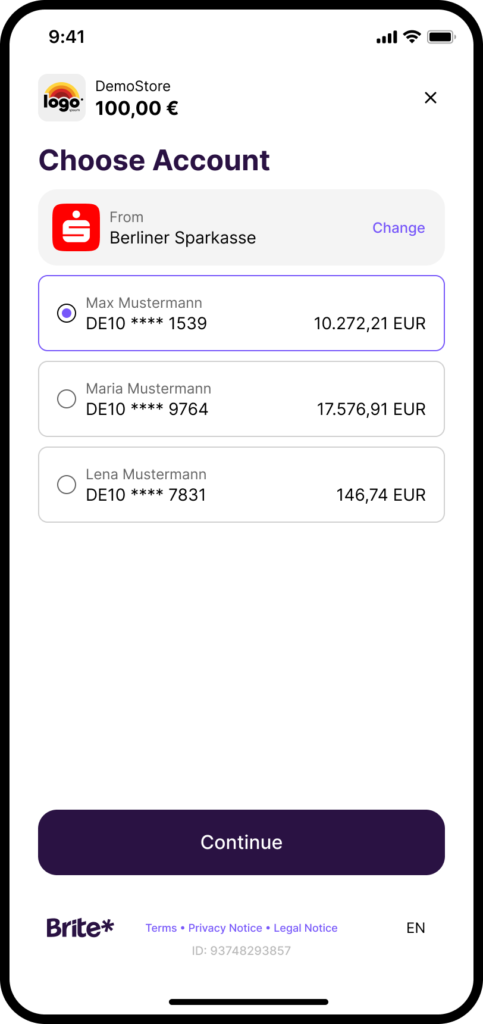

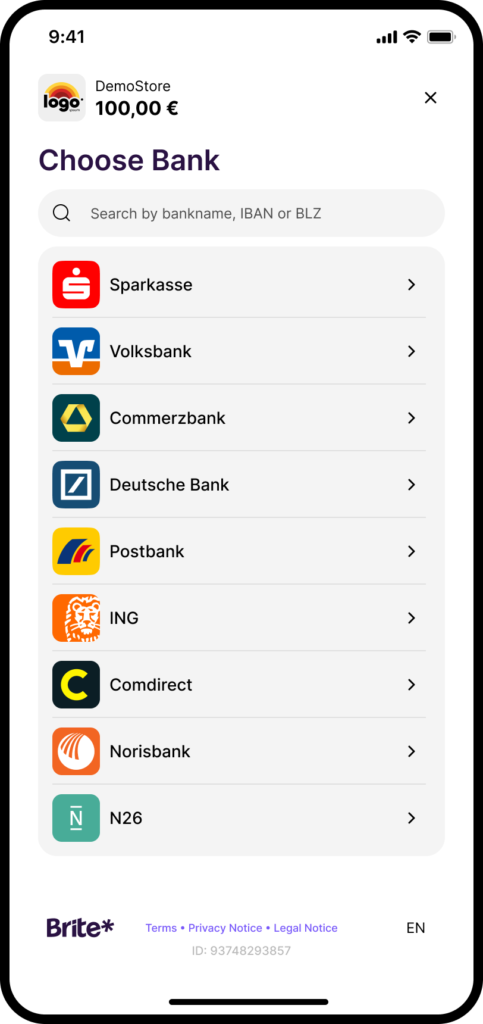

A Pay by Bank flow that converts

A Pay by Bank flow that converts

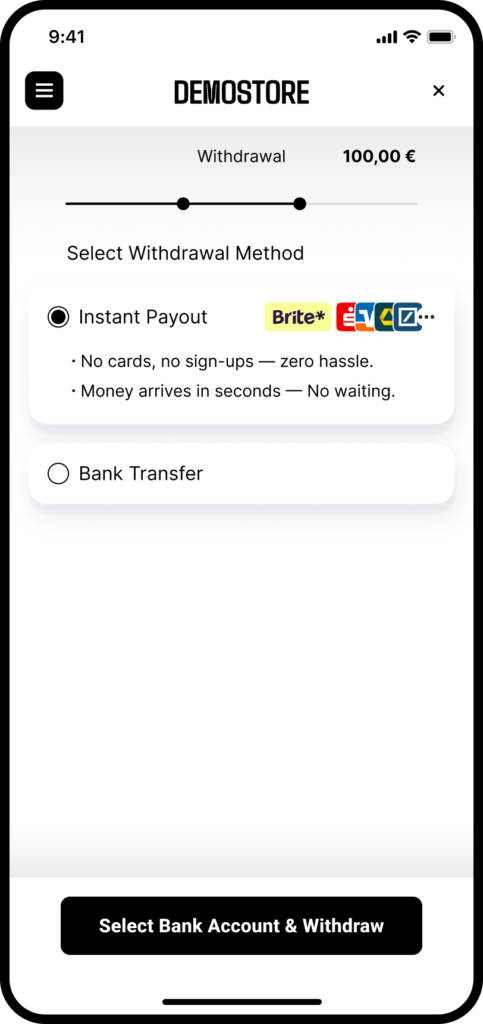

Simple steps for Payout control

One journey for multiple scenarios

Our Customers

E-commerce

Financial Services

Financial Services

Go Live in Hours, Not Weeks

Clean, powerful, and built for developers. Our API and clear documentation gets you from sandbox to launch, fast. Stop integrating, start innovating.

Security isn’t a feature – it’s our foundation

Trusted stability

With historically impressive uptime of 99.99%, Brite is built with bank-level encryption and security as standard, adhering to key industry data protection protocols.

