Account-to-account (A2A) payments are quickly taking the lead as the future of financial transactions. Equipped with the speed and efficiency needed for today’s consumers, this direct transfer mechanism is witnessing exponential growth.

As of 2022, its global transaction value has exceeded $525 billion. This growth is further validated in the latest Global Payments Report, highlighting the undeniable momentum and preference these payments are securing among global consumers.

In this article, we’ll cover the five key benefits of A2A payments: reduced fees, convenience, security, accessibility and currency options. Plus how, as a leading payment provider, Brite can help facilitate them.

Why use A2A payments?

At its core, an A2A payment refers to a direct funds transfer from one bank account to another. As a result, merchants can eliminate the need for intermediaries, like credit or debit card processors.

This seamless approach is one of the reasons for its rising popularity among consumers and businesses. Indeed, recent research suggests A2A payments are poised for further growth, with a projected 13% CAGR by 2026, potentially taking the global e-commerce market size close to $8.5 trillion.

However, a significant boost to the A2A payments has been the introduction of open banking and the adoption of 2018’s PSD2 regulations within the European banking sector. (Learn more in our Open Banking Explainer.)

This has supercharged A2A payments across the EU, enabling both A2A payment and new payment providers to offer even greater flexibility and power for businesses and consumers alike.

The result is the arrival of open banking-driven instant A2A payments and new payment options such as “pay by bank” as a checkout option across the websites of many merchants.

Benefits of account-to-account payments powered by open banking:

1. Reduced fees

One of the most enticing benefits of A2A payments is, of course, cost reduction. Traditional card transactions impose interchange fees on merchants. Often, these expenses trickle down to consumers in the form of higher prices.

However, A2A payments are not governed by major card networks and are insulated from such additional costs. This results in merchants saving money and consumers benefiting from more competitive prices.