Fraud resilience

With direct bank authentication and Strong Customer Authentication (SCA) at the core of Open Banking, Brite goes one step further. Using our infrastructure we keep fraud and unsettled payment rates impressively close to zero.

Compliance excellence

Our controls are risk‑based, continuously monitored, and mapped to AML, PSD2, GDPR, DORA, European Accessibility Act and all other regulations applicable to payment institutions.

Latest Resources

Your Brite Payments Questions Answered

What is Brite Payments?

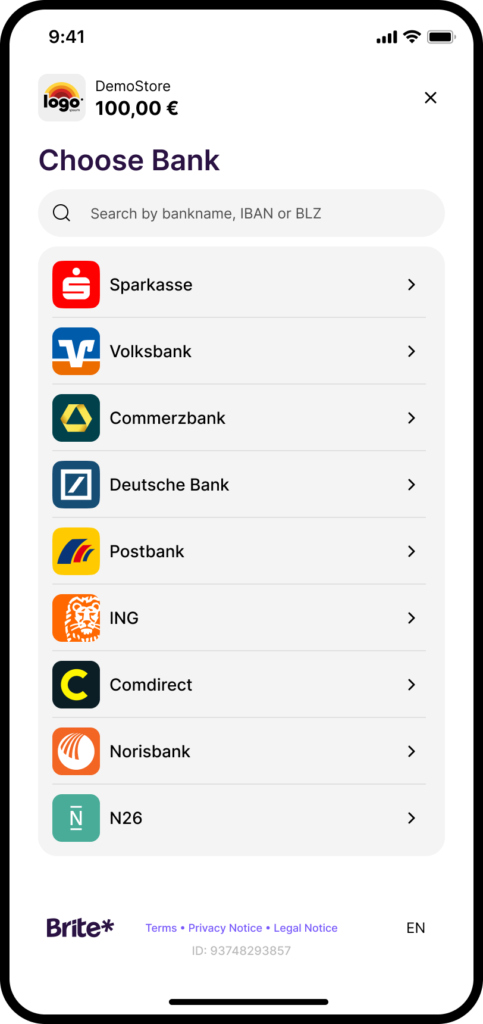

Brite Payments is a Swedish fintech and a leader in Instant Account-to-Account (A2A) payments powered by Open Banking. We enable consumers to pay directly from their bank account (also referred to as Pay by Bank) in real-time, without needing cards, apps, or sign-ups.

Where is Brite Payments based?

Brite Payments is headquartered in Stockholm, Sweden. Brite also has offices in London (UK), Malaga (Spain), and Valletta (Malta).

How secure is a Pay by Bank transaction for my customers and my business?

Pay by Bank transactions are exceptionally secure. They are built on the PSD2 Open Banking framework, which mandates Strong Customer Authentication (SCA)—a two-factor verification (such as biometrics) performed directly by the consumer’s own bank.

For your business, this means no sensitive card data is stored, drastically reducing your fraud risk and PCI compliance burden.

Which banks and countries does Brite Payments cover in Europe?

Our Instant Payment Network (IPN) is connected to over 3,800 banks and operates in 27 markets across Europe, allowing merchants to centralise payments, payouts, and treasury across the continent. Markets where Brite products are available:

Austria

Belgium

Croatia

Cyprus

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Latvia

Lithuania

Luxembourg

Malta

Netherlands

Norway

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Switzerland

United Kingdom

How long does it take to integrate Brite into my website or platform?

Brite offers a clean, developer-friendly API designed for efficiency. While actual go-live time depends on your internal resources, our platform, including features like the Checkout UX Assistant (CHUX), is designed to help businesses integrate and launch their first solution in a matter of days or weeks.

How does Brite help me save money and improve conversion?

We improve your financial performance through two key value drivers:

- Cost Savings: By bypassing card networks, we eliminate high interchange fees and chargeback costs.

- Conversion: We remove friction (no card details, no registration) and optimise the checkout UX, with features like ‘Pay Faster Next Time’ enabling payments up to 40% faster than standard Brite flows (according to the latest Brite internal data), leading to higher completed sales.

How is Brite Payments different from a credit/debit card processor?

Brite differs fundamentally from a credit/debit card processor by:

- Cost: Offering significantly lower transaction costs by eliminating expensive card network interchange fees.

- Risk: Providing zero chargeback liability, as our bank-verified payments are irrevocable and far more secure.

What's the difference between open banking, account-to-account payments, and Pay by Bank?

Open Banking: The regulatory framework (PSD2) that mandates banks to share financial data and services securely.

For consumers, open banking is a secure framework allowing them to initiate bank payments or share financial data (with their explicit consent) via authorised third-party providers (like fintech apps) through APIs, enabling new, innovative services like faster payments, budgeting, easier loan applications, and consolidated account views, fostering competition and giving consumers more control over their money. It opens up traditionally closed bank systems to trusted companies, with consumers holding the keys to their data.

Account-to-Account Payments (A2A): The technical term for the direct funds transfer between bank accounts, without the reliance on card networks.

A2A payments are direct transfers of money from one bank account to another, without intermediaries such as card networks (Visa, Mastercard) or payment processors, making them faster, cheaper, and more secure for peer-to-peer (P2P) payments, bill payments, e-commerce, and business transactions. Using bank-specific rails, A2A moves funds directly from a payer’s balance to a payee’s, reducing fraud risks and processing fees.

Pay by Bank: The common, consumer-facing term for A2A payments initiated via open banking technology.

Pay by Bank means making an online payment directly from your bank account using your online banking login, facilitated by secure technology like Open Banking for quick, card-free, and often cheaper transactions, where you simply log in and approve the payment in your bank’s app or website. It’s a modern alternative to card payments, moving funds instantly (or near-instantly) from your account to the merchant’s.