2. More convenient

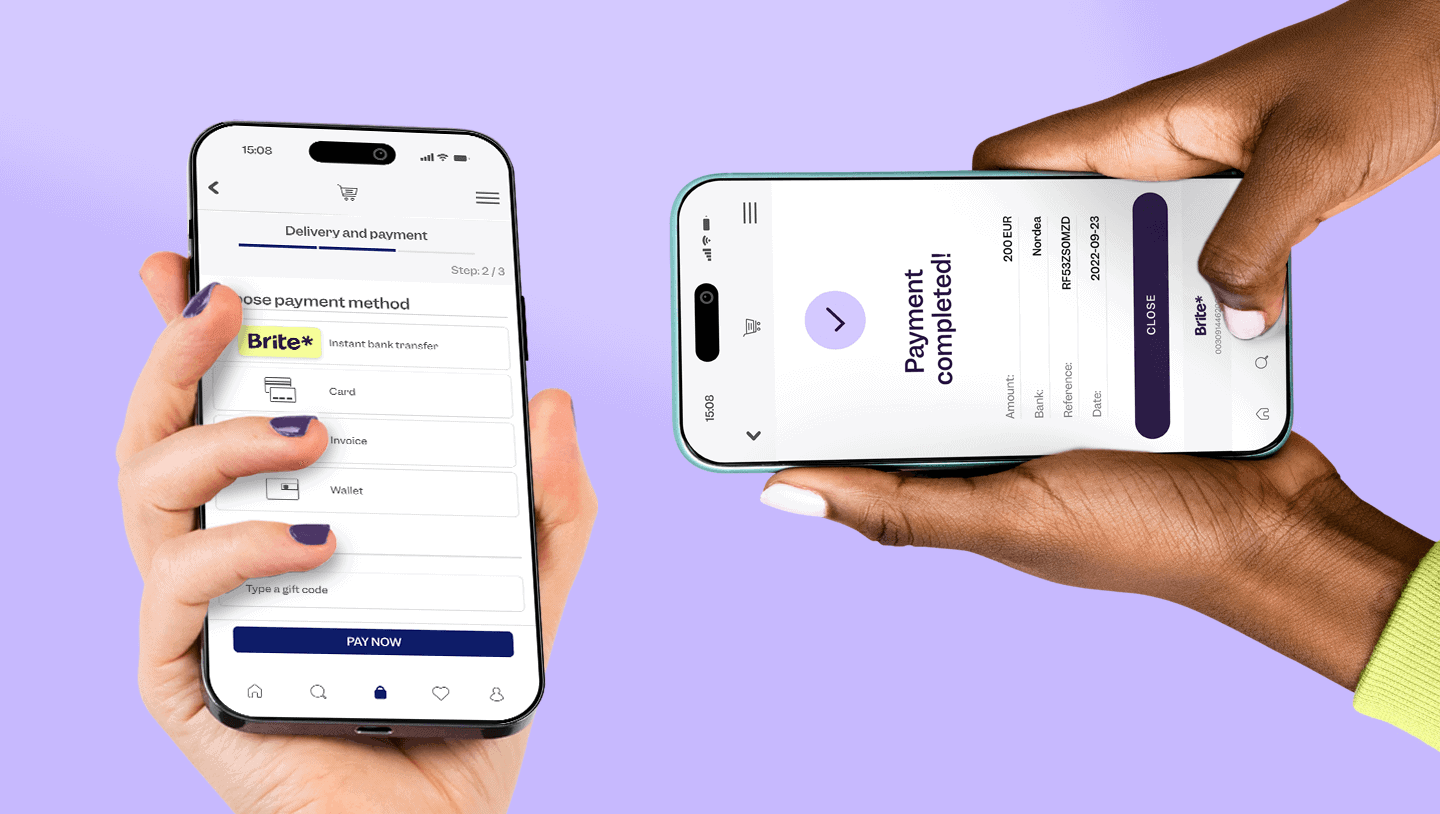

Instant A2A payments have redefined convenience. Forget the tedious task of inputting long card numbers; customers can now swiftly and efficiently complete transactions. This is particularly beneficial when purchasing high-demand items, like tickets to a much-anticipated concert or a product on sale, and it has been made more convenient with its fusion with open banking.

Open banking has revolutionised A2A payments by automating much of the process, speeding up transfer times, improving transparency, and enhancing security. Now, users can make A2A payments directly with their banking app or online banking platform. Often with just a few clicks.

Open banking has also expanded access to A2A payments, making them more widely available to a broader range of users. For example, at Brite Payments, our open banking-powered Instant Payments Network is facilitating even faster and simpler transactions.

3. Improved security

In an increasingly digital world, protection against cyber threats and data breaches is crucial. A2A payments rise to the challenge, offering consumers a method that’s not only convenient but also highly secure. Unlike many traditional payment methods that expose users to various vulnerabilities, A2A payments incorporate protective measures that lower the risk of breaches.

One of the standout features of A2A payments is the mandatory use of strong customer authentication (SCA). This process ensures consumers must validate their identity through multiple verification steps before a transaction can be approved. This multi-factor authentication, which may include passwords, mobile devices, or biometric data like fingerprints, acts as a formidable barrier against unauthorised access and potential fraud. By introducing this layered validation process, A2A payments substantially lower the risk quotient, instilling confidence in users.

Furthermore, A2A payments remove the need to store sensitive card information on browsers or merchant systems. This is significant because intermediary platforms often become targets for cybercriminals. By eliminating the need to save this data in potentially vulnerable places, A2A payments reduce the exposure points and, in turn, the opportunities for data breaches.

4. Increased currency options

A2A payments empower merchants and consumers with diverse currency options. Traditionally, merchants must establish bank accounts in multiple markets to cater to international clientele.

However, with Brite’s instant A2A payments, this is handled automatically, meaning merchants don’t have to open accounts in various currencies and markets, offering an even more streamlined experience. Moreover, the speed, efficiency and convenience of A2A payments through mobile apps increase reliability for remittance providers in cross-border transactions.

There is also the additional benefit of receiving payments in a different currency. For example, Brite Payments’ software enables you to swiftly convert foreign currency back to your own home currency.

5. Enhanced accessibility

A2A payments stand out for their sheer ease of use. By bypassing the need for physical cards or digital wallets, they cater to a broader audience that prioritises ease and security. Moreover, the user-friendly nature of A2A payments, coupled with heightened security, is particularly helpful for driving up conversion rates.

Brite currently offers a system that automates customer onboarding while making a deposit or payment. This native feature streamlines transactions by ensuring customers only enter the data they need to. Brite then automatically retrieves any remaining information from the user’s bank account or via a data register. As a result, merchants can simplify payment processes and offer their customers a highly familiar transaction environment – their own bank account!

Discover more benefits of account-to-account payments with Brite

If you’re a merchant looking for a way to facilitate fast, safe, and easy A2A transactions, Brite Payments can help. Our simplified API solution and powerful proprietary network delivers payments which are the benefits of the type of A2A payment discussed in this article. Get in touch now.

If, however, you would like to know more about about account-to-account payments and how they can benefit merchants and consumers alike then click below to download our explainer.